The 'Dangerous Obsession' with Gold

Commodities / Gold and Silver 2016 Mar 24, 2016 - 04:28 PM GMTBy: Jesse

"Gold has worked down from Alexander's time. When something holds good for two thousand years I do not believe it can be so because of prejudice or mistaken theory." Bernard Baruch

"Gold has worked down from Alexander's time. When something holds good for two thousand years I do not believe it can be so because of prejudice or mistaken theory." Bernard Baruch

"The commerce and industry of the country, however, it must be acknowledged, though they may be somewhat augmented [by paper money], cannot be altogether so secure, when they are thus, as it were, suspended upon the Daedalian wings of paper money, as when they travel about upon the solid ground of gold and silver." Adam Smith, Wealth of Nations, p. 262

"Gold, unlike all other commodities, is a currency...and the major thrust in the demand for gold is not for jewelry. It’s not for anything other than an escape from what is perceived to be a fiat money system, paper money, that seems to be deteriorating." Alan Greenspan, former US Federal Reserve Chairman, August 23, 2011

"For central banks this [gold] is a reserve of safety, it’s viewed by the country as such. In the case of non-dollar countries it gives you a value-protection against fluctuations against the dollar." Mario Draghi, ECB President, Q&A at the Kennedy School of Government at Harvard, 2014

"Le papier-monnaie revient finalement à sa valeur intrinsèque - zéro." Voltaire

Someone sent me another clumsy hit piece on the precious metals today, coming out from the mainstream financial press, passed on by their courtiers and hangers-on in support of a hit on the metals. They do this not only for the metals but for the miners as well, and it is sometimes surprisingly blatant. New York and London have nothing over the Canadians in this regard.

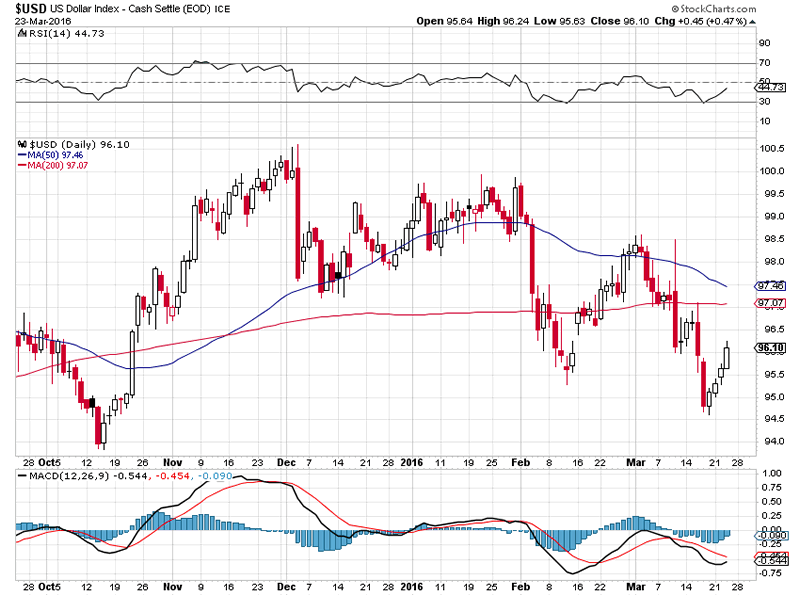

And why a hit on the metals now? Because I think the physical bullion 'float' in the West is getting more and more thin as a result of the misguided attempt of the financial engineers to correct their outrageous and persistent errors in monetary and fiscal policy by reshaping the markets and values to suit their own personal needs.

They are attempting to sustain the unsustainable, which is one of the artifacts of the credibility trap.

These sorts of affairs are 'fiat' with a capital 'F.' Things are this way and of this value because we say so. But unfortunately that sort of approach to reality only works as far as your span of significant control.

And this seems to be the reason why so many modern theoreticians seem to be caught up in a Ponzi-like need to keep expanding and increasing that control, because their policies and theories are cutting so badly against the grain of reality.

External standards and restraints, such as gold in the case of money, seem particularly dangerous to those with an almost pathological obsession with power. Perhaps I am incorrect, but this is where the data leads my thinking, and history tends to support it.

But, after all, we are in a largely unreformed and corrupt financial system against the broader backdrop of a major change in the global currencies, also known as a currency war. And truth is often one of the first victims. C'est la guerre.

