Renewable Energy’s Problem and the Solution

Companies / Electricity Mar 10, 2017 - 05:48 PM GMTBy: Richard_Mills

The electric vehicle (EV) market, indeed the entire energy storage market, is at the start of an at least decade long major transition.

The electric vehicle (EV) market, indeed the entire energy storage market, is at the start of an at least decade long major transition.

Why would I think that? Well…

- Electric cars deliver full torque from a standstill so they have impressive acceleration. They are fun to drive!

- Electric cars are quiet, there is no combustion, no muffler.

- Electric cars do not use explosive fuel, there is no gas tank.

- Electric cars are cheaper to operate, electricity being cheaper than gasoline.

- Electric cars are also cheaper to maintain than combustion systems. Having far fewer parts makes the car less complex, easier and cheaper to maintain – there’s no ignition, exhaust, timing or cooling systems.

- Electric cars can be plugged in at home and you wake up with a fully charged battery every day.

- No more getting ‘hosed’ at the gas station, not even the day before a long weekend when combustion engine car owners are lining up.

- Road trips have currently been extended to over 400 km on a single charge.

- A network of charging stations is being built with potential recharge times as low as two minutes.

- Old batteries can and will be recycled. Current technology saves a minimum of 70 percent on CO2 emissions involved in creating lithium-ion batteries from scratch.

- Zero tail pipe emissions.

According to Navigant even though technological advances in batteries have been slow to come the lithium-ion battery business is a US$18B a year industry. Continued double-digit annual growth in smart phones, tablets, sales of EV’s (Tesla S, the GM Volt, and the Nissan Leaf etc), should push the lithium-ion battery market to about US$38 billion by 2020, says Navigant.

Tesla says it has 400,000 Model 3’s already preordered. The Chevy Bolt has projected annual sales of 30,000 to 80,000. Volvo plans to sell over a million EVs by 2025. Volkswagen, Nissan, BMW, Ford, Toyota, Kia/Hyundai and Daimler all sell EV’s/hybrids.

Tesla’s American Gigafactory will eventually produce 35 gigawatt-hours of battery capacity. But such numbers pale in comparison to what’s coming in China and elsewhere. Contemporary Amperex Technology Co.’s new manufacturing plant is expected to build 50GWh’s of battery power storage per year. The company has offices in Sweden, Germany and France and plans to build a factory in Europe.

Panasonic, LG Chem, and Boston Power are building new megafactory plants in China, while companies such as Samsung and BYD are expanding existing ones. All lithium-ion plants in China currently have a capacity of 16.4GWh – but by 2020, they will combine for a total of 107.5GWh.

LG Chem plans to build 5GWh in Poland by 2020 and South Korea is planning on increasing their lithium battery manufacturing capacity from the countries current 10.5GWh to 23GWh over the same time period.

Samsung SDI is investing about $358 million to build EV batteries near Budapest, Hungary and the production facility is expected to be operational by the second half of 2018. It should have the capacity to produce enough batteries to supply about 50,000 electric vehicles per year.

|

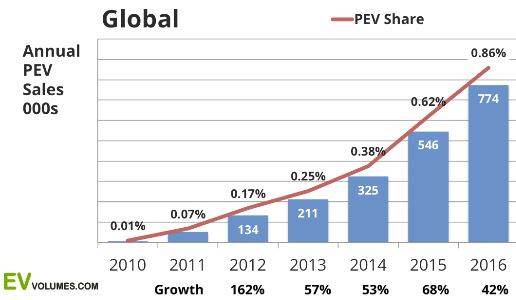

The global motor vehicle population of cars and trucks has reached 1.4 billion and just 2 million of them can be plugged in. |

“The electric vehicle revolution could turn out to be more dramatic than governments and oil companies have yet realized. New research by Bloomberg New Energy Finance suggests that further, big reductions in battery prices lie ahead, and that during the 2020s EVs will become a more economic option than gasoline or diesel cars in most countries.

The study, published today, forecasts that sales of electric vehicles will hit 41 million by 2040, representing 35% of new light duty vehicle sales. This would be almost 90 times the equivalent figure for 2015, when EV sales are estimated to have been 462,000, some 60% up on 2014.

This projected change between now and 2040 will have implications beyond the car market. The research estimates that the growth of EVs will mean they represent a quarter of the cars on the road by that date, displacing 13 million barrels per day of crude oil but using 2,700TWh of electricity. This would be equivalent to 11% of global electricity demand in 2015.

