How Could Shift in Monetary Regime Affect the Gold Market?

Commodities / Gold and Silver 2016 Oct 28, 2016 - 12:17 PM GMTBy: Arkadiusz_Sieron

Some economists, including San Francisco Fed President John Williams, have recently suggested raising the FOMC’s 2-percent inflation objective or implementing monetary policy through alternative frameworks, such as price-level or nominal GDP targeting. It is not a mere academic debate, as the Bank of Japan increased its inflation target in a sense, as it committed “itself to expanding the monetary base until the year-on-year rate of increase in the observed consumer price index (CPI) exceeds the price stability target of two percent and stays above the target in a stable manner”. What are these frameworks and how could they, if implemented in the U.S., affect the gold market?

Some economists, including San Francisco Fed President John Williams, have recently suggested raising the FOMC’s 2-percent inflation objective or implementing monetary policy through alternative frameworks, such as price-level or nominal GDP targeting. It is not a mere academic debate, as the Bank of Japan increased its inflation target in a sense, as it committed “itself to expanding the monetary base until the year-on-year rate of increase in the observed consumer price index (CPI) exceeds the price stability target of two percent and stays above the target in a stable manner”. What are these frameworks and how could they, if implemented in the U.S., affect the gold market?

When President Nixon closed the gold window in 1971, ending the gold standard, the central banks were left without a nominal anchor for monetary policy. So, at the beginning, they adopted money supply targeting. That approach was based on the constant growth in the money supply which was supposed to translate into stable inflation rates. However, as the velocity of money was not constant, monetary targeting failed to generate stable prices. This is why in the 1990s and 2000s many central banks adopted inflation targeting. In such a framework, central banks have explicit target inflation rates for the medium term which is publicly announced (readers interested in the topic should read this study where they find a more elaborate definition of inflation targeting). The idea is that when inflation is higher than targeted, the central bank hikes interest rates, and reduces them when inflation falls below the target. But in the current environment of ultra low interest rates, there is a zero-bound problem. This is the primary reason to raise the inflation target from the current 2 to, let’s say, 4 percent, as some economists suggested. Higher inflation targets would increase the nominal interest rates (as investors would demand some inflation premium), allowing central banks to cut interest rates more when a recession occurs, and thus ease the zero-bound constraint.

How could the higher inflation target influence the gold market? First, if believed to be credible (many analysts doubt whether the Bank of Japan is able to overshoot its 2-percent inflation target), it should increase gold’s appeal as an inflation hedge, especially in the transition period, since the yellow metal shines the most during periods of high and accelerating inflation rates. Moreover, the higher the inflation rate, the more volatile it is. The higher and more volatile the inflation, the more intense the demand for gold to hedge against inflation. Second, higher inflation reduces the real interest rates and gold usually blossoms in the environment of low real interest rates. Third, the upward change of the inflation target would reduce the credibility of central banks and spur some safe-haven demand for gold. The reason is that central banks have invested their credibility in a 2 percent target. If they raise it, people may fear that they will increase it again (“if they go to 4 percent, why should we trust that they will not go to 6 percent, and so on?”). If the public stops believing that the price stability is a credible goal of central banks, inflation expectations will become unanchored. Moreover, the move would be interpreted as an act of desperation: “You see, central bankers lack appropriate tools to revive the economy, so they turn to higher inflation”. Fourth, the increase in inflation targets would be detrimental for the bond market. Higher inflation could even prick the bond bubble, which should boost the price of gold, as the yellow metal’s safe-haven appeal would increase.

And what about the suggested shift from inflation targets to price-level or nominal GDP targeting? Price-level targeting is similar to inflation targeting, as it also aims to achieve price stability. The only difference is that under such a regime, the central banks target not the change in the price level (i.e., the rate of inflation), but the level of prices. It implies that the central bank would try to offset the impact of an inflation shock on the price level, while treating past target misses as bygones under inflation targeting. For example, when inflation is 1 percentage point below the target, the central bank that targets a price-level would try to push inflation above the target in the subsequent period to offset the initial undershooting. Under such a regime, all years of inflation rate below the Fed’s target would have to be neutralized by tolerating inflation above the target for a significant period of time. It goes without saying that implementation of this regime could increase inflation in the current environment, spurring some inflation-hedge demand for gold. Moreover, although price-level targeting has some pros, it would increase inflation rate variability, which should also support the interest in the shiny metal.

