Silver and The Bond Market Collapse

Commodities / Gold and Silver 2015 Oct 06, 2015 - 05:16 PM GMTBy: Hubert_Moolman

Debt is at the root of money creation in this debt-based monetary system. In fact, as the name suggests, money is debt in this system. Historically, instead of debt as money, there would have been gold or silver.

Debt is at the root of money creation in this debt-based monetary system. In fact, as the name suggests, money is debt in this system. Historically, instead of debt as money, there would have been gold or silver.

Gold is still somehow linked to the monetary system, albeit in a very small way, as can be seen by the fact that many central banks own gold as part of their reserves. Silver, on the other hand, has been completely eliminated from the monetary system.

Given the above, it should be clear that silver and debt are virtually complete opposites, within this system. This is evident in the fact that silver and bonds have historically moved in opposite directions. If silver is going up, then bonds are going down and vice versa.

Alternatively (because the interest rate on a bond moves opposite to the price of the bond), when interest on those bonds are going up, then silver is going up, and vice versa. So, interest on bonds moves together with the silver price (as previously explained).

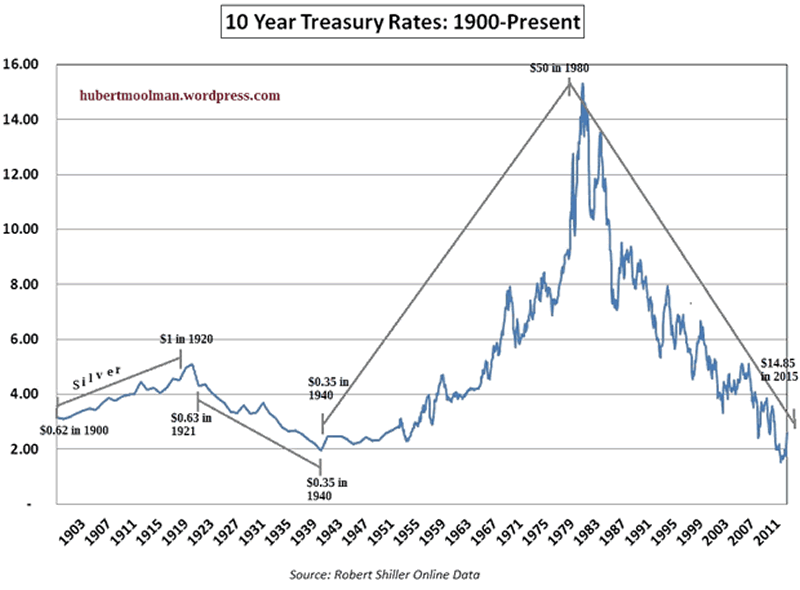

Below, is a chart of interest on 10 - year treasury bonds, since 1900:

The blue is the actual interest rates movement, whereas, I have indicated (in grey) how the price of silver has moved almost in union with the interest rates over the long-term.

Interest rates is in a way an indication of the value that the market places on debt (or bonds).

If interest rates are low, then the market places a high value on debt, and if the interest rates are high, then a low value is placed on debt. Therefore, when interest rates are low, the market is putting a low value on silver, and when interest rates are high, then the market is putting a high value on silver.

So, if silver is going to come into its own, there would have to be a collapse of the debt markets, especially sovereign bonds, while the silver price is rising. This has not happened yet. Yes, silver has been rising since about 2001, although the interest rate trend has been down. However, it has risen mostly because negative real interest rates have been present.

Economic decline is the trigger that can bring a change in the prevailing interest rate trend (or bond price trend). When there is economic decline, there is reduced expectation that debts will be paid (This is why the stock market collapse is such an important signal for the coming silver rally). Debt is then considered very risky, so higher interest rates are required.

Today we have gigantic debt levels, which will never be paid. Given the size of these debt levels relative to the size of the economy; there is no way that the bond markets could handle a change in the interest rate trend to the upside. This interest rate trend change to the upside will come; therefore, the bond market will collapse, and silver will rise in value and to its role as money.

For more of this kind of analysis on silver and gold, you are welcome to subscribe to my premium service. I have also recently completed a Long-term Silver Fractal Analysis Report .

Warm regards

Hubert

“And it shall come to pass, that whosoever shall call on the name of the Lord shall be saved”

http://hubertmoolman.wordpress.com/

You can email any comments to hubert@hgmandassociates.co.za

© 2015 Copyright Hubert Moolman - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.