Why EU BrExit Single Market Access Hard line is European Union Committing Suicide

Politics / BrExit Feb 22, 2017 - 12:37 PM GMTBy: Nadeem_Walayat

Some 8 months on from the British people voting against the interests of the establishment elite, most notable of which was for the emergence of an undemocratic european super state that further concentrated power into their own hands to the detriment of ordinary people. Britain is counting down to the triggering of Article 50, the formal request to LEAVE the European Union within a technical 2 year time limit for completion of but in practice may extend to several more years beyond. However, the EU elite even before the June 23rd 2016 vote, have been persistently warning the British people that they will be punished for voting for freedom from the EU super state, where the unsaid reason being so as to prevent a total collapse of the European Union as other states take Britians cue to rush for exit freedom.

Some 8 months on from the British people voting against the interests of the establishment elite, most notable of which was for the emergence of an undemocratic european super state that further concentrated power into their own hands to the detriment of ordinary people. Britain is counting down to the triggering of Article 50, the formal request to LEAVE the European Union within a technical 2 year time limit for completion of but in practice may extend to several more years beyond. However, the EU elite even before the June 23rd 2016 vote, have been persistently warning the British people that they will be punished for voting for freedom from the EU super state, where the unsaid reason being so as to prevent a total collapse of the European Union as other states take Britians cue to rush for exit freedom.

In practice a EU hard line translates into no access to the single market, which in trade terms will result in a World Trade Organisation tariffs regime that typically range from between 5% to 15% tariff for most goods and services.

“The British should know this, they know this already, that it will not be at a discount or at zero cost. The British must respect commitments they were involved in making, so the bill will be, to put it a bit crudely, very hefty.”- EU Commission President Jean-Claude Juncker warns - 21st Feb 2017

“We have to avoid that the British example will be followed by other member states. That’s been the position of the German government.” German Finance Minister Wolfgang Schäuble - 20th Feb 2017

"Britain must not be better off outside the European Union after Brexit" - French Senate - 19th Feb 2017

In response to the near daily avalanche of warnings emanating out of the EU our shy Prime Minister Theresa May has mostly gone dark, only offering the occasional speech which is in stark contrast to the 24 hour news cycle spin machines of the past 20 years that offered a near immediate response to whatever story the manic mainstream media were running with at a particular hour, not so for Theresa May where it is a case of the exact opposite - SILENCE! Which actually makes a refreshing change from the lying spin machines of Blair and Cameron's governments as it now implies that the PM is actually getting on with running the country than pandering to the self absorbed mainstream media that seeks to exaggerate and see's controversy in every event.

However, as I have covered numerous times over the years that the EU taking a hard line against Britain in terms of access to the single market can only hurt Europe far more than Britain and especially the likes of Germany -

UK Government EU Referendum Propaganda Leaflet Backfires as Anger Spurs BrExit Support

Apr 11, 2016 - 01:16 PM GMT

A stronger economy paints a picture of 4 million UK jobs reliant on the EU. Which even if true has a gaping omission which is that Britain has an annual trade deficit with Europe of over £90 billion per year! What does this mean? It means that Britain employs net several millions more German, French and other EU workers at an annual cost of £90 billion a year. So the truth is that the European Union would bend over backwards to retain this net annual jobs subsidy from Britain that supports so many millions of European Union jobs, for if there were trade balance rather than the current imbalance then that £90 billion could create and sustain 3 million UK jobs if Britain stopped paying for EU jobs effectively bringing jobs home from Europe.

