Chinese Markets Short Term Mess But Long Term Opportunity?

Stock-Markets / Chinese Stock Market Dec 28, 2015 - 06:14 PM GMTBy: Sol_Palha

A bird doesn't sing because it has an answer, it sings because it has a song. Maya Angelou

A bird doesn't sing because it has an answer, it sings because it has a song. Maya Angelou

In the short term, China is still a mess, and the reasons are all but obvious. Greed and stupidity fuelled the bubble that popped back in June of this year. Some estimates put the number of individuals opening new accounts without high school diplomas at over 60%. Secondly, a large portion of these investors were playing the markets with borrowed money, otherwise known as trading on margin. Making matters worse to circumvent the limits placed by regular margin trading, many turned to the shadowy banking sector, where one could borrow up to ten times the value of one’s stock holding. At the height of the mania over 500,000 new brokerage accounts were being opened per week, a clear sign that the masses were ecstatic and believed that the market could only trend higher. When you couple Greed with stupidity, the result is always unpleasant.

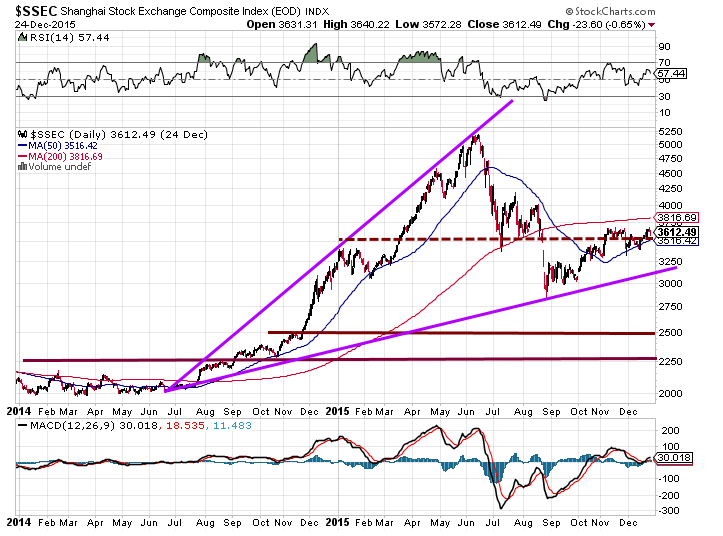

Since June, the Shanghai index has shed more than 40% and the government has spent over $200 billion trying to stabilize the markets. While the markets are trading off their lows, we are not sure that this money was spent wisely as the charts are still indicating that the markets could still test their lows again.

Factors creating uncertainty

• The Chinese economy is slowing down and this, in turn, affects the stock market; the perception being that if the economy is slowing then, then corporations are going to face leaner times.

• The government is attempting to clean up the house to some degree. It has indicated that it is no longer willing to fund companies that are operating at a loss indefinitely. It has actually come out and stated that such companies need to cut down costs and streamline operations. One of the suggestions put forward was for companies to merge in doing so improve efficiency. In the short term this is not going to be pleasant as many large companies could go belly up, adding further uncertainty and markets hate uncertainty, so in the short-run, the outlook favours more pain. Lastly, the economy is in a transition stage and is trying to move from an export-based economy to a domestic one, and such transitions are never smooth. While the masses hate uncertainty, contrarian investors should be preparing a list of blue chips stocks to invest in for the long run.

There were plenty off signs warning the astute investor that the Chinese markets were headed for a crash. The masses were Euphoric, and everyone felt that the markets could only go up. This is the clearest signal that you can ever get, and it needs no deep knowledge of fundamentals or technical analysis. A simple understanding of the basic tenets of mass psychology is all that is required. Mass psychology clearly dictates that one should be wary when the masses are jubilant and elated when the masses are cautious.

Long term factors bode well for the Chinese economy and stock market

China has a 49% personal savings rate, putting all the developed countries savings rates to shame. China’s Middle Class is still growing in leaps and bounds. There are over 109 million Chinese with savings over $50,000. While the middle class is getting decimated in America since 2000, twice as many Chinese as Americans have joined the ranks of the middle class in this period. China accounts for a fifth of the world’s population and holds about 10% of the global wealth. This figure is set to rise dramatically in the years to come. Lastly, the number of millionaires in China is also skyrocketing; China now has more than a million millionaires. These factors bode well for China going forward.

The technical outlook for Chinas market

The Shanghai Index has rallied sharply from its lows and is attempting to find support in the 3400 ranges. However, there is still not enough fear in the air and therefore, there is a good chance that the Shanghai index could test the 2500-2700 ranges again. If 3400 is taken out on a weekly basis, then a test of the 2700 ranges will be inevitable. From a long-term perspective, any level below 3000 makes for a good entry point.

At this stage of the game, the astute investor should start compiling a list of stocks that he/she wants to get into, so when the opportunity arises, you will be ready to jump in. We are currently creating a list of stocks and as soon as our trend indicator generates a buy signal we will be prepared to jump in. This is the same trend indicator that flashed an exit signal in June; we did not get out at the exact top, but based on our entry points we did not need to. Trying to time the exact top or bottom is an exercise in futility.

The masses are getting nervous now and this should be viewed as a bullish development. However, we would wait for them to move into the doom and gloom camp before jumping in.

Back of ninety-nine out of one-hundred assertions that a thing cannot be done is nothing, but the unwillingness to do it.

William Feather

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2015 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.