Dow Jones Stock Market Index is Not Going to Crash

Stock-Markets / Stock Markets 2015 Nov 19, 2015 - 10:05 AM GMTBy: Sol_Palha

Empty pockets never held anyone back. Only empty heads and empty hearts can do that. ~ Norman Vincent Peale

We have published several articles over the past few months refuting proclamations from experts calling for a crash, two of which are Market sell off time to panic? And The Dow index is getting ready to soar . Instead, we viewed each so-called crash event through a bullish lens. We even went so far as to tell our clients to celebrate while the markets were pulling back, a practice that is unheard of today.

Look at the bright side; you get to do something you have never done before. Drink while everyone is screaming bloody murder and sing when the markets are sinking. Who knows you might be a budding singer in the makings. Yes, most will call you insane, but instead of being stricken with fear, you will now be the master of your destiny instead of a slave to another's. Drink and be merry for the markets are letting out some well-deserved steam. We see no reason to worry and no reason not to sleep well at night. ~ Interim Market Update July 9, 2015

New phrases have been coined to put the fear of God into the masses. Earnings recession is one that comes to mind. Yes if things were that bad, and then pray do tell, what gives, why are the markets trending higher.

The comical fixation on whether the Feds will raise rates is another clear way to miss what is going on right in front of your eyes. It reminds us of a silly young girl pulling the petals of a flower and saying "he loves me, he loves me not". While the masses fixate on what effect a rate hike would have on the markets, the markets have already moved up from their lows and dangerously close to testing their highs. So if you continue to follow the talking heads, you will always be one step behind, and the only thing you will have to show for you worry is a bag full of dust.

Even secondary indicators can be used to create a bullish argument for the markets and offer a more plausible scenario than what is being offered by the Doctors of Doom. For the record, we never rely only on secondary indicators. Our main indicator is our trend indicator, which is bullish and as long as it remains bullish we will not think of shorting this market.

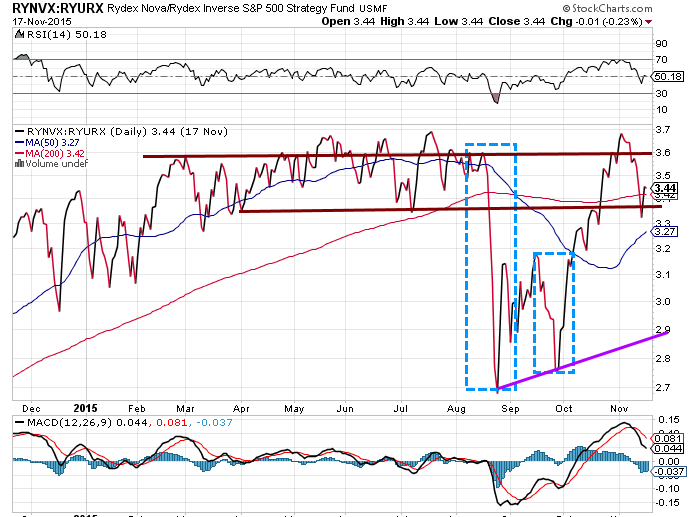

The Rydex Nova/Ursa ratio can be useful when it trades in the extreme zones as was the case back in Sept and Oct of this year. When you see this occur, and the crowd is panicking, it is time to pay attention. It can be used to help determine when a market is close to putting in a top or a bottom. Right now it has mounted a very strong rally, so it's letting out some steam. If it does not break above 3.6, then a test of the 2.8-3.00 ranges is warranted.

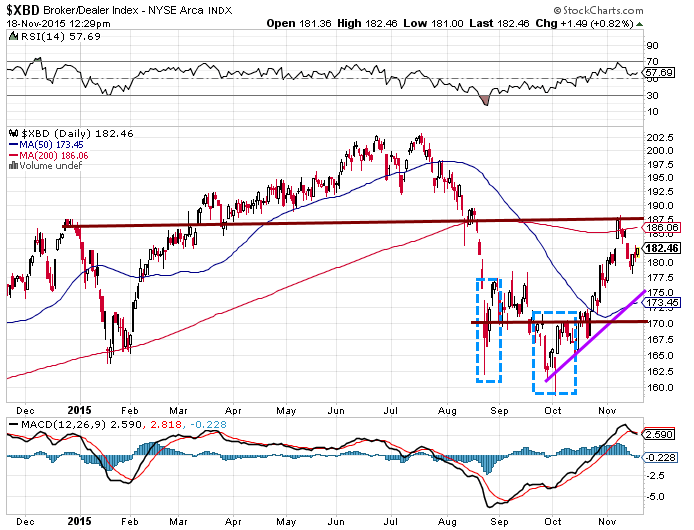

The broker-dealer index is also a useful index to monitor in times of turmoil and or euphoria

