Plunger’s Gold Bottom Watch

Commodities / Gold and Silver 2015 Nov 10, 2015 - 05:52 AM GMTBy: Plunger

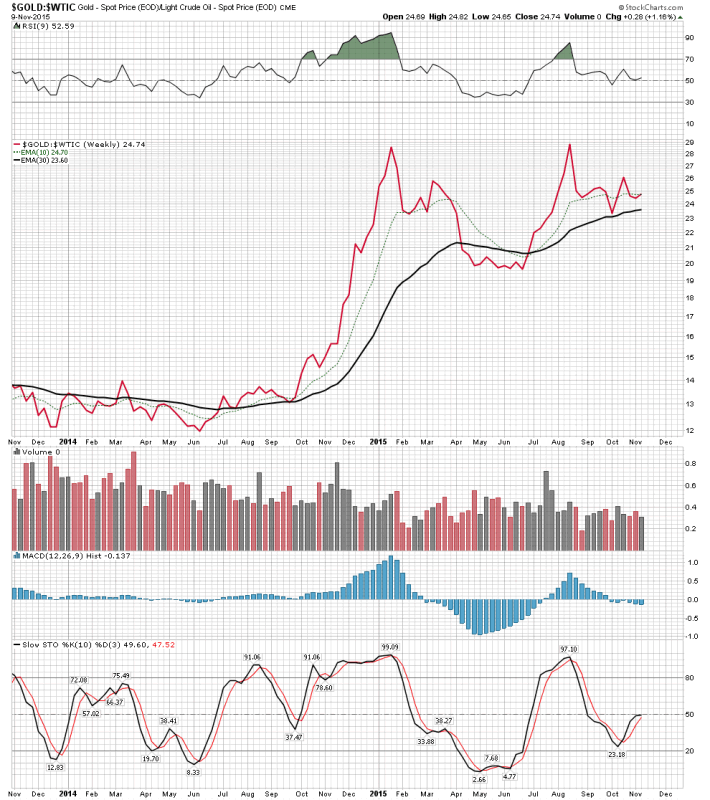

That’s where it appears we are now, the final drive to the bottom. Rambus’ weekend charts still show how bearish the PM charts are and it will take a lot of work to turn them around and get them pointed back up, Having said that I see the initial components we should expect to see of a bottom and turn entering into the picture. Call these pathway elements as they come before the bottom and take a bit of time to have their effect of bringing about the turn. First off what will propel the next bull leg in the PM stocks is the investment case for metal stocks. That is primary defined by the real price of gold and input costs into mines, That has been improving for over one year now. Mainly driven by the oil price, which imputes itself into all costs of a mining operation. Cheaper oil impacts not just extraction cost but costs of materials, explosives, those big expensive truck tires etc. Plus communities and governments are warming up to mining projects. Ecuador is a case in point, since oil revenue is down they need taxes from other sources and the mining sector is becoming favored again. Here is a view of the gold/oil relationship, note how the trend (30 EMA) is higher.

That’s where it appears we are now, the final drive to the bottom. Rambus’ weekend charts still show how bearish the PM charts are and it will take a lot of work to turn them around and get them pointed back up, Having said that I see the initial components we should expect to see of a bottom and turn entering into the picture. Call these pathway elements as they come before the bottom and take a bit of time to have their effect of bringing about the turn. First off what will propel the next bull leg in the PM stocks is the investment case for metal stocks. That is primary defined by the real price of gold and input costs into mines, That has been improving for over one year now. Mainly driven by the oil price, which imputes itself into all costs of a mining operation. Cheaper oil impacts not just extraction cost but costs of materials, explosives, those big expensive truck tires etc. Plus communities and governments are warming up to mining projects. Ecuador is a case in point, since oil revenue is down they need taxes from other sources and the mining sector is becoming favored again. Here is a view of the gold/oil relationship, note how the trend (30 EMA) is higher.

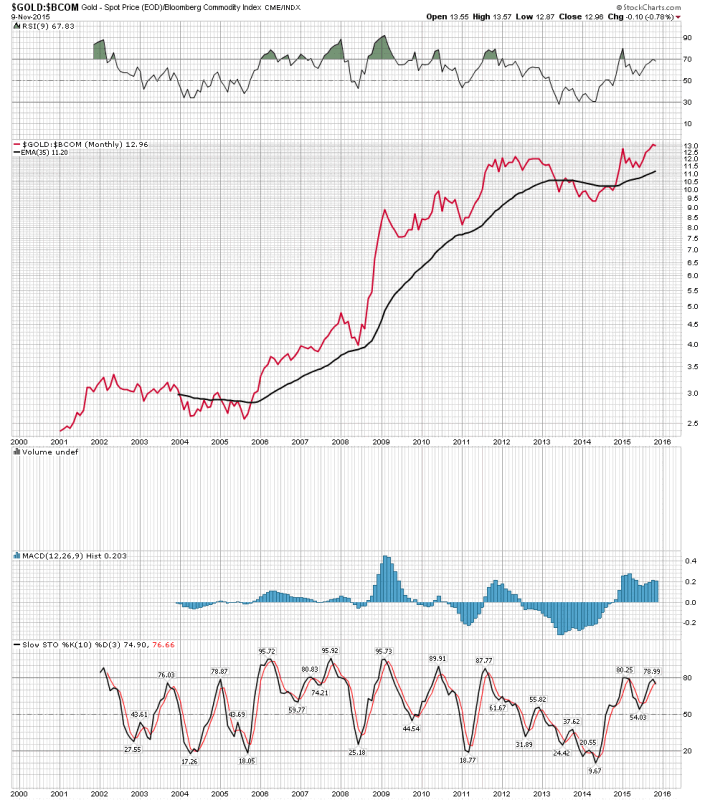

Since mid-2014 this dynamic has been working its way into the finance equation. On the chart below we can see this same effect on a much broader cost view using the bloomberg commodity index. Note how the peak in the real price of gold peaked right at the top of the bull market in late 2011 and declined into the summer of 2014. So this is an improving picture setting the backdrop for a bottom and eventual advance in the PM shares.