Colin McKerracher, lead advanced transportation analyst at Bloomberg New Energy Finance, said: “At the core of this forecast is the work we have done on EV battery prices. Lithium-ion battery costs have already dropped by 65% since 2010, reaching $350 per kWh last year. We expect EV battery costs to be well below $120 per kWh by 2030, and to fall further after that as new chemistries come in.” Bloomberg New Energy Finance

Q: From what energy source(s) will all that new electricity (11% of global 2015 demand) generation come from?

A: For the first time, more solar systems came online in 2016 than natural gas power plants - the top source of electricity in the US in 2015 - as measured in megawatts.

Solar farms built in 2016 exceeded the 8 gigawatts of natural gas power generating capacity and the 6.8 gigawatts of wind power constructed. Solar farms used by electric power companies accounted for 70 percent of total solar industry growth in the third quarter of 2016.

In 2015, the total global electricity installed capacity was 6412 GW, of which solar had 4%. By 2040, the total global electricity capacity will have more than doubled, to 13,464 GW. Of this its estimated solar will have a 29% share.

Renewable’s problem

Every sunny afternoon there’s a remarkable amount of the sun’s energy, in the form of solar power, fed into the electricity grid. The problem is that all this new electricity from the sun is coming through the grid at the wrong time of day. Between noon and 4pm is a trough in power demand. It’s during peak hours of demand in the evening when all this excess energy can be utilized.

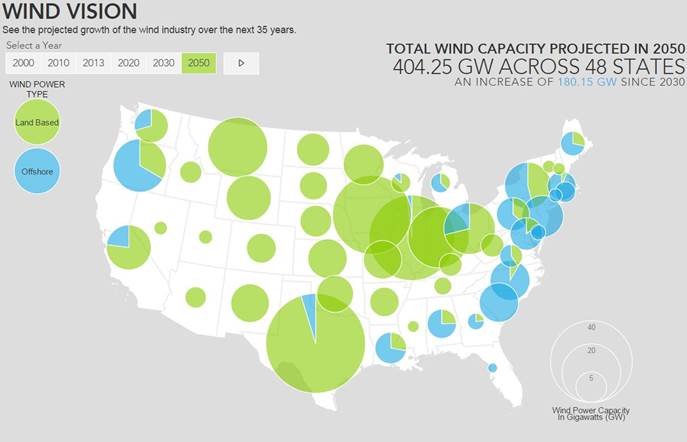

Wind power encounters the same intermittency problems as solar power - sometimes the wind blows, sometimes it doesn’t, sometimes the sun shines sometimes it doesn’t.

If a large part of the needed energy (2,700TWh of new electricity by 2040) is going to be produced from solar (and other renewable’s), and it certainly seems like that is the direction power generation is headed, how will the energy produced be stored so it can be used when its needed, not just when its produced?

Energy.gov

Unlike other forms of energy, electricity cannot be easily stored in large quantities. The ability to store large amounts of electricity over long periods of time would, besides taking advantage of the clean and green nature of renewable’s to reduce pollution and combat global climate change, be beneficial in the following ways:

- With new more cost-effective energy storage technologies electricity could be captured and dispatched to the grid whenever required

- Brings added stability to the electricity system by smoothing out fluctuations in solar and wind resources output

- Temporarily absorbs surges and excess power flow eases points of congestion in transmission and distribution networks

- Absorbs surplus base load generation when the output is higher than minimum demands

Renewable Energy’s Problem Solved

An emerging market opportunity is rapidly developing for vanadium pentoxide (V2O5) to be used as the main ingredient, the electrolyte, in the vanadium redox flow battery (VRFB) aka the Vanadium Flow Battery (VFB) or V flow battery.

Vanadium Flow Battery’s can store large amounts of energy almost indefinitely, which makes them perfect for wind/solar farms, industrial and utility scale applications, to supply remote areas, or to provide backup power.

How VFB’s work

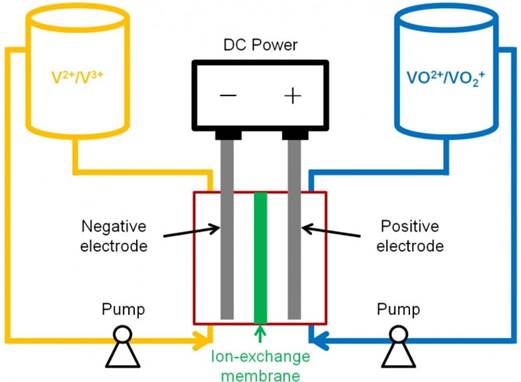

Batteries store energy and generate electricity by a reaction between two different materials, usually zinc and manganese.

