Why China Is Really Dictating the Oil Supply Glut

Commodities / Crude Oil May 04, 2016 - 12:51 PM GMTBy: OilPrice_Com

Ship tracking data from Bloomberg shows that 83 supertankers carrying around 166 million barrels of oil are headed to China, which has stockpiled an impressive 787,000 barrels a day in the first quarter of 2016—the highest stockpiling rate since 2014.

Ship tracking data from Bloomberg shows that 83 supertankers carrying around 166 million barrels of oil are headed to China, which has stockpiled an impressive 787,000 barrels a day in the first quarter of 2016—the highest stockpiling rate since 2014.

While the world was speculating about oil prices plunging to $20 and $10 per barrel, China was busy stockpiling its reserves.

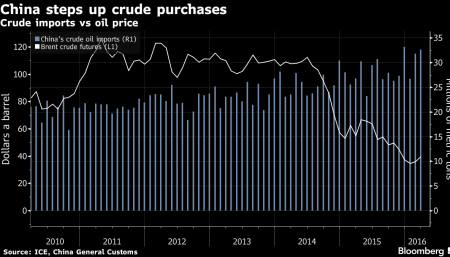

The chart below shows an increase in imports as crude prices collapsed. Since the beginning of this year, China has imported a record quantity of oil.

Back in January 2015, Reuters had reported that China planned to increase its strategic petroleum reserves (SPR) from 30 days to 90 days. In January 2016, it was revealed that China was building underground storage to complement its above-ground storage tanks.

The Chinese urgency points to two things. China believes that crude oil prices will not remain at the current levels for long, and that a disruption is possible due to geopolitical reasons, which can propel oil prices higher.

As a net importer of crude, it is protecting itself against a black swan event and using the current low prices to fill its tanks. The filled up tanks will ensure a steady supply of crude for at least three months in case of a disruption.

Does the record buying spree by the Chinese indicate a bottom in crude oil prices?

That is difficult to conclude, but it does put a floor beneath the current lows, because in all likelihood, China will resume its record buying and top up its SPR if prices tank.

The total Chinese imports in March via the very large crude carriers was 7.7 million barrels a day. Other than the supertankers, China also imports oil through pipelines and small tankers.

The Chinese demand doesn't show a huge uptick corresponding to the rise in imports. JP Morgan estimates that in March, the total demand for oil in China was 10.3 million b/d, down 2.5 percent over the previous year and down 2.3 percent month on month, whereas the chart shows that imports are higher compared to the same period last year.

Crude oil prices have been on an upswing this month. The import data coming out of China for April will give a clue as to whether the Chinese demand remains intact at higher crude prices or the imports drop when prices rise.

If the demand drops following a rise in prices, we can assume that China doesn't believe that the price rally will be sustained. At lower levels, Chinese buying might become a factor in deciding the bottom, as their increased imports will reduce the glut.

Similar to Saudi Arabia, which is a swing producer, China is acting like a swing consumer. However, as China doesn't report its storage data, it is difficult to estimate how long this trend will continue.

Though other factors were involved in encouraging the bulls to buy at lower levels, the increased demand from China also helped in lapping up the excess production. If their imports drop, the world will return to the supply glut and oil prices will retrace back to the lower $30 s/b.

Link to original article: http://oilprice.com/Energy/Crude-Oil/Why-China-Is-Really-Dictating-the-Oil-Supply-Glut.html

By Rakesh Upadhyay for Oilprice.com

© 2016 Copyright OilPrice.com - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

OilPrice.com Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.