Why Stability is Not what Bitcoin Needs and Why Big Business Should Move Into It

Currencies / Bitcoin Aug 06, 2016 - 05:16 PM GMTBy: Submissions

Shannon Lowery writes: It is constantly spoken that Bitcoin is not viable because it is not stable.

Shannon Lowery writes: It is constantly spoken that Bitcoin is not viable because it is not stable.

Stability, from my view point, is not what Bitcoin needs.

Bitcoin needs appreciation.

From my personal vantage point, Bitcoin should not be stable until it reaches 1 Million Per Bitcoin, or even more. Why? Because it is severely undervalued at the moment being that it has yet to go commercial, which is why this platform was created.

The fact of the matter is that inflation must come, and has already come in a great deal of places. IE) Houses now come with a 30 year mortgage, consuming 30-40 of monthly household income in the US.

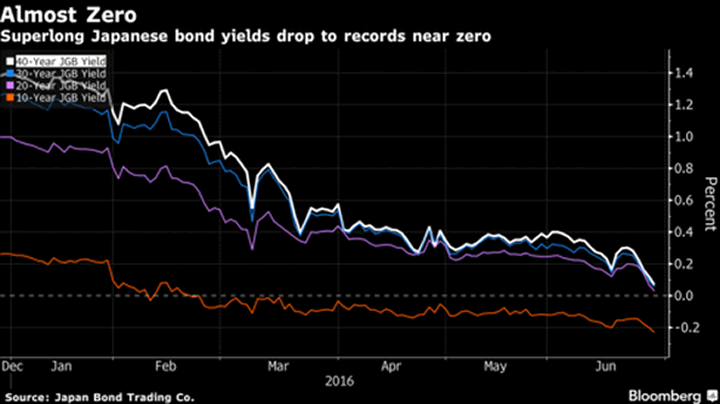

The inflation and currency difficulty is everywhere and can only get worse. Never in modern finance and economics have so many Government Bonds yielded negative interest rates, certainly an indicator that can not be further ignored.

If something must be inflated, it seems more appropriate that Bitcoin should be inflated because it is limited to 21 Million and has the capacity to be divided by several decimal points for future lending and/or societal use, meaning it can be inflated well beyond any other asset or commodity and still retain its future usefulness.

After reaching the fore mentioned level, or whatever level is deemed appropriate, then it should be stabilized so that lending can be accomplished via the increments of Satoshi.

Any businessman that can see beyond 4 months must certainly know that Bitcoin Lending will come. As time proceeds, the system will become more faster and efficient and be adopted as the eventuality of the current monetary order further showcases itself.

As a truth, it is in any businesses interest to accept Bitcoin, because it is appreciating in value while other money commodities are devaluing, though in its current state I suppose it should be confined to large commercial transactions so as to not congest the system.

Certainly the day will come when Bitcoin will be accepted at major retailers, at service stations and every other venue where all other major payment methods are on display, for those retailers own good and profitability.

For those laboring to accomplish this end, the only way for this to be accomplished, or one way at least, is for it to begin appreciating, forcing all to take notice.

Thus, in conclusion, volatility- as it relates to the price of Bitcoin in it's current stage of development, is not necessarily bad, so long as its long term trajectory remains upward.

Apparently a 4400% increase in 7 years mainly on the back of retail transactions has been insufficient, however, with what is taking place on the Global Economic Stage, it's real appreciation must shortly begin.

As a matter of facts, paper currencies do not last forever nor have they historically lasted long, their nature is depreciation.

It is near miraculous that the Federal Reserve and a number of Central Banks have had the capacity to hold things together this long, yet in still, there is an eventuality that must be faced if we are to be prepared for that eventuality.

As such, it would seem prudent for Governments, as good stewards, to slowly (some faster than others) to collectively begin introducing this global solution into their economies, and for those institutions who wish to hold some sort of leading position in the future, or to get ahead of what is happening, to begin building reserves in it.

By Shannon Lowery

http://www.securetradeplatform.com

© 2016 Copyright Shannon Lowery- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.