Gold, Zince, the Ultimate Resource Investing Portfolio for 2017

Commodities / Investing 2017 Jan 07, 2017 - 12:15 PM GMTBy: The_Gold_Report

Investors can profit in resources, says Lior Gantz, editor of Wealth Research Group, by partnering with and investing like the big players in the field.

Investors can profit in resources, says Lior Gantz, editor of Wealth Research Group, by partnering with and investing like the big players in the field.

The natural resource industry is a maze of companies—thousands of them—but when you get right down to it, this entire sector is 95% made up of average businessman and a small and tight-knit group of top dogs.

Partnering up with them and investing like them has proven to be enormously profitable.

Ray Dalio is the most successful fund manager in history. LCH Investments says its estimates show that the hedge fund Dalio founded in 1975, Bridgewater Associates, has produced more net gains in absolute U.S. dollars than any other hedge fund, surpassing all others.

Bridgewater's Pure Alpha hedge funds have generated $45 billion in net gains since inception, compared to the $42.8 billion produced by Soros' funds, LCH Investments reported.

Dalio allocates 15% of his portfolio to commodities. The reason is that they have the most upside potential of all stocks.

In order to become a Metalionaire, a resource investor privy and well aware of the boom and bust cycle, one must learn to use these waves of riches to their advantage.

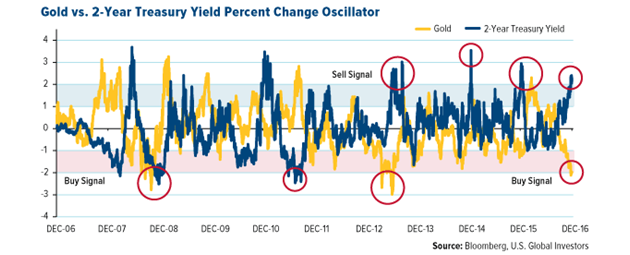

Resource investing is a sector reserved for professionals who know how to look at data and form hard, non-compromising decisions, like today's gold technical analysis chart.

Before one becomes a true resource investor, is it genuinely beneficial that every investor have core investments in companies that compound wealth over decades—these are Wealth Stocks. This unique group of companies outperforms 95% of managed money, and it does so with far less risk.

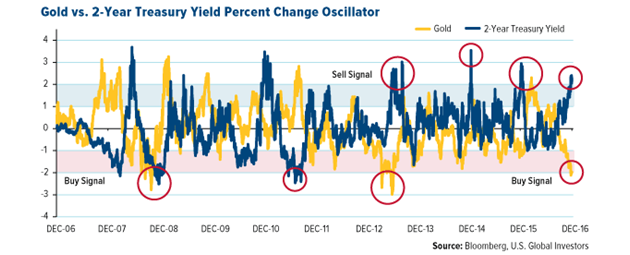

Just as critical in today's ultra-low interest rate environment is a balanced exposure to companies that provide high yields.

In order to really capture the potential of these stocks, we searched only for the safest companies with an over 7% yield, and we are constantly conducting due diligence on more.

These types of investments are what we call "Income Champions."

Most of your wealth and portfolio should be devoted to safe income ideas or long-term wealth, but a true investor always makes room for speculation.

Resource investing is, by far, one of the most tremendous opportunities to create a fortune in a short period of time.

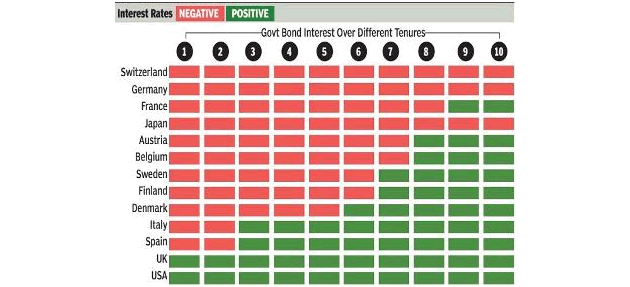

It's because most minerals suffer absolutely brutal bear markets that then make the stage ready for epic bull markets, and the more severe the bear, the more exponential the bull.

Watch These Metals in 2017

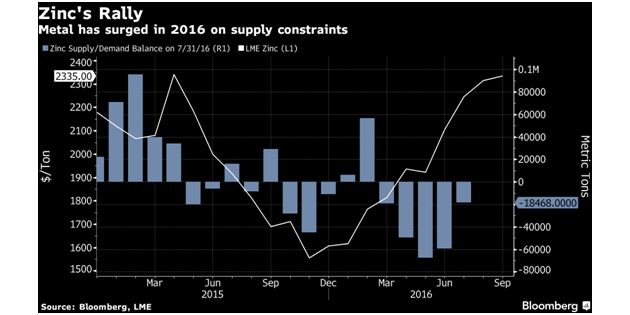

This is going to be a seriously great year for zinc investments.

What is also unique and could be truly profitable are cobalt companies. We are actively conducting due diligence on 141 projects, and we have narrowed it down to three stocks we have complete confidence in. Members will receive a full report in the coming days.

We are also expanding our reach to include nanotechnology, biotechnology, marijuana and high-tech stocks.

Investing in the future by positioning now is the key. There are absolutely remarkable gains for those who can be in early.

This is a great year to be an investor, and I urge you to remember that a crisis can happen at any moment because of central bank manipulation. Therefore, always stay vigilant with the five timeless principles of success.

Lior Gantz, an editor of Wealth Research Group, has built and runs numerous successful businesses and has traveled to over 30 countries in the past decade in pursuit of thrills and opportunities, gaining valuable knowledge and experience. He is an advocate of meticulous risk management, balanced asset allocation and proper position sizing. As a deep-value investor, Gantz loves researching businesses that are off the radar and completely unknown to most financial publications.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Statements and opinions expressed are the opinions of Lior Gantz and not of Streetwise Reports or its officers. Lior Gantz is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Lior Gantz was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview or article until after it publishes.

Charts courtesy of Wealth Research Group

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.