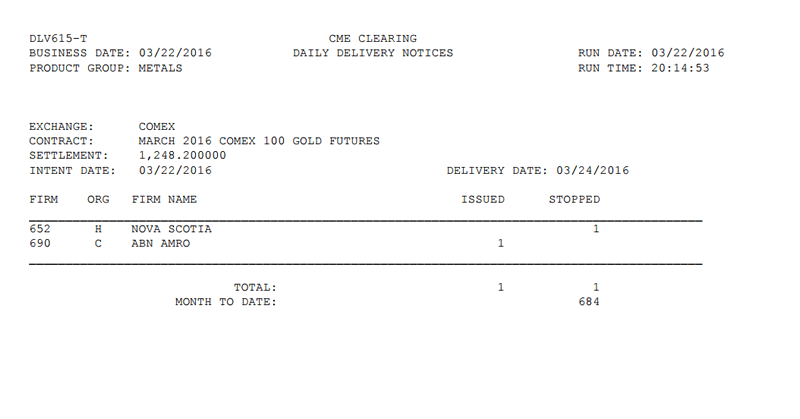

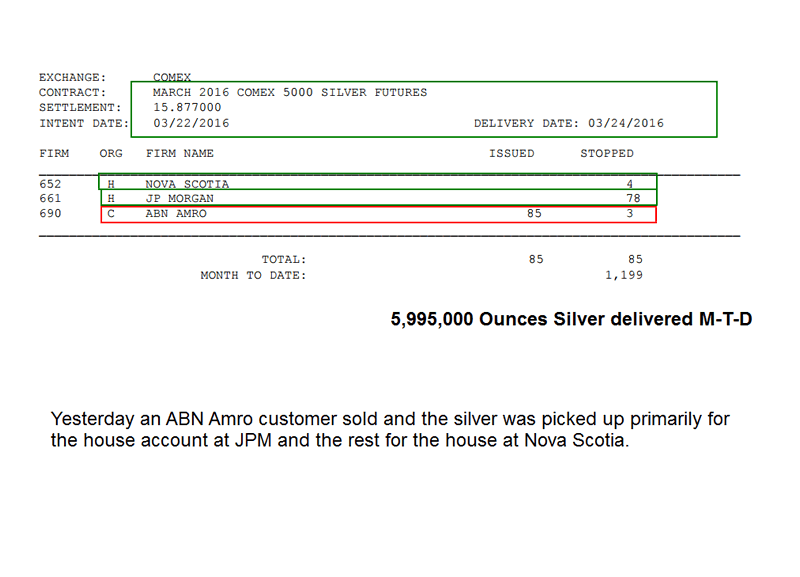

Speaking of data there was little meaningful action for gold at The Bucket Shop yesterday, although there was some movement in silver.

A customer coughed up some silver bullion and the house at JPM took most of it, with Nova Scotia taking the rest. And in the warehouses, silver continues to move since this is how CNT is managing its wholesale bullion business.

