Active vs Passive Investing: And the Winner Is ...

Stock-Markets / Stock Market 2017 Jan 22, 2017 - 03:59 PM GMTBy: EWI

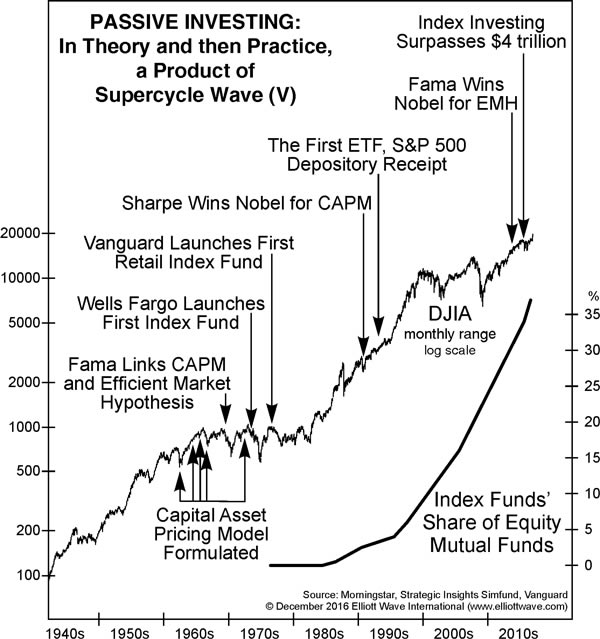

The chart below comes from a new report from our friends at Elliott Wave International.

The chart below comes from a new report from our friends at Elliott Wave International.

It's as straightforward as it looks -- not much need for animation.

But, perhaps you're not completely clear about the difference between passive vs. active funds -- or about WHY that difference is even worth talking about -- then please stick with me as I offer a fast summary.

Active funds include the human element -- as in, a fund manager or managers.

Investors who invest in active funds want a manager who can identify trends in a securities market or market index, of stocks or bonds or money market instruments -- the fund manager sees opportunities in that market, and decides to allocate the fund accordingly.

The vehicle of choice for passive investing is, the Index Fund. Put simply, these funds track an index -- like the Dow or NASDAQ -- and wherever the index goes, the fund follows.

Index funds were created in the bear market years of the 1970s. Yet, participation was almost nonexistent until after 1985 -- when the great bull market was already underway.

Yet, unlike U.S. stock indexes -- which saw two huge declines in the first decade of the 2000s -- the growth of index funds has gone in only one direction -- up for three decades.

The index funds share of equity mutual funds today exceeds 35% percent, and the trendline is getting steeper.

Total index investing today exceeds 4 Trillion dollars.

So, back to the chart above.

What this chart shows us is how the passive investing trend accelerated in 2016. For the year, 286 billion dollars flowed OUT of active funds -- a record amount...

... And it's no stretch to infer that at least some of this outflow became the inflow into passive funds -- some 428.6 billion dollars flowed into active funds in 2016 -- also a record.

So the question is -- why? Why has the share of index fund investing gone from basically zero in 1985, to more than 35% in 2016?

Why have an ever-greater number of U.S. investors entrusted their money, not to experts, but to the assumption that the stock market itself can just take care of their investment?

These and MANY other questions are answered in Elliott Wave International's annual State of the Global Markets Report. See below for more details.

Markets all around the world are at a critical juncture -- you must see this free report now.This is the fifth year EWI has created our annual State of the Global Markets Report. And since many markets around the world are at a critical juncture, this may be the most-timely edition of the State of the Global Markets Report yet! It comes right out of the pages of their paid publications. For a limited time, you can see this report at no cost. Get your 21-page State of the Global Markets Report -- 2017 Edition now. |

This article was syndicated by Elliott Wave International and was originally published under the headline Active vs Passive Investing: And the Winner Is .... EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.