A Look At Commodities and Financial Markets Trading Week Ahead

Stock-Markets / Financial Markets 2016 Aug 15, 2016 - 11:19 AM GMTBy: Submissions

Symmetry Trader writes: Crude Oil (CLU6) - Our primary trading instrument turned up in a correctional fashion this week.

Symmetry Trader writes: Crude Oil (CLU6) - Our primary trading instrument turned up in a correctional fashion this week.

We look for it to be up for the next couple of weeks. Look for buys at 42.50 and resistance at 47 area

ES is at a 1.272 (fibonacci) resistance area. We could see it pulling back to the 2100 area.

It is in the middle of nothing, not a buy nor a sell at this level. We think it is a buy at 2100 and a sell at 2254-2290

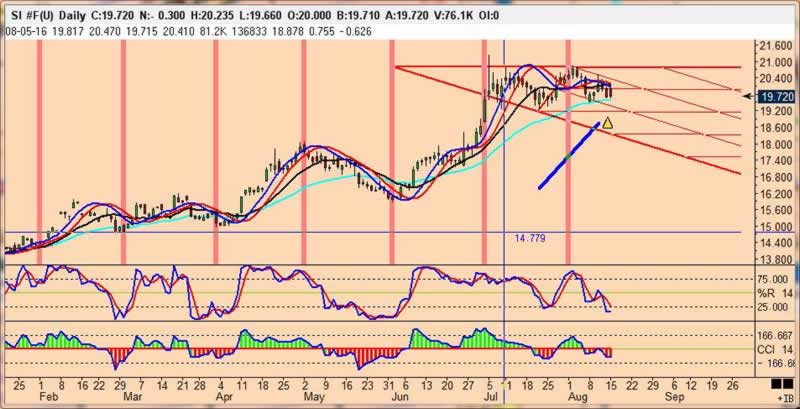

Silver is at a pullback area. Monthly support is around the 18 area and weekly support around 18.800

Look for a support/buy area next week on SI at the 19350-19400 area for a bounce

Look to sell the 6E at the 1.1252 area as long as that downtrendline holds. We are looking for lower to the 1.0804 area

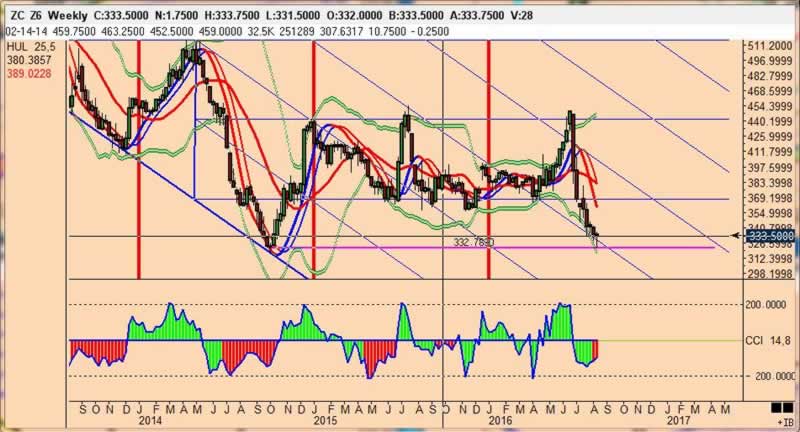

Most interesting chart of the week: DEC2016 Corn. Might spit down to the 3.20 area and then up or it could just go from this area.

The daily is making an abcde triangle and this formation could very well break upward. Corn is well below production b/e (even though

they say there is a glut of corn, but we think it is more strong-dollar related). Anyway, we are looking for a 30 cent move to the 3.60-3.65 area

We have owned corn as we have predicted the bottoms and tops for the last 4 years.

We predicted this years high earlier at 4.45-4.50 and see the low in corn at 3.20-3.30

The dollar has been in an abc formation for the past few two years trading in a range between 92.40 and 101.50, roughly a 9 point range

Look for dollar longs at 9475, but 99.50 should contain any rallies

New crop December cotton looks to have hit a possible high at 77.98. We would be looking to hedge this years crop anywhere above 74.00

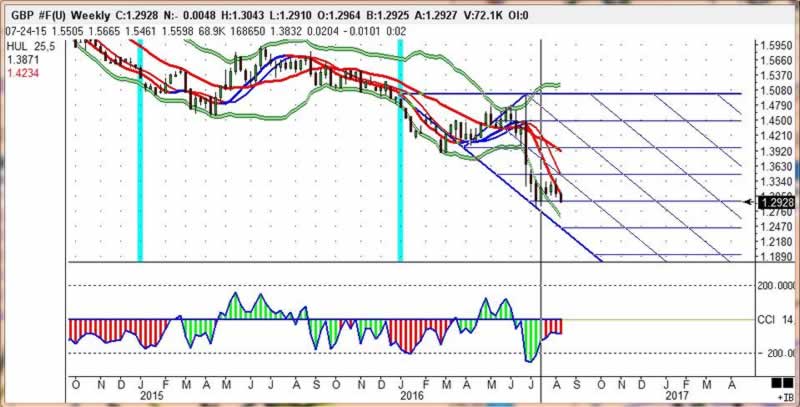

This sterling chart looks like the big money is really trying to punish Great Britain for leaving the euro. Sell all rallies, this looks down to at least 1.1953 area

Trade Room free open house 8/15/16-8/19/16 :: Email or complete form to join us (type "OPEN HOUSE" in email subject line or in Question/Comment section of our form).

THE RISK OF LOSS IN TRADING COMMODITY FUTURES AND OPTIONS CAN BE SUBSTANTIAL AND MAY NOT BE SUITABLE FOR ALL INVESTORS. There is always a risk of loss. Prior to utilizing a trading system, investors need to carefully consider whether such trading is suitable for them in light of their own specific financial condition. Past performance is not necessarily indicative of future results.

© 2016 Copyright Symmetry Trader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.