Stock Market Week Of Uncertainty

Stock-Markets / Stock Markets 2016 Jun 20, 2016 - 08:59 AM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX Long-term trend: A lengthy correction is most likely underway!

SPX Intermediate trend: The British referendum could have a significant impact on the intermediate trend.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discuss longer market trends.

Daily market analysis of the short term trend is reserved for subscribers. If you would like to sign up for a FREE 4-week trial period of daily comments, please let me know at ajg@cybertrails.com

A WEEK OF UNCERTAINTY

Market Overview

Next week, on June 23rd, the British people will vote on whether or not to stay in the European Union. The result of this vote could have a serious short-term -- and perhaps intermediate -- impact on the market, especially if it is for Brexit! At the recent FOMC meeting, in the Q&A session Janet Yellen cited it as one of the reasons to hold off on raising interest rates as Brexit could have an impact on the US economy. The recent decline from 2120 may have been motivated primarily by cautious selling ahead of the vote and there could be more of the same over the next three days, especially if the re-bound from 2050 was primarily the function of options expiration.

With the latest polls showing a virtual tie, serious analytic forecasting will be of little use. The next three trading days could be volatile, and it is not clear that the market will be able to predict the outcome by its behavior. The only certainty about the result of the referendum will come when it is announced on Friday morning.

SPX Chart Analysis (This chart and others below, are courtesy of QCharts.com.)

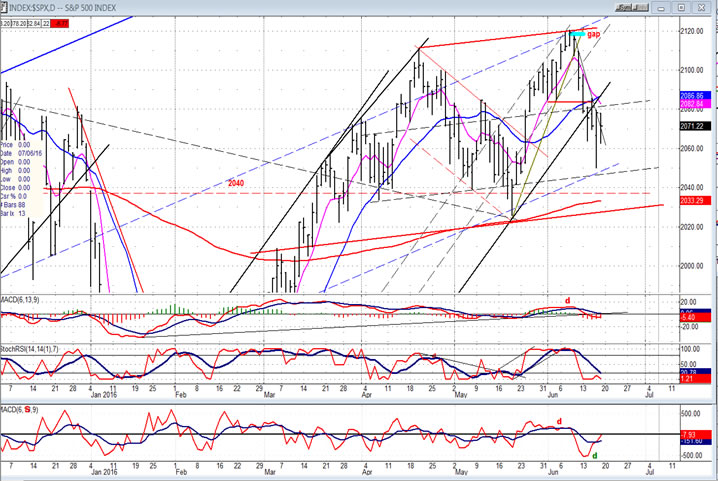

Daily chart

Last week, SPX continued the decline which it started from 2120 the week before. It finally found support at 2050, a few points short of its initial projection of 2046. There is another projection from the top which could extend the downtrend to the former low of 2025. Whether or not this can be achieved before Thursday remains to be seen. Good support starts at 2060, but the drop to 2050 may have weakened it and the next challenge to that level may have clear sailing all the way to the next projection target.

Continuing the decline to that level is certainly a possibility if the media continues to stress the potential consequences of Brexit. It looked as if options expiration had a positive effect on the index on Thursday and Friday. This is now behind us and by Friday’s close, the bounce from 2050 looked ready to resume the decline. Although the hourly indicators stopped just short of giving a sell signal, the daily indicators remained in a declining mode, and one could even make the case that the weekly SRSI gave a definite sell signal and that the weekly MACD made a bearish cross after showing unmistakable negative divergence. Is this enough to conclude that the intermediate trend has turned down, meaning that Brexit will win out? Probably not, but taken at face value, technically, it’s not a positive development for the market.