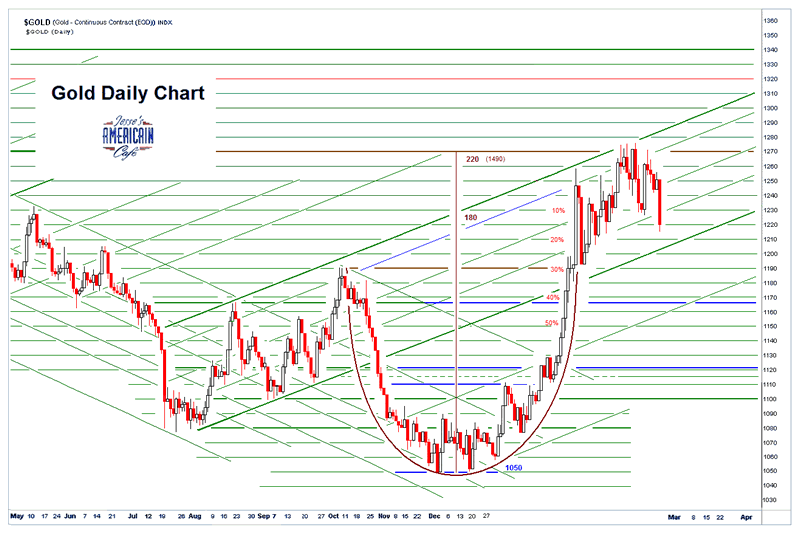

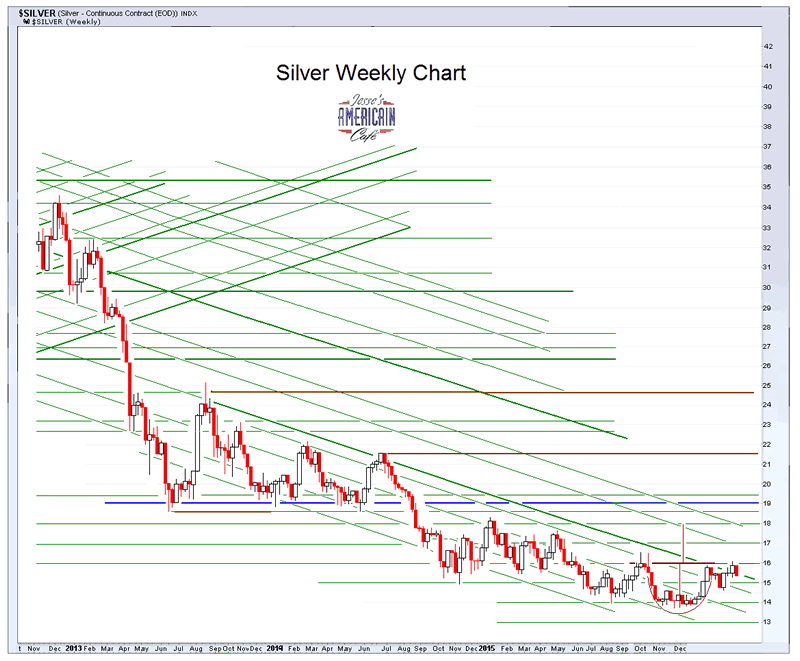

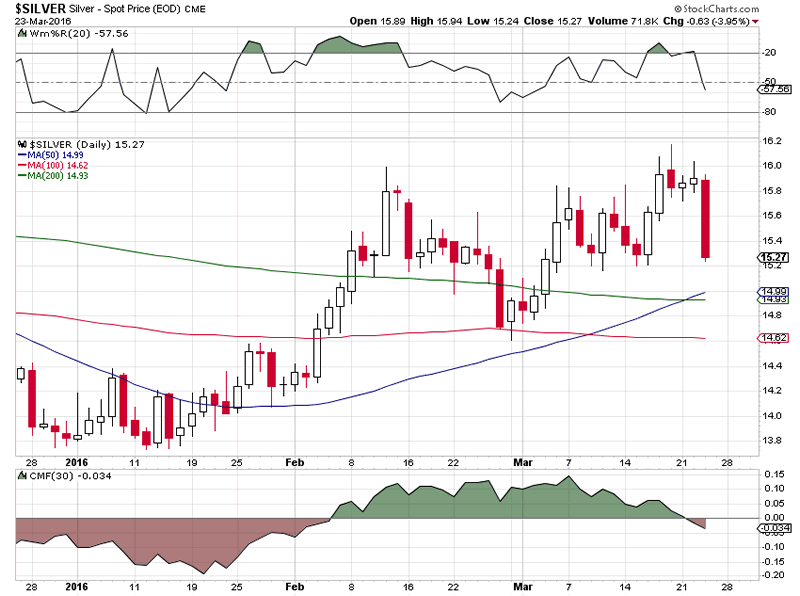

The cup and handles on the charts are still operating but not activated yet. If you do not understand this you may wait for it to happen and be reported here or you can click on the topic on this site and read the explanations of this chart formation.

We need to see a resolution of 'the handles' especially in gold. In silver it must merely sustain any retests.

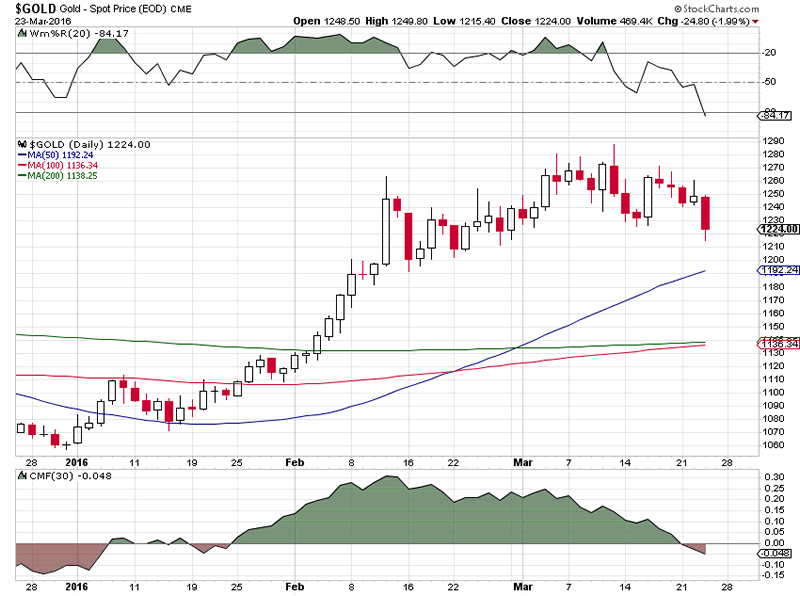

In the short term gold is now oversold. It may become even more oversold. Silver is not quite there yet as can be seen on the special charts with technical indicators below.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2016 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.