Gold and Silver Price Rise Has Begun

Commodities / Gold and Silver 2016 Feb 22, 2016 - 03:14 PM GMTBy: DeviantInvestor

The S&P 500 Index (chart below) shows a top in May 2015, a correction into August, and a deeper fall this month – February 2016. Look out below.

The S&P 500 Index (chart below) shows a top in May 2015, a correction into August, and a deeper fall this month – February 2016. Look out below.

The Shanghai Composite Index looks grim.

Both markets are due for a bounce with more downside thereafter.

Gold mining stocks (the GDX) have rallied over 50% since the January low. They should correct and then rally for several years.

The chart of gold looks similar. It has broken out of a long term downtrend, looks ready to correct, and then continue its rally past all-time highs.

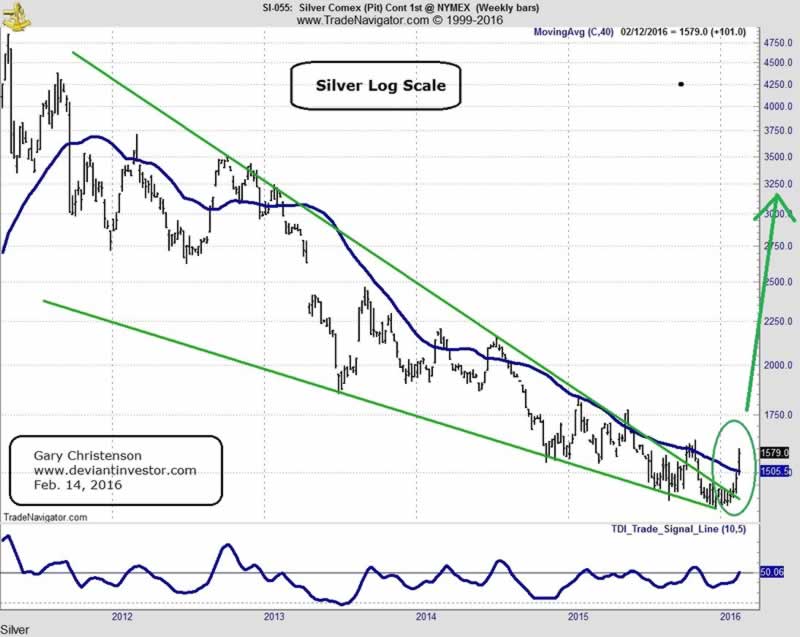

The silver chart is showing the same message as gold – a bottom, breakout, possible correction, and then more rally. Expect all-time highs in 2016 – 2017.

T-Bonds (monthly chart) look …. well, crazy. For a start, who lends capital to insolvent governments for 30 years at 2%? Worse, who lends capital to insolvent governments for 10 years at negative rates? You “benefit” from guaranteed capital destruction and are repaid in a devaluing currency? Desperation? Markets have gone insane? The new normal? Increase debt to solve an excess debt problem? QE did not work – so the central banks must not have done enough of it? Strange and getting stranger, or just utterly insane?

The US dollar began a furious rally in mid-2014 and peaked in March 2015. Crude oil and commodity prices have not recovered. Emerging markets have been hammered. Was the rally caused by the “strong fundamentals” of the US economy, “strength” in the US job market, “excellent management” in the US government, “intelligent and healthy” economic direction from the Fed, or … should we expect a massive correction that brings the US dollar back toward the 70s?

From Martin Armstrong:

“… rates will rise as we move into the sovereign debt crisis, which will pick up steam in 2017 moving into 2020.”

“The Cycle of War turned up in 2014 … This will pick up also in 2017 and move into 2020.”

From Bill Holter:

“Markets all over the world are coming apart at the seams and “control” is rapidly being lost.”

“The big problem is this, the dollar is the lynchpin “reserve” currency for the entire world, what would it say if we had to move to negative rates … because NOTHING ELSE WORKED?”

“… you are watching the system implode upon itself… They have started a process in motion that will not be stopped.”

Gold has no counter-party risk. Silver has no counter-party risk. Both have been money and a store of value for about 30 times the life of the Federal Reserve. The intrinsic value of the dollar is approximately zero.

The process of discovering true value has begun, as indicated by the decline in the S&P, decline in the Shanghai Index, rise in gold stocks, rise in gold, and rise in silver. Expect it to continue.

The reckoning has begun. The ride will get bumpy.

Protect your assets. Purchase physical gold and silver from Tom Cloud or Roxanne Lewis.

Gary Christenson

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2016 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.