Silver's Bearish Rally

Commodities / Gold and Silver 2016 Apr 15, 2016 - 04:32 PM GMTBy: P_Radomski_CFA

Silver moved sharply higher recently along with mining stocks, but unlike the latter, the white metal continued to show strength even on Thursday by holding up well despite gold's and mining stocks' decline. What does this tell us?

Silver moved sharply higher recently along with mining stocks, but unlike the latter, the white metal continued to show strength even on Thursday by holding up well despite gold's and mining stocks' decline. What does this tell us?

It tells us that a decline is very likely to be seen shortly. Let's see why (charts courtesy of http://stockcharts.com).

In yesterday's alert we wrote the following:

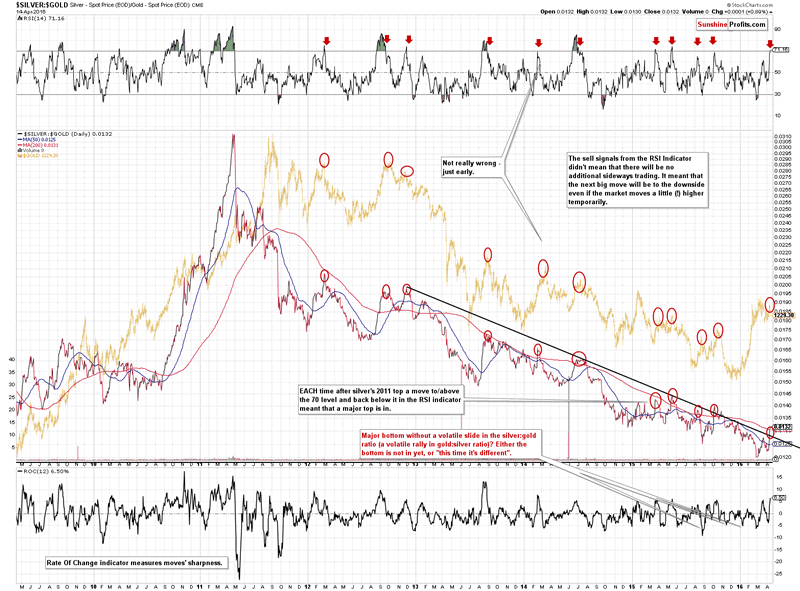

The silver to gold ratio and the indicators plotted on the chart show how often the above signal worked. The RSI close to 70 usually meant that an important top was in or about to be in, especially if the ratio was close to the declining resistance lined and / or the 200-day moving average. This is the case right now and the implications are bearish.

As you can read on the above chart, the signal was even clearer when the RSI moved above 70 and then declined back below it. Based on yesterday's outperformance of silver relative to gold, the RSI moved above 70 and thus it's only a matter of time (probably a very short amount of time) when the key sell signal is seen. It seems that one can already view the above situation as very bearish for the upcoming weeks.

Naturally, a question comes to mind: Why would silver's temporary (!) outperformance be such a bearish sign in most cases? There is no specific fundamental reason for the above . However, in the short term, markets don't move based on fundamentals, but emotions. The likely reason behind this phenomenon is the popularity of silver among small, individual investors and the relatively small size of the silver market (compared to other markets, like the gold market) and these investors tend to get in the market close to tops. Consequently, extraordinary performance of silver relative to gold may be viewed as a sign of the top. A similar phenomenon sometimes occurs for junior mining stocks (and you will find more details by clicking the above link) but in the past years, silver's signals have become more meaningful and clearer than those from juniors.

On a side note, we expect silver to outperform gold in the upcoming years, but as far as short-term trading implications are concerned, the above remains to be a very useful trading technique.

