US Government Hits Its Debt Target (Ceiling) Again As Trump Has No Plan To Reduce Government

Interest-Rates / US Debt Mar 17, 2017 - 10:26 AM GMTBy: Jeff_Berwick

Many people fell for Donald Trump’s pre-election promises, but we warned there would be no major changes made and that Trump was an elite insider.

Many people fell for Donald Trump’s pre-election promises, but we warned there would be no major changes made and that Trump was an elite insider.

How right we were.

Here was a list of his biggest promises and how he has already backtracked on all of them:

Putting Hillary Clinton in jail.

-

This was a big one for a lot of people as Killary is a massive criminal. But, within seconds of being elected, Trump reminded people of their decades long friendship and said that he would not be going after Hillary because the Clintons “are good people”.

Rescinding Obamacare

-

So much for that, Trump made a few minor tweaks and it essentially remains the same.

Building a wall across a continent and making Mexico pay for it.

-

Forgetting for the moment that this wall would be a testament to stupidity and it, and Trump’s other protectionist measures, would destroy the US economy and US dollar… and that the wall is probably to keep Americans in at some point and that immigration from Mexico to the US is at a 40 year low. Forgetting all that, Trump actually plans to tax Americans twice for it. Once in the form of billions of dollars in expenditures to build the wall over decades and another in the form of charging Americans 20% more to buy Mexican products (which is mostly in the form of food and petroleum).

And, many people assumed that when Trump said he was going to drain the swamp, reduce the size of certain government departments and reduce regulation, that he was going to reduce the size of government as a whole.

Nope, not at all. Trump has just come out with his budget and it puts the US government into just as much debt as Obama did.

This is from Trump’s budget:

The core of my first Budget Blueprint is the rebuilding of our Nation’s military without adding to our Federal deficit. There is a $54 billion increase in defense spending in 2018 that is offset by targeted reductions elsewhere. This defense funding is vital to rebuilding and preparing our Armed Forces for the future.

Notice he says it won’t increase the size of the “deficit”. This is not the same as the debt. What it means is that he will still put the federal government into hundreds of billions of dollars per year more debt… but he won’t increase the amount he is putting it in debt over what Obama did.

He is closing some museums and firing some totally useless people at departments like the EPA (which should be closed entirely along with every other department of the federal government) but is increasing expenditures on the US Empire’s terrorist network, the Pentagram, also known as the Department of Offense, by tens of billions of dollars.

This is a military, by the way, that spends more than every other country’s military in the world combined! That’s the same Pentagram by the way, that said it lost over $6 trillion recently and doesn’t know where it is.

And so, now, under Donald “big government” Trump, the US government has yet again hit their debt target.

They call it a ceiling, but if you hit something nearly every year since the “debt ceiling” was created in 1917 you might as well call it a target. Because it certainly isn’t a ceiling!

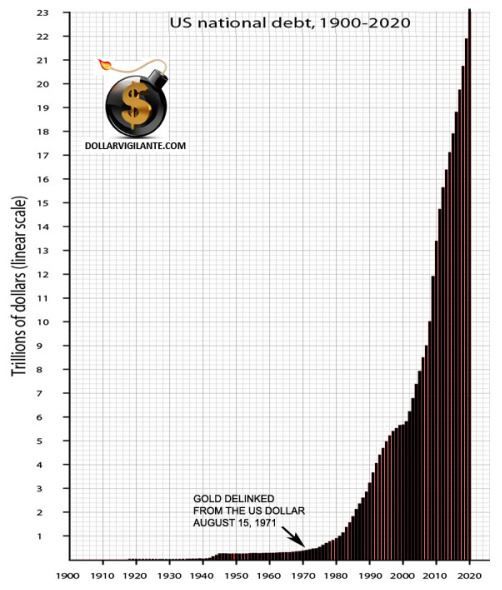

The current US federal government debt is $19,865,505,000,000. That is $8,550,505,000,000 more than it was when Barack O’Bomber took his seat in the Oval Orifice in 2008.

In other words, there really is no difference here from Bush, to Obama to Trump. All continued on with criminal wars and occupations and all continued to plunge the US into unfathomable debt.

And all of them like to create a big show about the raising of the debt ceiling, like they would ever not raise it. It’s just a big show to see how many indoctrinated, brainwashed citizens will beg for their own enslavement when the government threatens to close a few national parks.

It is all a show. All scripted. And people keep falling for it.

But nothing important is going to change. Trump is just the new boss, same as the old boss. The wars, debt and tyranny will continue on.

In our TDV Summit, the videos of which will be released in just hours, we go over a lot of what to expect from Trump and how to protect yourself and profit from the tyranny. You can get access for a discount until they go live by clicking here.

As for Trump, y’all who believed in him got fooled again. Who wrote a song about that?

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2017 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.