You Are Here, the Next Fourth Turning, No More Room to Increase Leverage

Politics / Social Issues Jun 06, 2016 - 08:31 AM GMTBy: James_Quinn

The next Fourth Turning is due to begin shortly after the new millennium, midway through the Oh-Oh decade. Around the year 2005, a sudden spark will catalyze a Crisis mood. Remnants of the old social order will disintegrate. Political and economic trust will implode. Real hardship will beset the land, with severe distress that could involve questions of class, race, nation and empire. The very survival of the nation will feel at stake. Sometime before the year 2025, America will pass through a great gate in history, commensurate with the American Revolution, Civil War, and twin emergencies of the Great Depression and World War II." - Strauss & Howe - The Fourth Turning

The next Fourth Turning is due to begin shortly after the new millennium, midway through the Oh-Oh decade. Around the year 2005, a sudden spark will catalyze a Crisis mood. Remnants of the old social order will disintegrate. Political and economic trust will implode. Real hardship will beset the land, with severe distress that could involve questions of class, race, nation and empire. The very survival of the nation will feel at stake. Sometime before the year 2025, America will pass through a great gate in history, commensurate with the American Revolution, Civil War, and twin emergencies of the Great Depression and World War II." - Strauss & Howe - The Fourth Turning

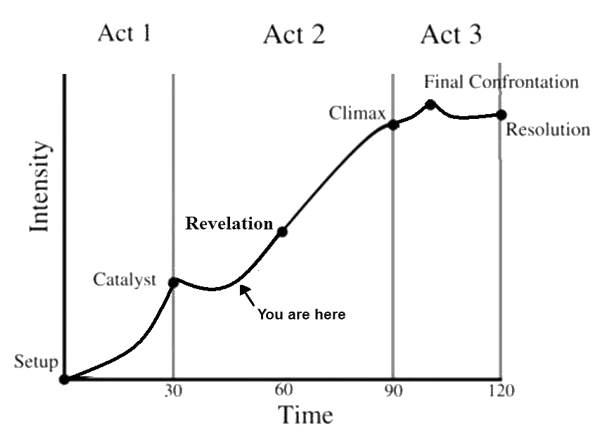

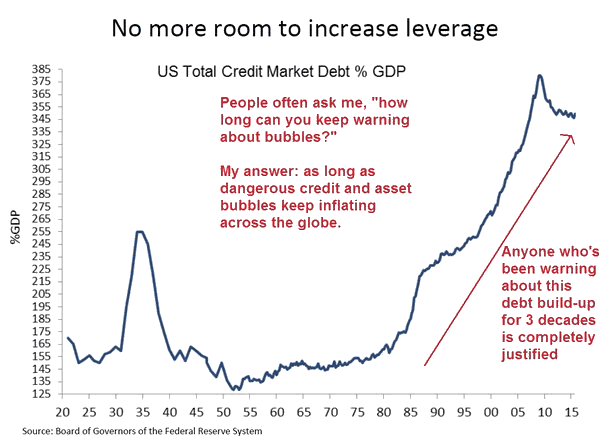

The chart below was posted by Jesse a few weeks ago. It accompanied a post titled Gathering Storm. He doesn't specifically refer to the chart, but his words reflect the ominous view of the future depicted in the chart.

"When gold and silver finally are able, through price action, to have their say about the state of Western fiscal and monetary policy actions, it may break a few ear drums and shatter a more than a few illusions about the wisdom and honesty of the money masters. Slowly, but surely, a reckoning is coming. And what has been hidden will be revealed."

The title of the post and the chart both grabbed my attention and provide a glimpse into the reality of our present situation. The Gathering Storm was the title of Winston Churchill's volume one history of World War II. Churchill documents the tumultuous twenty years leading up to World War II in The Gathering Storm. The years following World War I, through the Great Depression and the rise of Hitler were abysmal, but only a prelude to the approaching horror of 65 million deaths over the next six years. What appeared to be dark days in the 1930's were only storm clouds gathering before a once in a lifetime tempest. In my view we stand at an equally perilous point in history today.

The graph represents the standard progress of a three act drama in literature. In the three-act structure, act one has the least tension, since it is only establishing the characters and the settings. The catalyst triggers an increase in tension with the revelation dramatically escalating the pressure as you approach the climax. The intensity remains high in act three as the final confrontation and resolution play out. Every Shakespearean tragedy follows this general pathway to a final denouement. It peculiarly parallels the path of a Fourth Turning.