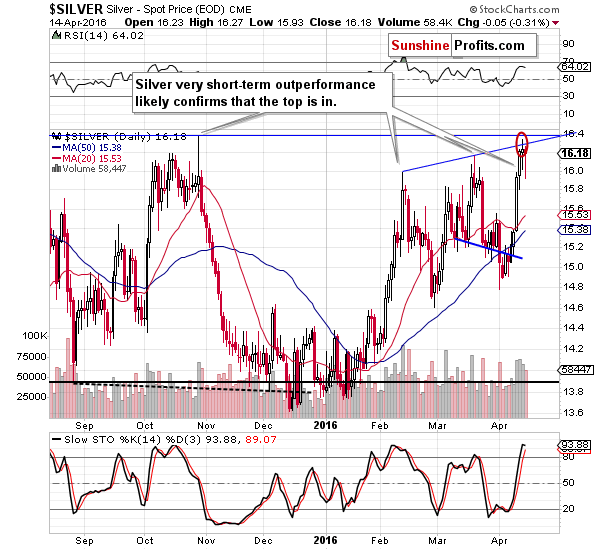

What about silver itself?

It moved to our target area - its upper part - and declined. It seems that the top is already in and if it's not, it seems that silver would not rally far as both resistance levels (the rising blue line and the October 2015 high) are relatively close.

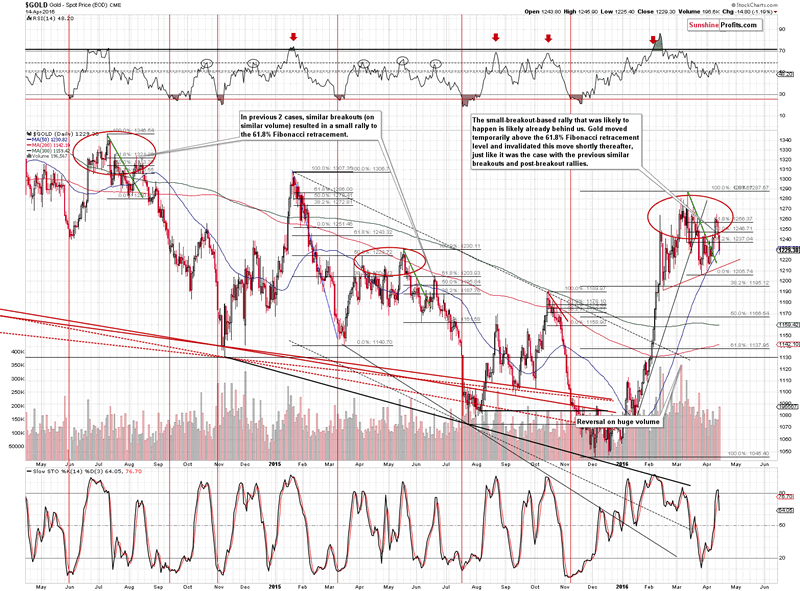

Moving to gold, we saw a decline on relatively big volume (biggest daily volume so far this month), which has bearish implications. It seems that the decline will be continue (especially if gold breaks below the red support line and the February-today head-and-shoulders pattern will be completed) and it appears that entering short positions when gold was at about $1,250 was a good idea.

Summing up, silver's strong performance in the recent days is not a bullish sign and this - along with a weekly reversal in gold stocks and the breakout in the USD Index - makes the outlook for the precious metals market bearish for the coming weeks. Consequently, we think that a short position (full) in gold, silver and mining stocks is justified from the risk to reward point of view. Moreover, it appears very likely that the profits on the current short trade will become much bigger before this trade is over. We'll continue to monitor the situation and report daily in our alerts.

There is a 7-day free trial for our Gold & Silver Trading Alerts, which you get automatically after signing up for our free gold newsletter. Again, it's free and if you don't like it, you can always cancel. Sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Tools for Effective Gold & Silver Investments - SunshineProfits.com

Tools für Effektives Gold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

Sunshine Profits enables anyone to forecast market changes with a level of accuracy that was once only available to closed-door institutions. It provides free trial access to its best investment tools (including lists of best gold stocks and best silver stocks), proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Przemyslaw Radomski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.