This Commodity Has Perked Up its Investors' Portfolios

Commodities / Agricultural Commodities Sep 27, 2016 - 06:34 PM GMTBy: EWI

The 90% rally in sugar prices since late 2015 fulfills our long-standing forecast

The 90% rally in sugar prices since late 2015 fulfills our long-standing forecast

Imagine that the world's leading commodity markets were cars speeding down a two-lane highway. Who do you think is in the driver's seat controlling which direction prices go?

Well, if you follow the mainstream school of wisdom, the answer to that question is simple: Outside factors, or "fundamentals," drive price trends in commodity markets. That can be a countless number of external factors related to the market itself, such as supply/demand data, weather patterns, political unrest in growing regions, other markets, and on.

We see the picture quite differently. In our opinion, fundamentals are in the passenger seat, at best. And behind the wheel is investor psychology, which unfolds as Elliott wave patterns on price charts.

Nothing makes this distinction clearer than the recent history of one single commodity: sugar.

In mid-2015, sugar prices were about as sweet as curdled milk. The market was mired in a multi-year bear market with prices circling the drain of an 8-year low.

According to the mainstream experts, the sugar "car" was being driven by several bearish factors, such as:

- The currency of the world's no. 1 sugar producer -- Brazil -- was at a 12-year low

- Oil prices were plunging, reducing demand for alternative, ethanol-based fuels

- The European Union was ending its "Quota system" which helps shield against outside competition

- China was flooding the market with artificial sweeteners

- The U.S. dollar was soaring

- And Brazil was experiencing a bumper sugar crop

Factors like these, many said, were destined to steer sugar prices Thelma & Louise style straight over a cliff -- as these news items from mid-2015 make plain:

"Sugar Bears Still in Charge" (Wall Street Journal)

"Global sugar prices have been on a downward trend, and there's no end in sight." (Food Navigator)

"The futures sugar market in New York behaves like an endless rerun of a horror movie." (Wall Street Journal)

"Such is the state of the sugar cane market that local media in India have reported a rise in the number of sugar farmers committing suicide. The market is expected to remain in surplus into next year." (The Telegraph)

Now, for our take on the situation. According to our chief commodity analyst Jeffrey Kennedy, that same sugar "car" was about to make an abrupt U-turn -- U as in "UP."

In our July 2015 Monthly Commodity Junctures, Jeffrey Kennedy outlined a very bullish scenario for sugar, including these details:

"I've noticed over the years that significant turning points tend to occur in years ending 0 and 5... as we move into 2015, I'm actually anticipating a significant low. I'm looking for prices to bottom this year.

"I believe we're in the very late stages of the initial move down. Ideally, say as move into the fourth quarter of 2015, the [decline] will terminate ant that will give way to an advance where I expect sugar prices to actually double.

"Once we do finish this move down, I will be looking for a sizable move, something that will easily push prices back up to 18, 20, even as high as 22."

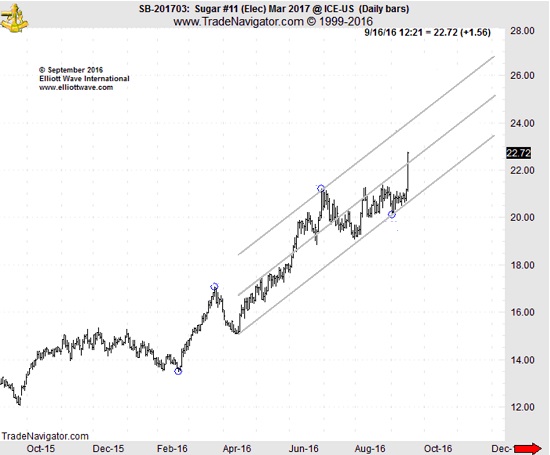

From there, the next chart shows what happened:

- Sugar prices bottomed in late September, 2015, the "fourth quarter" time window that Jeffrey identified.

- Then, sugar prices exploded upward in a 90%-plus rally to the 22 cents/pound price target that Jeffrey identified.

When markets present Elliott wave counts as strong as the one that helped Jeffrey anticipate sugar's dramatic 2015-6 comeback -- it captures all of our analysts' attention.

In fact, in our September 19 Short Term Update, we gave a special commodity update to address the next likely move in sugar -- one that may make a dramatic appearance soon:

"As for other markets, if you have any experience in commodities, Sugar is a candidate for a [major move]."

|

Get 32 pages of actionable trading lessons, hand selected by EWI's Chief Commodity Analyst Jeffrey Kennedy, designed to help you become a better trader. Absolutely free! All you need is to create a free Club EWI profile. Here's what else you'll learn:

Download your copy of Commodity Trader's Classroom now. |

This article was syndicated by Elliott Wave International and was originally published under the headline This Commodity Has Perked Up its Investors' Portfolios. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.