The IMF’s Internal Audit Reveals Its Incompetence and Massive Rule Breaking

Politics / Global Financial System Aug 26, 2016 - 06:06 PM GMTBy: John_Mauldin

To understand the sordid tale of the IMF, we need to look back at Greece. We think of Greece as the epicenter of the eurozone debt crisis, but it had company.

To understand the sordid tale of the IMF, we need to look back at Greece. We think of Greece as the epicenter of the eurozone debt crisis, but it had company.

As the Fed’s initial QE program pushed US stocks higher, Greece’s growing budget deficit led credit agencies to downgrade its sovereign debt rating in late 2009. So, the government cut spending… but not by enough.

Prime Minister George Papandreou formally asked for, and received, a bailout from a “Troika” consisting of the EU, ECB, and IMF.

It soon became clear that Greece's heavy debt load would require harsh measures. The question then became how to distribute the pain.

The IMF shouldn’t bail out Greece in the first place

A normal bankruptcy proceeding results in some kind of balanced plan. Creditors take a haircut while the debtor gives up assets and/or income.

In Greece’s case, the creditors were large European banks that were not predisposed to writing down their asset values. Through the EU and ECB, they pushed for Greece to cut spending and sell state-owned assets to raise cash.

The Greeks were not enthusiastic about austerity. The population wanted its benefits, and the oligarchs didn’t want to reform.

Europe didn’t want a banking crisis but also didn’t want to pony up enough money to really rescue Greece.

A long standoff ensued.

IMF rules say the organization is not supposed to make a loan unless the borrower has a reasonable prospect of repaying it. It has routinely demanded harsh conditions in exchange for aiding smaller African, Asian, and Latin American countries.

These conditions for getting the money all but guaranteed continued crisis in the countries that were subjected to them.

So why was the IMF reluctant to apply similar measures to Greece?

Fear of contagion led the IMF to break its own rules

Thanks to the IEO report (internal audit), we know that IMF officials sneaked a major rule change into the plan presented to the IMF board. It allowed an exemption from normal credit standards in cases where there was risk of systemic contagion.

I don’t doubt they were worried about contagion. Their action came on the heels of the Lehman Brothers bankruptcy and 2008–2009 financial crisis.

There was concern that anything done for Greece would set a precedent for far larger Spain and Italy. The markets knew that and were watching closely.

The fear that contagion would result if the IMF played by its usual rules was not irrational.

On the other hand, rules exist for a reason. Propping up banks that make bad loans is not part of the IMF’s remit. Nor is it the IMF’s mission to prop up governments that will not make reasonable economic reforms.

Arguably, the whole Greek affair was not the IMF’s business. Greece was a member of the European Union. The EU should have taken responsibility. The IMF should have offered nothing but advice and best wishes. But that’s not what happened.

More mistakes amid internal turmoil

Around this time, Christine Lagarde’s predecessor, Dominique Strauss-Kahn, was arrested in New York. He was charged with sexual assault of a hotel maid.

Whatever happened, it seems the IMF managing director had more than Greece on his mind. He stepped down in May 2011, and Lagarde took his place a few weeks later.

So in addition to being involved where it shouldn’t and breaking its own rules, the IMF was embroiled in internal turmoil while nations teetered on the edge.

The stress showed up in disastrously wrong growth forecasts used to justify the eurozone bailouts.

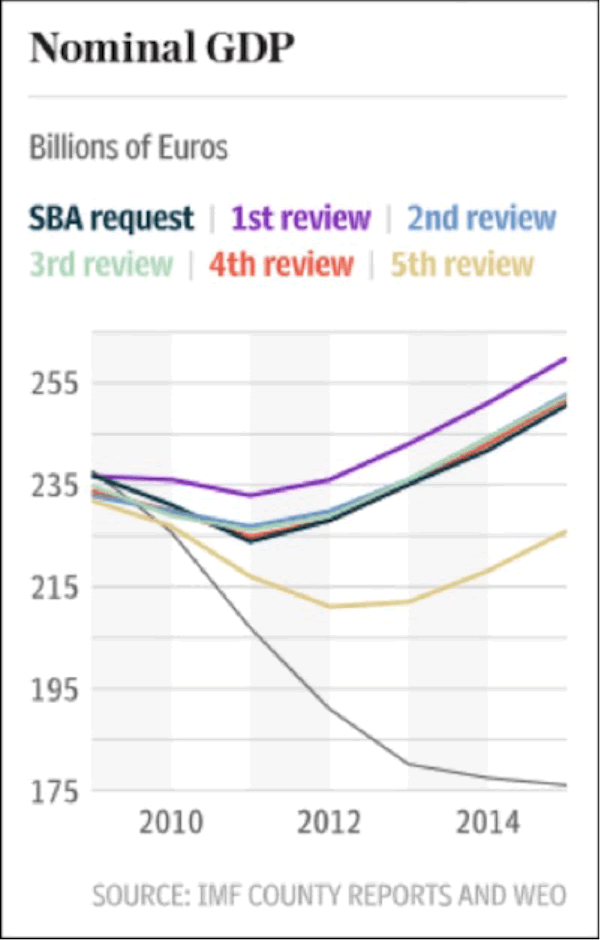

The thin black line that scrapes the bottom of the following chart is actual Greek GDP.

The other lines are forecasts the IMF made during periodic reviews. By the fifth review, they were closer to reality but were still tracking far above actual GDP.

The IMF wanted to set off a crisis to achieve its goals

It gets worse. It seems that as late as this year, IMF technocrats were actively plotting how to create another European crisis to further their goals.

In April, Wikileaks released the transcript of an IMF teleconference. The conversation occurred on March 19, 2016, and included the two IMF officials responsible for Greece, Paul Thomsen and Delia Velkouleskou.

Here’s the interesting part.

THOMSEN: What is going to bring it all to a decision point? In the past there has been only one time when the decision has been made and then that was when they were about to run out of money seriously and to default. Right?

VELCULESCU: Right!

THOMSEN: And possibly this is what is going to happen again. In that case, it drags on until July, and clearly the Europeans are not going to have any discussions for a month before the Brexit, and so, at some stage they will want to take a break and then they want to start again after the European referendum.

THOMSEN: But that is not an event. That is not going to cause them to… That discussion can go on for a long time. And they are just leading them down the road… why are they leading them down the road? Because they are not close to the event, whatever it is.

VELCULESCU: I agree that we need an event, but I don’t know what that will be.

The “event” they are wishing for is something that will put Greece in default and force Europe, particularly Germany, to agree to IMF demands.

They see the upcoming Brexit vote as an opportunity since Britain and others will be looking away from Greece. They also think the “event” will jar the Greek parliament into agreement.

We don’t know if the hoped-for event would have done the trick. The leak was just weeks before the Brexit vote.

At least, the IMF showed that it understood the situation. Their goal was to force Greek and EU negotiators into a compromise that had eluded everyone for years.

On the other hand, they were willing to set off a whole new crisis in order to accomplish this. In which case, they might have cured the disease but killed the patient.

Join Hundreds of Thousands of Readers of John Mauldin’s Free Weekly Newsletter

Follow Mauldin as he uncovers the truth behind, and beyond, the financial headlines in his free publication, Thoughts from the Frontline. The publication explores developments overlooked by mainstream news and analyzes challenges and opportunities on the horizon.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.