In VFB batteries, these materials are liquid and have different electric charges. Both liquids (V2+/V3+ and VO2+/VO2+) are pumped into a tank. A thin membrane separates the two liquids but the liquids are able to react and an electric current is generated.

Vanadium is used because it can convert back and forth from its various different states which carry different positive charges. The risk of cross contamination is eliminated as only one material is used. They are also safer, as the two liquids don’t mix causing a sudden release of energy.

The liquids have an indefinite life, so the replacement costs are low and there are no waste disposal problems. Also, battery life is extended potentially infinitely. By using larger electrolyte storage tanks VFB’s can offer almost unlimited energy capacity and they can be left completely discharged for long periods with no ill effects.

“V-flow batteries are fully containerized, nonflammable, compact, reusable over semi-infinite cycles, discharge 100% of the stored energy and do not degrade for more than 20 years. Unlike solid batteries, like lithium-ion or lead-acid, that begin degrading after a couple of years, V-flow batteries are fully reusable over semi-infinite cycles and do not degrade, giving them a very, very long life.” James Conca, The Energy Storage Breakthrough We've Needed

Introducing hydrochloric acid into the electrolyte solution almost doubles the storage capacity and enables the system to work over a far greater range of temperatures, from -40°C to +50°C.

V-flow batteries offer the best deployable large battery storage technology developed so far.

Vanadium has also begun to play a role in applications for electric and hybrid vehicles. Vanadium acts as a supercharger to batteries by increasing the energy density and voltage of the battery. This is important for electric and hybrid vehicle performance since energy density equates to distance/range, while voltage equates to torque.

Demand Outlook

“VRFBs have emerged as a promising solution for grid services because of their long lifecycle potential and high energy capacity, which can provide extended discharge times. Additionally, given the ability to scale power and energy of a system independently, VRFB technology may be a long-term solution for off-grid power systems and micro-grids. In particular, these systems could be used to support residential, community, military, and commercial end-users, and to fulfill remote-energy-access needs of rural areas in developing countries.

Approximately 90% of today’s vanadium consumption occurs in the steel industry. About 10% is used for non-ferrous alloys (titanium alloys, super alloys, magnetic alloys) and chemical applications (catalysts, dyes, phosphors). VRFB energy storage applications, in which V2O5 quality requirements are usually more rigorous, accounted for about 1 kt V demand in 2014, compared to global production of 94.3 kt V that year.

Estimates on vanadium requirements for VRFB vary among producers, with an average of approximately 8 Kg of high purity V2O5 per KWh. Currently, there are few vanadium producers able to produce high purity V2O5 and products show significant differences in purity and trace element levels…

Considering the potential size of the grid energy storage market, even a slight increase in VRFB demand would mean significant growth in V2O5 consumption for this end-user product. For example, it is estimated that the vanadium consumption in the battery energy storage industry could rise 3100% by 2025, to 31 kt V.

Currently, 55% of global V2O5 production occurs in China, followed by 17% in South Africa, 8% in Russia, and 4% each in the USA and Austria.” Canadian National Research Council (CNRC) report

Conclusion

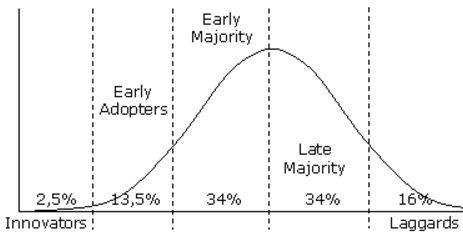

In 1962, Everett Rogers, a professor of rural sociology, published his seminal work: Diffusion of Innovations. Rogers theory seeks to explain how new ideas/technologies are adapted. The chart above shows the stages of consumer adoption.

At current .86% adoption for EV’s and just 4% for renewable energy we are still in the “innovator” phase of the product adoption bell curve for both EV’s and renewable’s. Which means almost all growth remains ahead of us for adoption of electric vehicles and energy storage solutions like the vanadium V-Flow battery.

This document is not, and should not be construed as an offer to sell or the solicitation of an offer to purchase any investment.

Richard owns shares in Vanadium One Energy Corp. TSX-V:VONE.

If not, maybe it should be.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2017 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.