Price Of Gold Is Breaking Out But “Commercial Traders” On The Wrong Side?

Commodities / Gold and Silver 2016 May 09, 2016 - 05:44 AM GMTBy: Chris_Vermeulen

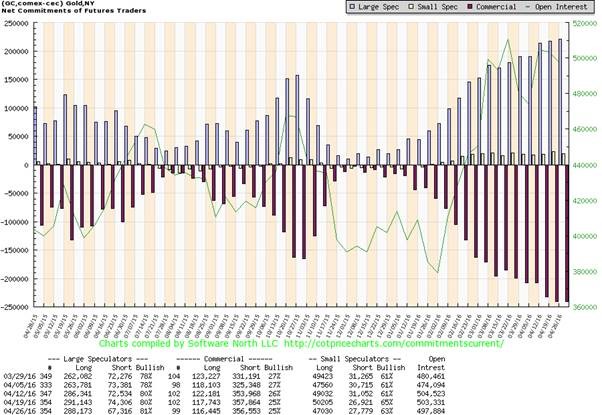

Price of Gold: The activities of the ‘commercial traders’ in the COT data is closely watched by the market participants, as they are believed to be the smartest of the lot. They take deliveries on their bets, unlike the speculators, who have no interest in taking a delivery.

Price of Gold: The activities of the ‘commercial traders’ in the COT data is closely watched by the market participants, as they are believed to be the smartest of the lot. They take deliveries on their bets, unlike the speculators, who have no interest in taking a delivery.

If you have followed the ‘commercial traders’, without paying attention to my proprietary predictive trend and cycle analysis for the price of gold and silver, you would be sitting on large losses, due to their ‘short positions’ which mean they expect price to move lower.

The ‘commercial traders’ ‘short positions’ are currently at record levels which are more than twice of that as compared to last years’ readings. Since the beginning of the second half of February of 2016, the ‘commercials’ have been increasing their short positions during the time that gold was closer to $1220/oz.

Daily Price of Gold Chart and Analysis:

However, if you have followed my recommendation, you would have maintained that once the price of gold crossed the $1190/oz. levels, it was destined to go higher.

However, the head and shoulder formation which developed after gold broke above the $1190 resistance trend line I did feel it would correct for a few weeks.

Instead, the price of gold did not correct, rather it consolidated with this what looked to be a head and shoulders pattern then broke out to the upside and rallied. Once a bearish pattern fails, it becomes very bullish which is what has happened in this case. I was quick to alert my subscribers to buy as soon as the pattern was broken and turned bullish.

However, the current price of gold at $1300/ oz. could offer some resistance, but the resolution of the trend in due time is going to be very strong. The pattern target of the current move is $1350/oz.

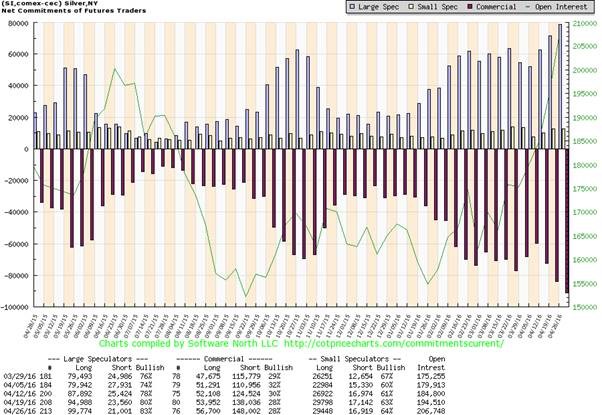

What about the ‘poor man’s gold’, Silver?

The chart indicates that in the last three weeks of April of 2016, the ‘commercial traders’ have added to their short positions continuously, however, they have been proven wrong once again with the breakout in silver returning 20% during the month of April of 2016.

Although we take note of the ‘commercial positions’, I strongly believe in my analytic models which have provided excellent returns, over many years.

Once above the $16/oz. levels, I have had no doubt that silver was ready for a sharp run-up. Therefore, I will be advising my private subscribers as to when to purchase silver, against the bias of the ‘commercial traders’ and I am confident that my subscribers will reap a windfall when the time is right.

Conclusion – Current Investment Strategy of the Mega-Rich

Do you really want to follow the ‘smart money’? Then follow the billionaires and the big banks as I have been doing. Ray Dalio, the founder of Bridgewater Associates, manages the largest hedge fund, in the world. His fund manages over $160 billion in assets. Today, his fund is bullish on gold. He recently stated “if you don’t own gold there is no sensible reason other than you don’t know history or you don’t know the economics of it”.

Stanley Druckenmiller has been purchasing a large long-term position in gold. He made an average of 30% of an annual return in his fund since 1986. So, what is he buying now?

He has an $880 million position in gold, right now. Do you think you should now be following the ‘really smart money’, today?

Follow the ‘smart money’! Gold is for the long-term investor, well looking forward 3-5 years at least.

Get My Daily Live Price of Gold Market Analysis, Forecast & Trade Alerts: www.TheGoldAndOilGuy.com

Chris Vermeulen

Join my email list FREE and get my next article which I will show you about a major opportunity in bonds and a rate spike – www.GoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.