Major Supply Shortage: Critical Minerals Igniting Cobalt Bull Market Mania

Commodities / Metals & Mining Mar 26, 2017 - 05:27 PM GMTBy: Metals_Report

Collapsing oil prices are only the beginning as fossil fuels are turning into a historic relic, says Kenneth Ameduri, chief editor of Crush the Street. He discusses two commodities whose demand he expects to skyrocket as the world shifts to cleaner energy.

Collapsing oil prices are only the beginning as fossil fuels are turning into a historic relic, says Kenneth Ameduri, chief editor of Crush the Street. He discusses two commodities whose demand he expects to skyrocket as the world shifts to cleaner energy.

Elon Musk is at the forefront of this movement with his innovations that are turning fossil fuels into a historic relic. Some say oil's true price per barrel with the "supply glut" that exists and the innovations in the battery space is $20 per barrel.

Oil prices are destined to collapse in REAL TERMS. Sure, there are some inflationary and deflationary forces counteracting each other over the longer term.

The fact is that oil is still a highly demanded commodity, and the world isn't ready to be converted to 100% electricity TOMORROW. The power grid would not support this rapid shift. Cars haven't fully gotten to the point YET where they are cost effective enough to be as practical as gas-powered vehicles. But believe me, it's coming.

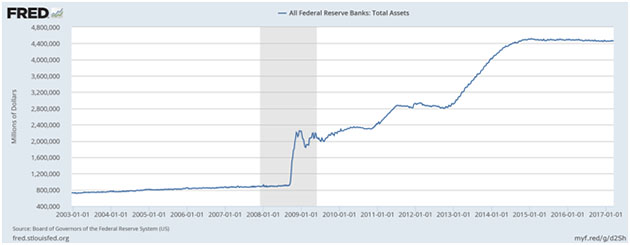

Also, the Fed's monetary policy and habit of printing trillions of dollars is going to put upward pressure on the price per barrel simply because there are more dollars chasing the same amount of goods.

No doubt, the world is demanding clean air solutions and this is deflationary for oil because demand will ultimately continue to dwindle.

As someone who heavily speculates in the mining industry, both of these commodities are especially attractive here in 2017 considering their supply shortages and their need in industrial changes.

Cobalt has most recently gained my attention because 60% of the cobalt that is supplied in the world comes from the Congo, a region that has come under heavy scrutiny for its practices and treatment of women and children.

You have children as young as seven years old in some of these mines. Some have deemed the Congo one of the worst places in the world for women and girls, considering the militias and armies warring over conflict minerals, with some of the highest rates of violence against them.

President Donald Trump has drafted an executive order targeting a rule requiring U.S. companies to disclose whether or not their products contain "conflict minerals" from a war-torn part of Africa and to report on their supply chains. The world is demanding alternatives, and companies that are on the front lines, positioning themselves as a solution to unfavorable mining, will be major beneficiaries.

Social pressures are pushing companies to do the right thing and invest their money in places where humans aren't being exploited and taken advantage of.

As a result, you have companies like Apple, Blackberry, Motorola and Intel who are deciding to move away from sourcing their materials from companies that utilize "conflict minerals."

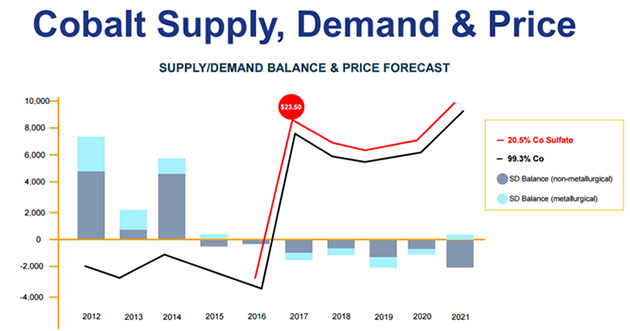

And as far as the implications this has in addition to an already existent supply shortage, we could see cobalt go sky-high in 2017.

Any type of major shift in supplies coming online from the world's largest supplier could double the price of cobalt from its current price to $50 or more.

With Donald Trump's "America First" approach on economics, cobalt companies in the U.S. could see a massive injection of demand as a result of converging trends, including ethical mining, infrastructure spending, pro-American projects, and an unstoppable clean energy trend.

By the year 2020, the use for cobalt in battery applications could be greater than the entire world market for refined cobalt in 2015. We are on the verge of a trend that could birth millionaires from one specific sector.

I have recently come across some of the most compelling research that has thoroughly convinced me that cobalt is poised to thrive and I want all my readers to be in front of this trend.

The Internet's impact on communication will be akin to clean energy's revolution on transportation.

It's happening now. . .

Prosperous Regards,

Kenneth Ameduri

Chief Editor

Crush The Street

Kenneth Ameduri is the chief editor and cofounder of financial publication letter CrushTheStreet.com. He was a founder in Future Money Trends and Wealth Research Group, which have gone on to be vital sources of education and wealth for hundreds of thousands of readers. In his 20s, Ameduri has founded multiple businesses that have gone on to be worth millions of dollars. Ameduri was also a founder of FMT Advisory, which successfully manages millions of dollars in client funds. He is an ardent student of Austrian economics and anticipating market trends as he has successfully invested and built companies for more than 15 years.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Statements and opinions expressed are the opinions of Kenneth Ameduri and not of Streetwise Reports or its officers. Kenneth Ameduri is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Kenneth Ameduri was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

Charts and photo courtesy of the author

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.