A Fourth Turning's three acts are the catalyst phase, regeneracy stage, and climax. The plot of this Fourth Turning crisis revolves around the core elements of debt, civic decay and global disorder. The 2008 global financial crisis, manufactured by the Fed and their Wall Street puppeteers, was catalyzed by hundreds of billions in bad debt issued as part of the largest control fraud scheme in world history. The brunt of this banker formulated disaster has been borne by the former working middle class and senior citizens dependent upon interest income to survive in an inflationary world. The initial threat of full-fledged collapse was deferred through extreme monetary and fiscal actions by the establishment vassals, as they created trillions in new debt to fill the vortex produced by the trillions in bad debt.

We are only in the early stages of Act 2 of this tragedy we call The Fall of the American Empire. The tension triggered in 2008/2009 by the Federal Reserve/Wall Street created subprime debacle subsided, as the ruling class was able to expand their wealth (rigging the financial markets), while crushing dissent (OWS, Tea Party), expanding their surveillance state (as revealed by Snowden), waging undeclared wars around the globe (Syria, Libya, Iraq, Yemen), adding $10 trillion to the national debt, while distracting the masses through propaganda, electronic bread and circuses, and trivial societal diversions. While the public is busy arguing about gay marriage, wedding cakes, transgender bathrooms, safe spaces, triggers, SJWs, Bruce Jenner becoming Caitlyn Jenner, and apes rights, the ruling class pillages the remaining wealth of the nation and forges ahead with their plans to control our lives.

Despite knowing a Fourth Turning generally ebbs and flows over a two decade time frame, it can be frustrating watching the corrupt crony capitalist pigs running this shitshow continue to flagrantly disregard the rule of law, the Constitution, and abusing the citizens of this country. But the temporary lull in intensity is coming to an end. We are now eight years into this Fourth Turning with at least a decade to go before the climax. The regeneracy has been slow in coming, but it appears the mood of the country has been catalyzed by the anti-establishment campaigns of Trump and Sanders. They have begun the process of regeneracy against the ingrained, corrupt, immoral establishment.

The people are collectively revolting against the existing social order as they are finally realizing they have been used and abused by the ruling oligarchy as pawns in their game of world domination. The obscene wealth of the .1% has been absconded from the working class through abuse of the tax laws, trade deals, regulations, monetary policy, public school indoctrination, peddling of debt to the masses, and relentless propaganda. The systematic manipulation of the financial, monetary, political and commercial markets by the money masters has left the country like a mighty diseased, hollowed out, rotting oak tree - one storm away from collapsing and splintering into a thousand pieces. A gathering storm approaches.

The mood of the country has turned dark. The political parties are splintering. The elites in NYC, DC, and LA are appalled the peasants in flyover country are not following orders and voting for the hand-picked lackey candidates. If Clinton can avoid indictment, she'll represent the establishment versus the anti-establishment Trump in the upcoming election. The establishment is using the power of the press to try and discredit Trump and Sanders. It's failing. The mainstream media is now trusted and respected on par with Congress - lower than whale shit.

The establishment is now resorting to paying thugs to violently disrupt Trump campaign events. This ploy is backfiring, as the white silent majority gravitates toward Trump every time an illegal immigrant burns an American flag or a young woman is assaulted by Black Thugs Matter paid rioters. With the economy in freefall, rigged financial markets immensely overvalued, debt levels at extremes, global tensions rising, and an increasingly angry American populace desperate for change, it appears the stars are aligning for a Trump presidency. He is a flawed human being, with a huge ego, no filter, and no experience governing. But none of that matters. He has captured the zeitgeist of this moment in history.

At this juncture in a Fourth Turning the public is ready to dump leaders who have downplayed the vast problems facing the country (unfunded liabilities, illegal immigration, entitlements, debt, wars, jobs, bankers) in favor of leaders who are willing to amplify and tackle those problems head on. A new civic ethos of addressing and responding to threats is taking hold. The generational configuration is aligned and the mood of the country is ripe for a prophet generation Boomer, like Trump, to be the Grey Champion who will lead the country through the darkest most perilous portion of this Fourth Turning.