Brokers and dealers are like the average Joe; they march to the same drumbeat of Joy and euphoria. Taking a position that is contrary to theirs when emotions are running high usually leads to a positive outcome. Like the masses, they panicked when the markets sold off as illustrated in the chart above. The Index plunged to new lows in Sept and October. Failure to trade past 187 on the next leg up will result in a test of the 170 ranges. The trend is up, the lower this index drops, the greater the opportunity.

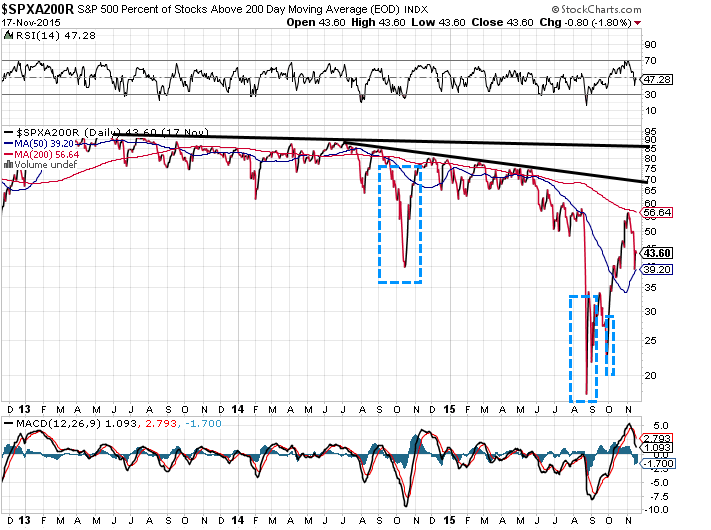

Experts would have you believe that it's bad news when more than 50% of the SP 500 stocks are trading below the 200MA. Yeah once upon a time this might have held true, but look at the above, chart, it shows that a large percentage of stocks in the SP500 has spent a considerable amount of time below the 200 moving average, and yet the markets continue to trend higher. Note too that they are trending downwards since 2013, so this should be a double negative; instead the markets have continued to soar.

What gives?

Well, markets are no longer free and dreaming about free market forces is a waste of time. The markets have continued to soar higher because its hot money that is fuelling this market, and it's hot money that will continue to fuel this market.

We view the above chart in a different light. We have opted to use the information in the above chart in a different manner; every large deviation from the mean is a buying opportunity; illustrated by the blue boxes. As long as our trend indicator is bullish, we do not care about the so-called bearish pattern this chart is generating.

From a psychological perspective, the markets are soaring higher because this is still one of the most hated bull markets in history. A large portion of the public is still sitting on the sidelines. You will also notice that when there is any bit of uncertainty in the markets, the individuals in the neutral camp surge the most. Individuals that claim to be neutral are simply gutless bulls or toothless Bears. As long as the number of individuals in the neutral remains high, the masses will not move to the euphoric stage. And, until the masses are euphoric this bull market will not end.

Finally, the Fed is trying to fire a shot across the Bow of this bull market by hinting about an interest rate hike in December. Our response is come on do it or stop the chatter; the fact that the Fed harps on this nonsense is totally unbecoming. There are better things to pay attention too; since when is a meaningless 0.25% rate hike such a big event. This drama should be viewed as a clear signal that this economic recovery is nothing but an illusion and that Fed is well aware of this. Rate hike or not, the Fed will have to come out with a new stimulus plan. This market is addicted to hot money.

Put it this way. We welcome a rate hike, for it will trigger another market selloff providing the prudent investor with another lovely buying opportunity. Every strong pullback is a buying opportunity, end of discussion.

Accuracy is to a newspaper what virtue is to a lady, but a newspaper can always print a retraction. ~ Adlai E. Stevenson

by Sol PalhaSol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2015 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.