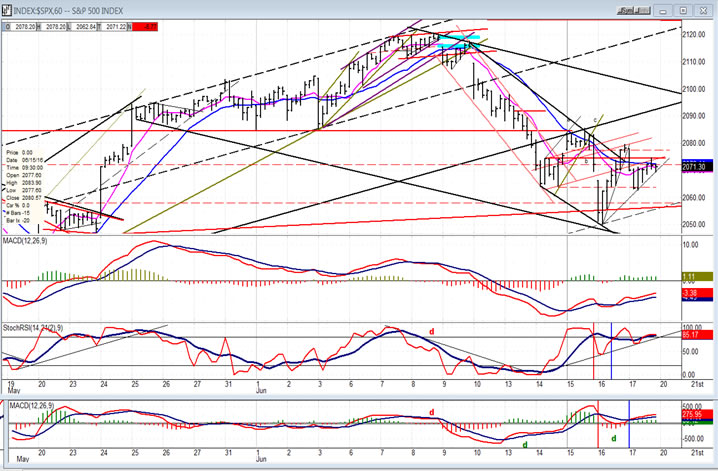

Hourly chart

Thursday’s bounce from 2050 was a quick 30-point retracement, but it fell short of the previous near-term high. There was a strong band of support at the 2085 level which held prices above it for nearly three weeks. It was penetrated to the downside during the 70-point decline from 2120, thus becoming an important resistance level which has already stopped prices on two different occasions. If SPX is to get back into an uptrend, it will have to rise above it.

For the moment at least, the index looks more inclined to go the other way. The bounce from 2050 stopped at 2080, then gave up half of its gain at Friday’s opening; although the market crawled back part of the way during the rest of the day. It’s likely that the move from 2050 was an oversold rally which was assisted by options expiration, but by Friday’s close, all the steam seemed to have gone out of the rally and the three oscillators looked ready to roll over with the MACD still negative.

Over the near-term, the path of least resistance still appears to be on the downside. There was some selling after Friday’s close, but it could have been options-expiration related.

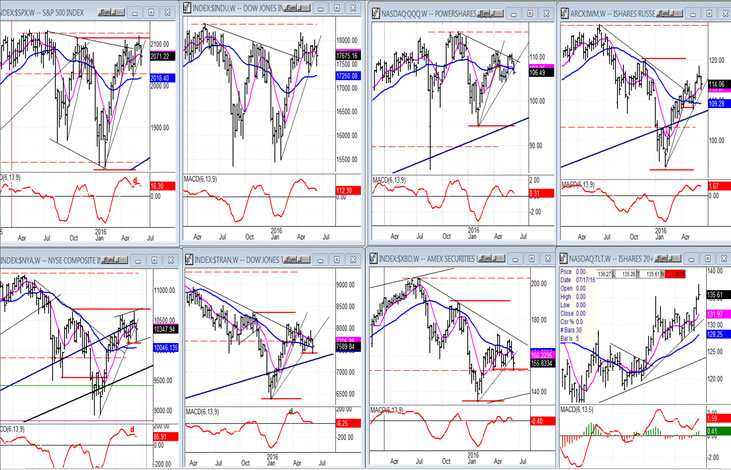

- SPX et al… (weekly)

- Last week, the worst performers of this group continued to be the same ones as before: TRAN and XBD, which gave up all of their previous rallies. The NYA also had a sharp retracement, but it participated in the options expiration rally. QQQ was influenced by the weakness in AAPL, and IWM had a good retracement but remained the strongest near-term member of this group… except for TLT, of course, which came close to its all-time high of 1/15 before pulling back a little.

- Note that with the exception of TLT, all the indicators are rolling over again from a lower high with TRAN and XBD about to go negative.

-

- UUP (dollar ETF)

- UUP has tried twice to move through its corrective channel and was stopped both times. If it tries again, it will have to surpass the high of the first attempt, but then will face more resistance from the 200-DMA. We need more clarity about UUP’s short-term intentions.

-

- GLD (Gold ETF)

- GLD had a strong rally which carried it to a slight new high, but it pulled back immediately after meeting trend line resistance. Whether or not it can push higher may depend on the result of Thursday’s referendum.

-

USO (US Oil Trust)

- USO met with resistance where it should have, and pulled back. It broke a steep trend line, but found support just above its main trend line. In spite of the sharp re-bound, it may not be ready to challenge overhead resistance without further consolidation.

Summary

The British referendum should have a significant influence on the markets this coming week. It is best to keep from making specific predictions, especially about the intermediate trend, until after the results have been announced.

Andre

FREE TRIAL SUBSCRIPTION

If precision in market timing for all time framesis something that you find important, you should

Consider taking a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth. It embodies many years of research with the eventual goal of understanding as perfectly as possible how the market functions. I believe that I have achieved this goal.

For a FREE 4-week trial, Send an email to: info@marketurningpoints.com

For further subscription options, payment plans, and for important general information, I encourage

you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my

investment and trading strategies, and my unique method of intra-day communication with

subscribers. I have also started an archive of former newsletters so that you can not only evaluate past performance, but also be aware of the increasing accuracy of forecasts.

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.