As this Fourth Turning careens towards its climax, the intensity will escalate. Bold decisions will need to be made requiring a leader who displays tremendous confidence and strong leadership. Political correctness will be cast aside. The previous two Grey Champion leaders - Lincoln and Roosevelt - are despised on many levels by many people, as they both ignored the Constitution on many occasions while attempting to do what they thought best in leading the country through desperate times. Their policies and executive actions during those dark days of the Civil War, Great Depression, and World War II left a long lasting impact on the country and play a major role in our current crisis. As Strauss and Howe predicted almost 20 years ago, the regeneracy is solidly under way.

"Soon after the catalyst, a national election will produce a sweeping political realignment, as one faction or coalition capitalizes on a new public demand for decisive action. Republicans, Democrats, or perhaps a new party will decisively win the long partisan tug of war. This new regime will enthrone itself for the duration of the Crisis. Regardless of its ideology, that new leadership will assert public authority and demand private sacrifice. Where leaders had once been inclined to alleviate societal pressures, they will now aggravate them to command the nation's attention. The regeneracy will be solidly under way." - Strauss & Howe - The Fourth Turning

It is difficult for the vast majority of people to comprehend the likely chaos, pain, bloodshed and war which will overspread the nation and the world during the final two acts of this tragic play. The discomfort most people are feeling is just their cognitive dissonance telling them everything will be fine as they experience a steady decline in their standard of living. Harkening back to Jesse's original chart, the Fourth Turning regeneracy is aligning with the Revelation in Act 2.

The day of reckoning will arrive when Trump is elected and that which has been hidden is revealed. Anyone who doesn't grasp the increasing intensity of the rhetoric, opponent interactions, and media responses will be blind-sided by the coming storm. The days of delusion, denial and debt are going to revert to dismay, depression and death.

There is no more room to increase leverage. Americans are up to their eyeballs in mortgage, credit card, auto loan, and student loan debt ($17.4 trillion). Corporations are stuffed with record levels of debt ($14 trillion) they used to buy back their stock at all-time high prices. State and local governments are drowning in trillions of debt and unfunded pension liabilities. The Federal government is $19.3 trillion in debt, with unfunded entitlement liabilities exceeding $200 trillion.

It is mathematically impossible for this debt to be repaid with a rapidly aging developed world and a debt saturated developing world. With financial markets as overvalued as they have ever been, the next crash will leave all the heavily indebted parties with no assets to repay the debt. The losses will make the 2008 financial crisis look like a stroll in the park. And the Fed shot their load years ago, without having the guts to reload. Their credibility is shot and their $4 trillion balance sheet is insolvent. The Wall Street banks are zombies sustained by 0% interest rates and accounting fraud.

I know the last few years have been frustrating for the "doom and gloomers" who actually have critical thinking skills and understand the nature of our dire economic situation. Much like Michael Burry, as described so well by Michael Lewis in The Big Short, your facts may be 100% correct but markets and people can remain irrational for longer than you think possible. By having the courage of your convictions, you must be prepared for scorn, ridicule, and mocking.

As the unpayable debt has expanded to ever greater heights and monetary authorities across the globe implement wildly desperate measure like negative interest rates and buying financial assets to prop up stock markets, the public has become more unquestioning of reality and deluded by the seeming stability of financial markets. Record low interest rates and rising stock prices reinforce the normalcy bias of most people.

Many smart, normally skeptical, people have thrown in the towel. Because the gathering storm has not struck as predicted, they begin to believe it will never strike. This same mindset existed in 1860, 1929, 1940, 1999, and 2007. It easy to be lulled to sleep by the propaganda media machines, lying politicians, and extreme monetary schemes portrayed as normal by the money men. Things are not getting better. We are not at the end of this crisis.

We are in the midst of a Greater Depression, with the most trying times still ahead. Fourth Turnings never de-intensify. They intensify into a chaotic whirlwind, where the future of our civilization hangs in the balance. The climax of this play is a long way off. The election of Trump in November will trigger the transformational change that always happens during a Fourth Turning. An ill wind is beginning to blow. You can't avoid the coming storm, but you can mentally and physically prepare. Our choices will make a difference.

"The seasons of time offer no guarantees. For modern societies, no less than for all forms of life, transformative change is discontinuous. For what seems an eternity, history goes nowhere - and then it suddenly flings us forward across some vast chaos that defies any mortal effort to plan our way there. The Fourth Turning will try our souls - and the saecular rhythm tells us that much will depend on how we face up to that trial. The saeculum does not reveal whether the story will have a happy ending, but it does tell us how and when our choices will make a difference." - Strauss & Howe - The Fourth Turning

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2016 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.