When Gold Confiscation Is a Personal Choice

Commodities / Gold and Silver 2016 May 06, 2016 - 11:00 AM GMTBy: MoneyMetals

The specter of government forcefully confiscating gold is still roaming around out there.

The specter of government forcefully confiscating gold is still roaming around out there.

That nagging prospect dampens many buying decisions, unfortunate at a time when gold, and especially silver, are near historically bargain basement prices when measured in fiat currency.

Buy low, sell high only works for those who buy low.

Somewhere in everyone's buying decision is rebellion against government lunacy. So, what's the plan if government outlaws that defiance?

In examples spanning eight decades over three continents, ordinary people caught in very different circumstances chose to defy government repression of personal gold ownership.

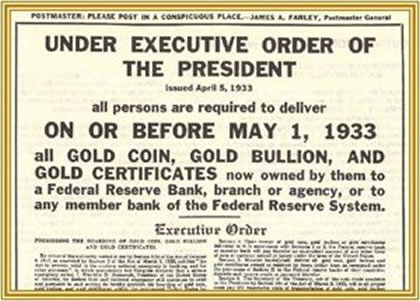

In the 1930's, President Franklin Roosevelt and Nazi dictator Adolph Hitler joined global, repressive trends by outlawing private ownership of more than five ounces of gold.

Many skeptical Americans responded by stiffing FDR, shipping outlawed gold overseas for safekeeping, or burying it on family farms. That gold remained hidden for four decades, until Gerald Ford lifted restrictions in 1974.

Europeans targeted by Hitler's murderous genocide improved their chances of escape using outlawed gold. It paid for bribes and safe passage away from Nazi atrocities and helped refugees build new lives once they stopped running.

In recent years, repressive gold policies in India jolted that continent, where gold lives deep in the DNA, essential to religious ceremonies and social structure.

Tax hikes and import restrictions were meant to protect the paper rupee. Citizens rebelled by dodging taxes, launching legal challenges, and doubling down on gold smuggling, while keeping demand for gold at a steady level. New Delhi was forced to rethink its repression, pushing a unique national discussion about gold to the forefront.

Today, a different crime of confiscation, stealing the value locked in gold and silver, is also failing.

Illegal, documented, proven and now admitted bullion bank price manipulation has likely denied gold and silver owners realistic, much higher values.

Each price suppression scheme in past years has failed when governments ran out of physical gold necessary to disguise crooked markets. As the current scheme fails, the pace accelerates, with exposed banks beginning to turn on each other.

Another confiscation is taxation when metals are sold for paper profit. Your practical, legal way to avoid that confiscation is to keep your metal instead of trading it for paper. That works great for those who see metals as money and savings, not investments.

That brings us to the chilling specter of that black-ops squad coming to confiscate your coins and bars.

Even in the 1930's, jack boots didn’t actually knock on doors to round up the gold. And the government’s call for everyone to turn in their gold didn't work very well. Would it even be attempted now?

Two internationally respected economists have opposing views on confiscation, but come to the same practical conclusion – always be buying gold.

Acclaimed Austrian School economist Dr. Marc Faber is known for predicting the 1987 stock market crash and the birth of the current gold bull market.

He's often argued the U.S. is “corrupt” and would force an expropriation of private gold, paying as little as possible. Faber seeks safety geographically, saying he would never hold gold in the U.S. or even in his Swiss homeland, feeling vaults in Asia are safer.

Economist, author and investor Jim Rickards is the guy who used to teach financial warfare to Pentagon generals. He sees any government confiscation attempt as "unenforceable" and "unlikely."

Rickards believes the day government really wants your gold, it will simply offer a high price to coax it from you, paying with paper money freshly printed that morning. The offer would be high enough to outbid competing market expectations. Otherwise, he says the Fed doesn't mind the price gradually rising.

Faber and Rickards, both recent Money Metals podcast guests, believe the planet is just one or two missteps away from a disastrous economic meltdown. Both make credible arguments the U.S. Federal Reserve and other central banks are inhabited by buffoons.

Both men are buying gold and silver and recommending you buy gold and silver too.

Rickards advises ten to twenty percent of invested wealth should be in physical gold. Incidentally, his studied math says gold today should be valued at many thousands per ounce.

Faber says he buys gold every month and doesn't intend to ever sell, despite his concern for confiscation. Says Faber, “we don't know how the world will look ten years from now.”

What's the plan if Faber is right?

You'll have warnings. News of intentions will leak. Lapdog media, fond of demonizing physical gold, will begin demonizing individual gold owners.

A familiar comparison is firearms ownership. While most Americans know little about gold, they do understand what's at stake in the up-close-and-personal 2nd Amendment gunfight.

America's reaction to constant, hard-nosed threats of firearms confiscation has been – buy more firearms! And extra ammo!

Sales zoom every time the subject comes up. Gun makers love to say Obama is the world's best gun salesman.

A government gold grab would mimic anti-gun rhetoric, tagging gold as a "national economic concern," just as Richard Nixon blamed "speculators" for his international gold default in 1971.

Gold demand (and prices) would skyrocket at the first sign of trouble.

And what if Rickards is right?

The notion the Fed might engineer a red hot gold price instead of a ham-handed confiscation is suggested by credible studies and by a former Fed Governor. Don't forget Alan Greenspan saying gold is going “measurably higher.”

Should market prices zoom ahead of banking price suppression in the race to the top, a paralyzed Fed may have no choice, just to establish its own cap on the all-important gold price.

Fears of "forced confiscation" might all but disappear – for awhile. Many gold owners would happily sell for overnight paper profits.

Many others, with no trust whatsoever in government, would keep their gold, choosing to wait and see.

Guy Christopher

Money Metals Exchange

Money Metals columnist Guy Christopher is a veteran writer living on the Gulf Coast. A retired investigative journalist, published author, and former stockbroker, Christopher has taught college as an adjunct professor and is a veteran of the 101st Airborne in Vietnam.

© 2016 Guy Christopher - All Rights Reserved

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.