Will the Fed be Blind Sided by Stagflation?

Economics / Stagflation May 31, 2016 - 04:16 PM GMTBy: Michael_Pento

Most Central Bank watchers know that our Federal Reserve has a dual mandate of stable prices in the context of maximum employment. But its use of the words "stable and maximum" is somewhat misleading. For instance, one would assume that "stable" inflation would lead the Fed to pursue no change in prices and "maximum" employment would be a rate targeted at 0 percent unemployment; but this is not the case.

Most Central Bank watchers know that our Federal Reserve has a dual mandate of stable prices in the context of maximum employment. But its use of the words "stable and maximum" is somewhat misleading. For instance, one would assume that "stable" inflation would lead the Fed to pursue no change in prices and "maximum" employment would be a rate targeted at 0 percent unemployment; but this is not the case.

For some antithetical economic reason central bankers have unanimously redefined stable prices as adopting a 2 percent inflation target. The Fed has also morphed the term maximum employment rate to mean a 5-6 percent unemployment rate, clinging to the misguided belief that full employment is the progenitor of inflation, despite no supporting economic or historical evidence.

For instance, the 12.2 percent (YOY) rise in the CPI in November 1974 led to the cyclical high of unemployment in May of 1975, which also coincided with the 1973-75 recession. Likewise, in 1979, the YOY high in CPI of 14.6 percent was followed by another cyclical high in unemployment of 10.8 percent in late 1982.

The Misery Index hit a high of 20.76 during 1980. And one now has to wonder what the true Misery Index (the unemployment rate plus the inflation rate) would be if both inflation and unemployment were calculated properly.

What the Fed doesn't understand is that full employment can exist in perfect harmony with stable prices. That's because having more people producing goods and services can never by itself lead to an environment of rising aggregate prices. And, most important, an increasing rate of inflation increases the rate of unemployment.

This condition plagued the United States during the majority of the 1970's and early 1980's and was "affectionately" referred to as stagflation: rising inflation that is coupled with a high unemployment rate and low to negative economic growth.

But Janet Yellen isn't going to have to dust off her eight track of KC and the Sunshine Band to evoke the 1970's; she is creating 70's style stagflation with her monetary policies.

For the past few weeks the Fed has been circling the wagons trying to convince markets it can raise the Fed funds rate slow enough to boost GDP growth higher than the 0.5 percent rate in the first quarter; while also raising it quickly enough to prevent inflation from getting out of control.

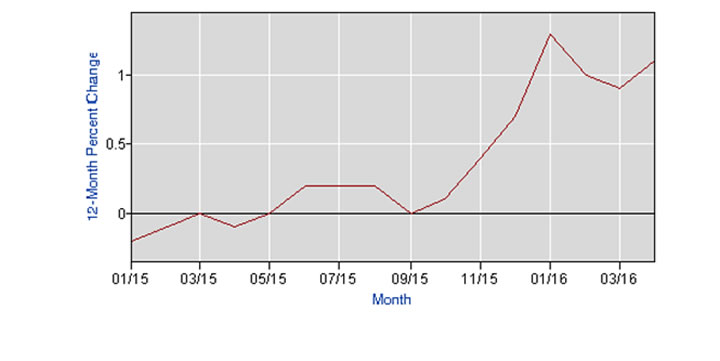

But, the evidence clearly shows that since July of 2015 GDP growth has been languishing; falling from 3.9% to 0.8%, while CPI has been rising during a relatively similar time span; from 0.2% to 1.1%.

In fact, the most recent month over month increase in the CPI of 0.4 percent was the highest since February 2013.

Meanwhile, the unemployment rate, which conveniently excludes discouraged workers, appears benign at just 5 percent. But we are starting to see chinks in the armor of employment.

Most recently, the 4-week moving average for unemployment claims was 275,750, an increase of 7,500 from the previous week's unrevised average of 268,250. And according to the BLS, the economy added just 160,000 new jobs in April. Wall Street had expected a 203,000 gain. This left many to wonder if hiring has begun to taper off along with a broader economic slowdown.

According to Market Watch, the pace of hiring was the lowest since September 2015 and job creation has slowed to an average of 200,000 net new jobs created for the past three months. This slowdown in the pace of hiring is coming off a five-year high of 282,000 a month in the fourth quarter of last year.

As stated before the Fed is seeking robust growth in the context of low inflation. But what is becoming manifest is the exact opposite. The Fed is missing its targets on both fronts--inflation is rising while at the same time growth is slowing.

What will Janet Yellen do if faced with a recession that comes along with inflation? Both the Fed and Wall Street are totally unprepared for this risk.

The government's effort to engender viable growth through debt and inflation is virtually guaranteed to fail. It has tried to repair an asset bubble and debt saturated economy by increasing both conditions. But, the real medicine the economy needs is to allow the free market to set interest rates much higher, which would deleverage the economy and allow the normalization of asset prices to income ratios.

This is why a collapse worse than 2008 is inevitable.

After 90 months of ZIRP and the creation of unprecedented asset bubbles--especially in the fixed income area--a neutral level on the Fed Funds Rate does not exist. Bubbles never pop with impunity no matter how much the FOMC would like investors to believe that this time is different.

The Fed will either be slowly raising interest rates into an economic meltdown or will remain behind the inflation curve until inflation runs intractable. Therefore, the most salient question for investors to answer is: Will the economy suffer through a 70's-style stagflation before the markets and economy fall into a steep and unprecedented contraction, or will it simply implode into the inevitable deflationary collapse straight away. My guess is that it will be the latter and next week's commentary will explain why.

Michael Pento produces the weekly podcast “The Mid-week Reality Check”, is the President and Founder of Pento Portfolio Strategies and Author of the book “The Coming Bond Market Collapse.”

Respectfully,

Michael Pento

President

Pento Portfolio Strategies

www.pentoport.com

mpento@pentoport.com

(O) 732-203-1333

(M) 732- 213-1295

Michael Pento is the President and Founder of Pento Portfolio Strategies (PPS). PPS is a Registered Investment Advisory Firm that provides money management services and research for individual and institutional clients.

Michael is a well-established specialist in markets and economics and a regular guest on CNBC, CNN, Bloomberg, FOX Business News and other international media outlets. His market analysis can also be read in most major financial publications, including the Wall Street Journal. He also acts as a Financial Columnist for Forbes, Contributor to thestreet.com and is a blogger at the Huffington Post.Prior to starting PPS, Michael served as a senior economist and vice president of the managed products division of Euro Pacific Capital. There, he also led an external sales division that marketed their managed products to outside broker-dealers and registered investment advisors.

Additionally, Michael has worked at an investment advisory firm where he helped create ETFs and UITs that were sold throughout Wall Street. Earlier in his career he spent two years on the floor of the New York Stock Exchange. He has carried series 7, 63, 65, 55 and Life and Health Insurance Licenses. Michael Pento graduated from Rowan University in 1991.

© 2016 Copyright Michael Pento - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Pento Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.