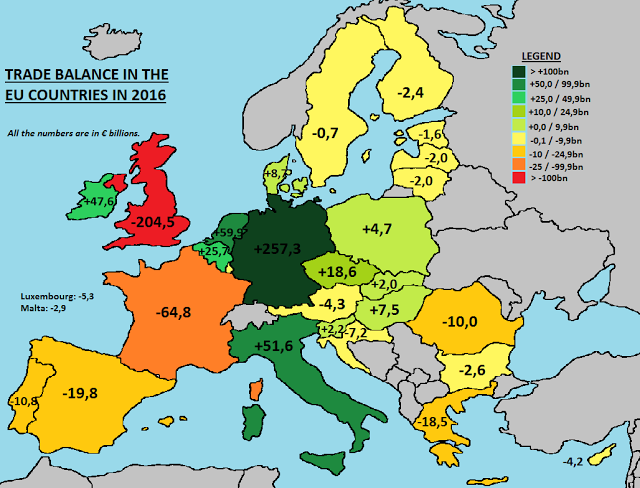

The following map further illustrates the state of the European Union's single market in terms of trade imbalances between member states that clearly shows Britain is the sucker in the room, being conned to the tune of Euro 200billion that are going towards employing a net several millions of German, Italian and Eastern European workers. So the only additional thing to note to that which I have written before is that Italy also hugely benefits at Britains expense.

Therefore in terms of trade flows Britain has a major card up its sleeve that it should play, that of a net 2.5 million EU workers Britain pays for as in Germany, and Italy alone Britain probably employs more than 1 million workers servicing its trade deficit with these two nations whilst also being a heavy employer of Spanish, Belgium, French and Polish workers.

In totality Britain employs approaching 3 million EU workers on mainland europe who produce goods for the British consumer, whilst at best UK exports to the EU probably employ some 1/2 million UK jobs thus technically a clean break resulting in total collapse of trade with Europe would result in UK demand for nearly as many as a net 2.5 million jobs whilst the EU would LOSE a net 2.5 million jobs with Germany, Spain, France and Italy being the hardest.

Furthermore EU share of Britain's exports has been on a declining trend trajectory for more than decade, falling from a peak of about 54% 10 years ago to 44% today which illustrates that economic growth has been coming from OUTSIDE the EU, whilst remaining within the EU PREVENTS Britain from entering into trade negotiations, which was made clear when the EU warned against Britain attempting informal trade talks with the Trump administration.

“I do not like that member states of the European Union, including those that are still a member state, are negotiating free trade agreements. This is an exclusive matter of the European Union.” - Juncker

“It’s very clear that in order to sign and have a bilateral agreement with third countries, the UK first needs to reach a settlement with the EU." - Muscat

This is just one example of how if the EU holds true to its threats of punishing Britain then it is the EU that would be the big loser! Yes there would be short-term turmoil as the UK economy adjusts to loss of access to the single market, but against this Britain would enjoy a short-term windfall from tariffs charged on trade of about £300 billion converting into a £30 billion tax revenue boost for the UK Treasury.

Another card to play is NATO, as Britain once more has been scammed by the EU to play a disproportionately large role in the defence of Europe with troops stationed on Europe's Eastern borders, that Britain could use against threats from the take-take states such as Poland and the Baltic states who repeatedly warn of tough negotiations because they want Britain to be forced to continue to pay its subsidy as part of the £11 billion annual EU black hole that UK tax payers fund.

So in conclusion the UK has many trump cards to play, not least of them President Trump who likens himself to being "Mr Brexit", which means that if the EU does carry out its threats that the remoaners such as Tony Bliar so vocally keep regurgitating then it would be tantamount to Europe committing economic suicide which could even trigger a BrExit recession for the likes of Germany and far worse for an economically more fragile Italy that would further weaken the European Union increasing the risks of disintegration that would make itself manifest in the bond markets.

At the end of the day Brexit for the EU is a lose, lose situation, and it all boils down to just how badly does the EU want to lose. For clearly punishing Britain, which whilst hurting Britain will nevertheless exact a far higher price on the European Union as any pain for Britain would be temporary whilst the consequences for the EU could be existential i.e. risk triggering a collapse of what remains of the European Union as the series of crisis triggered from a German and Italian recession snowballing out of control, having unintended consequences such as other anti-EU political movements being elected to push more nations to follow Britain's Brexit's lead.

Brexit Implications

As for the implications of BrExit on the UK economy and markets then see see my extensive analysis that looked at ten major drivers for the UK economy, of what to expect to happen next:

- BrExit Implications for UK Economy, Interest Rates, Bonds, Markets, Debt & Deficit, Inflation...

- BrExit Implications for UK Stock Market, Sterling GBP, House Prices and UK Politics...

By Nadeem Walayat

Copyright © 2005-2017 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.