The last option to be discussed is to target nominal GDP growth rate. Contrary to inflation targeting, it would include both inflation and output, as the central bank would try to target the total amount of nominal spending in the economy which can be broken down into price inflation and real economic growth. The technical problem associated with nominal GDP targeting is that GDP is subject to large and frequent revisions, making such a policy difficult to undertake and communicate. However, what is probably much more important is that nominal GDP targeting would imply that central bank commits to keeping the nominal spending level growing even if real economic growth slows down. It would mean accepting more inflation in times of sluggish growth (and less inflation in times of quick growth). In the current economic environment, it would imply stagflation, i.e., people would face not only sluggish growth, but also increasing prices. Oh, it sounds so great! So, this option would also lead to higher inflation, which would be positive for the gold market.

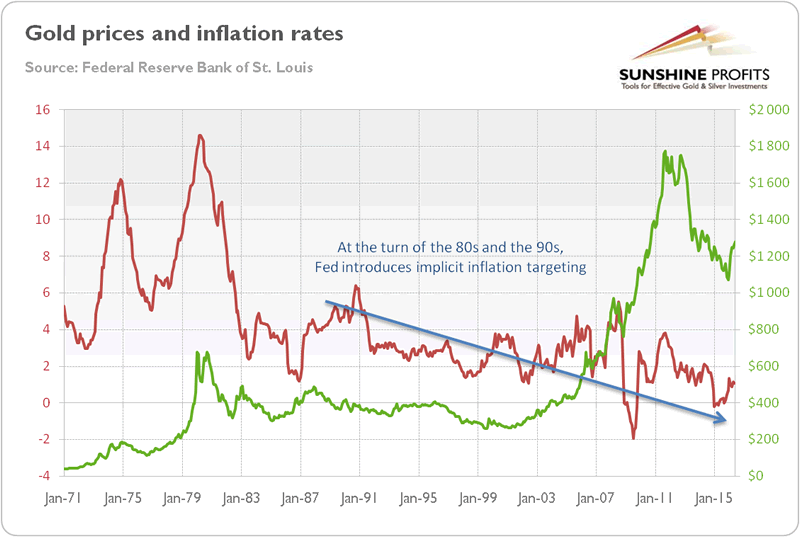

It should now be clear that all propositions to change inflation targets have one aim: to generate higher inflation. Their implementation should be thus positive for the gold market. It’s true that the shiny metal is not always the best inflation hedge – however, replacing the inflation targeting could not only increase inflation rates (in the medium term), but also decrease the credibility of central banks, at least in the transition period. To be clear, we are not devoted supporters of inflation targeting, especially since we believe that such a regime made central bankers blind to asset bubbles (since asset prices are not incorporated into targeted price indices). Instead, we only point out that the inflation targeting was rather successful in controlling inflation in the past – the empirical evidence proves the effectiveness of this framework in delivering low inflation and anchoring inflation expectations. Indeed, the Fed adopted implicit inflation targeting at the turn of the 1980s and 1990s. As one can see in the chart below, the inflation rate diminished since then. The success in reducing inflation increased the faith in the Fed and the U.S. dollar, and put gold into a bear market until the 2000s.

Chart 1: The price of gold (London P.M. Fix, right axis, green line) and the CPI (annual rate, left axis, red line) from January 1971 to June 2016.

Therefore, if central banks abandon inflation targeting, they risk their credibility. Since our current monetary system is basically based on faith and central banks’ ability to control the economy, it would raise the market uncertainty and thus the demand for gold, as it happened in the 1970s or the 2000s. On the other hand, investors should remember that the mere change of the monetary policy regime will not immediately trigger higher inflation, which to a large extent depends on the commercial banks’ activity.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.