Stock Market Thinking Upside Down; Dow 18k Still Key

Stock-Markets / Stock Markets 2016 Jun 17, 2016 - 06:19 AM GMTBy: Doug_Wakefield

Do you remember the ‘70s, and the all-star disaster films like the Towering Inferno and the Poseidon Adventure? As interest rates and gas prices soared, we “escaped” to the theatre to watch these big disaster films.

Do you remember the ‘70s, and the all-star disaster films like the Towering Inferno and the Poseidon Adventure? As interest rates and gas prices soared, we “escaped” to the theatre to watch these big disaster films.

You will remember in the Poseidon Adventure that a luxury liner traveling from New York to Athens is broadside by a huge rogue wave set off by an underwater earthquake. The entire ship is turned upside down. Reverend Scott (Gene Hackman) surmises that the solution is to be found by climbing upwards to the stern, where the ship’s propellers are now the highest point on the ship. Robin (Eric Shea) is a young man interested in ships and tells Scott that the hull is only 1 inch thick near the propeller shaft.

Through an intense drama to find the bottom of the ship (now the HIGHEST point since turned upside down), a group finally makes it to a watertight door to the propeller shaft’s room. Detective Rogo (Ernest Borgnine) is left to lead 5 passengers through the door and into the propeller shaft tunnel, where the group bangs on the hull to attract the rescuers’ attention. A hole is cut, where the group finds themselves being rescued to safety.

As I look at the deflationary forces that have been impacting the global economy for more than two years now, I believe that the story, though certainly dramatic and some would argue a bit melodramatic, has some very practical lessons for everyone today.

When you are coming to the end of the great central bank promoted “we can inflate our way out of this mess by attempting to levitate financial assets with even more debt”, then the best decisions seem to me to be the ones where we move in the opposite direction. In other words, we seek to think upside down.

[Chart from article, When Rare Data Screams, Listen, May 19 ‘16]

Deflationary Forces Are Coming, Printing Money Has Not Stopped It

Anyone looking at various charts and statistics can see that the global economy has slowed, individual markets have been deflating, and more QE has not stopped this trend. This is extremely critical for investors in American equities. As of April 2016, according to the Investment Company Institute, domestic and international equities stood at 8.18 trillion, down 487 billion (5.6%) from its $8.67 trillion a year earlier.

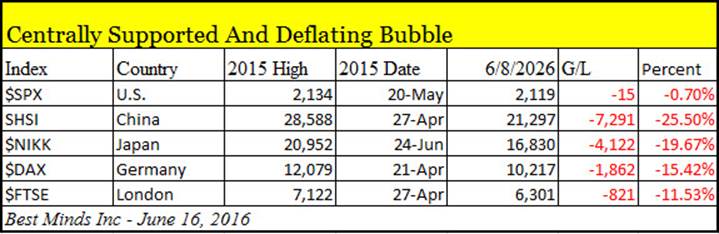

Yet if I take THE highest close in the S&P 500 this year, a value less than 1% from its May 20, 2015 all time high, and compare it with other major equity markets around the world, I find that they were much lower than their 2015 highs by June 8, 2016.

We should all be asking, “Are the other global equity markets leading the deflationary bust, or is the US economic and corporate picture getting stronger, and thus US equity markets will lead these other major equity markets higher?”

Let’s take a look at a few places to find some answers.

Global shipping has declined sharply over the last two years.

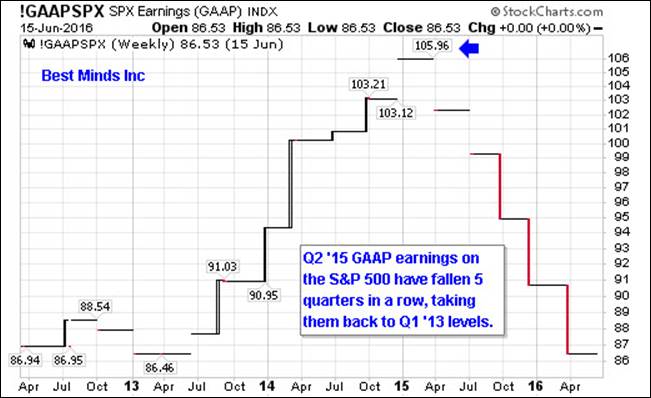

Corporate earnings in the S&P 500 have declined over the last 5 quarters. Using the standardized GAAP method of accounting, they are back at Q1 ’13 levels.

Is there anyone who does not know that even after the powerful rally in oil (WTIC) this year, it is still over half the price per barrel seen in July 2014?

We continue to watch the utter failure of years of QE (quick and easy money) to get the global economy moving faster, even as this week we have seen another first in history event as yields on 10-year German bunds went negative.

IMF Slashes World Growth Forecasts Again, CNBC, April 12 ‘16

German Bonds Enter Uncharted Negative Territory, CNN Money, June 14 ‘16

So with May’s worst jobs numbers in 5 years, I really don’t think anyone was really that surprised that the Federal Reserve now finds its hands tied, thus rate hikes from a “strengthening” economy are off the table.

The central bankers’ policy has been that higher stock prices mean the economy will follow. However, higher US stock prices have not levitated other major equity markets to US levels, and quarter-after-quarter deflating economic pictures continue rolling in.

- Our hearts and prayers go out to the family of MP Jo Cox today. Jo Cox MP Dead After Shooting Attack, BBC News, June 16 ‘16

Be a Contrarian, Remember Your History

Bulls become bears, and bears become bulls. Trends always end; always begin.

If you have never downloaded my research paper, Riders on the Storm: Short Selling in Contrary Winds (Jan ’06), do it now while the Dow is still close to 18,000. At the top of a bubble, learning from those who are the ultimate contrarians (chapter 4) is extremely valuable, no matter what your relationship to the world of money and markets.

To gain access to the most up to date research, click here to start a six month subscription to The Investor’s Mind. Critical thinking, technical analysis, and history are crucial for everyone seeking patterns to help navigate the waters.

On a Personal Note

Check out the posts at my personal blog, Living2024. The latest post is The “Experience” Market Bubble.

Doug Wakefield

President

Best Minds Inc. a Registered Investment Advisor

1104 Indian Ridge

Denton, Texas 76205

http://www.bestmindsinc.com/

doug@bestmindsinc.com

Phone - (940) 591 - 3000

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.