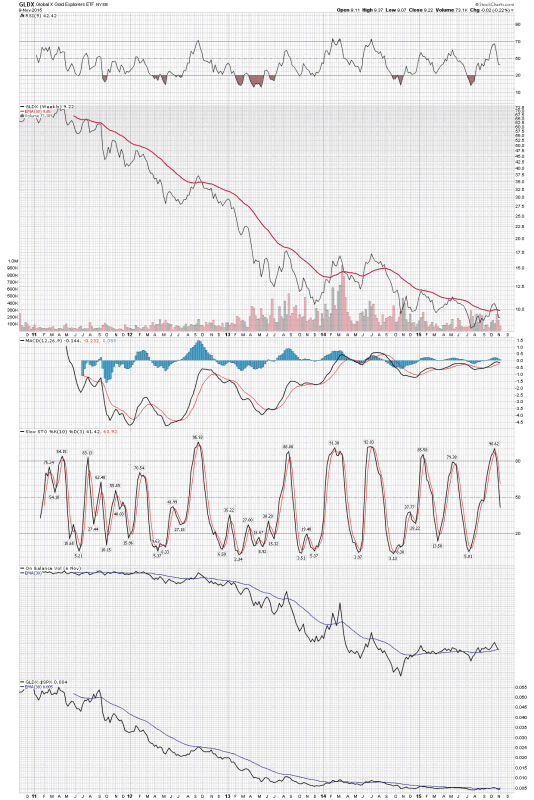

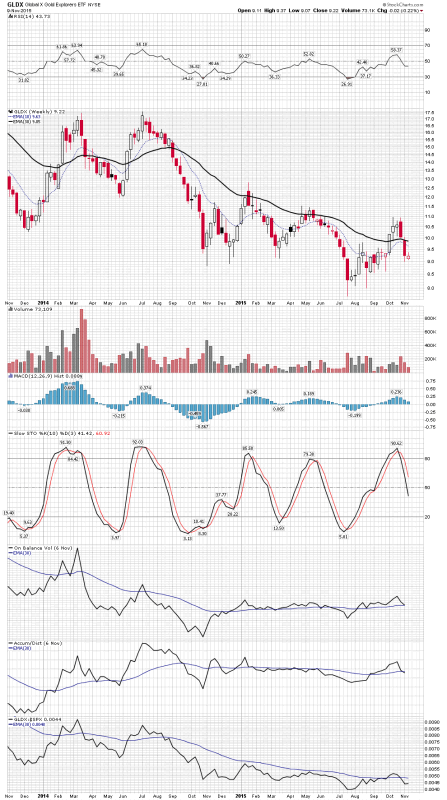

Decreasing Volume: We should know that bear market bottoms are normally associated with lower volume as the price action has no longer served to excite or to draw in new participants. I am seeing that now across the board. It is not as pronounced among the majors, however the juniors are showing it. My interpretation of this is that the majors still have a good wash out ahead of them. Also many of the smaller miners are looking much better chart wise. A good example of this is the components of the GLDX etf. If you review all the stocks in this ETF they are actually looking much better as their 30 W EMA has flattened and some are breaking above it announcing bottoming action. There are a few disasters in this ETF such as RBY, XRA, CNL.to, if these were removed the index would have already bottomed! Keep in mind this index has gone down 90% and now is exhibiting bottoming action. I am posting 2 charts on this the 5 year and 2 year. Note on the 5 year how it is exhibiting a maturing Weinstein stage 1 look. On the 2 year notice how the volume is now trailing off. I think one could now buy this index on any spike down. The stocks that make up this ETF are actually pretty good quality.

Now I defer to my friend Mark Lundeen, who does compelling independent work using the step sum indicator he has developed. FLASH NEWS ALERT-The step sum is finally crashing. This indicates we are in the give it up final phase. There is no indication how long, but this is an important indicator that few even know exist.

Finally, I would like to pass on 2 anecdotal stories which I experience recently which also fit into this bottom narrative. I attend 4-5 mining conferences a year and last week was at the New Orleans Investment conference. Now these conferences have been suffering dwindling attendance for 2 years now so the statement that animal spirits were at a low doesn’t really pinpoint a bottom too accurately since that’s the way its been for 2 years now, but two things happened to me that really made me take notice. First was that I went by the Sprott Booth and saw Rick Rule there standing alone. That’s right, alone. Normally there is a mob scene around Rick trying to pepper him with questions and to find out the latest story. Well I engaged him for 20 minutes without anyone even coming by to try to but in. Frankly I have never seen this occur before.

That was a anecdotal bottom indicator in my view, Next I went to the GATA briefing. Chris Powell and Bill Murphy gave the drivel, nothing really new, but I was curious if anything had changed…it hadn’t. Now I have never really been a GATA follower, although I do believe they are correct, but its not something to involve oneself in because, although true, it mainly serves to distract oneself away from the business of making money. Nobody has made money from these guys is what I am saying. But here is the thing that struct me…They both came across to me as defeated. They have mentally lost the righteous battle they have been fighting for 15+ years. They freely admitted they couldn’t change anything and it in fact wasn’t going to change. This is such a sea change from years past. Its just an anecdotal story with out much specific meaning, but when one puts this in context with all these other bottom indicators I am picking up it says something.

Interesting Times

Plunger

Editor’s Note : Plunger is Resident Market Historian with Rambus Chartology

More Plunger

http://plunger.goldtadise.com/

Copyright © 2015 Plunger - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.