The 2 Best Assets to Own While Waiting for a Recession

Stock-Markets / Investing 2017 Apr 06, 2017 - 02:05 PM GMTBy: John_Mauldin

BY STEPHEN MCBRIDE : The current bull market celebrated its eighth birthday on March 9. At 96-months long, it’s now the second longest in history.

BY STEPHEN MCBRIDE : The current bull market celebrated its eighth birthday on March 9. At 96-months long, it’s now the second longest in history.

However, with the S&P 500 set to have its worst monthly performance in over a year and the DJIA down six days in a row, questions have arisen about how much longer this run can continue.

As bull markets usually end with sharp declines, now could be the time for investors to recession-proof their portfolios.

With that said, what are the best assets to own during a downturn?

Fool-Proof Protection

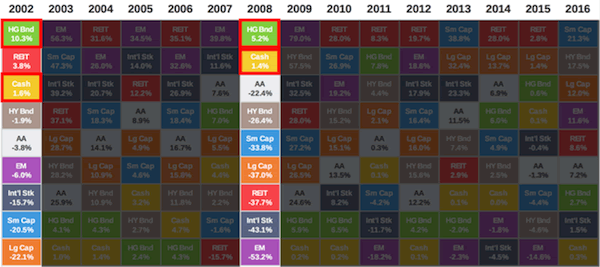

This chart shows Treasuries and cash were the best performers across 2002 and 2008—the two worst years for markets in recent history.

Investors want to have both Treasuries and cash in their portfolios when the next downturn arrives. However, as these assets are ultra-defensive, they won’t yield decent returns as they lie in wait for the recession.

But there is one asset that’s not included in this chart… and it just so happens it’s the best performing asset since 2000.

Asset #1: Gold—Beat S&P 500 Eight Times Since 2001

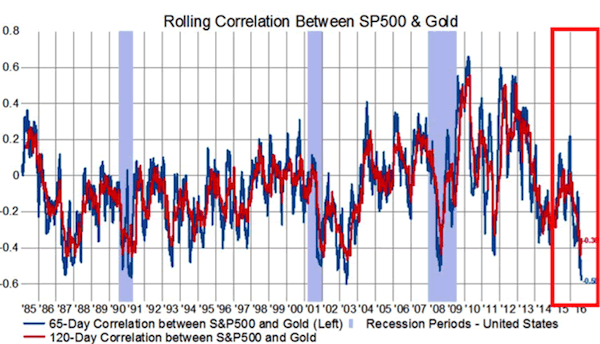

As we’ve written about before, a major reason to hold gold in your portfolio is its negative correlation to stocks. This correlation has been at all-time lows lately. In other words, gold zigs when stocks zag.

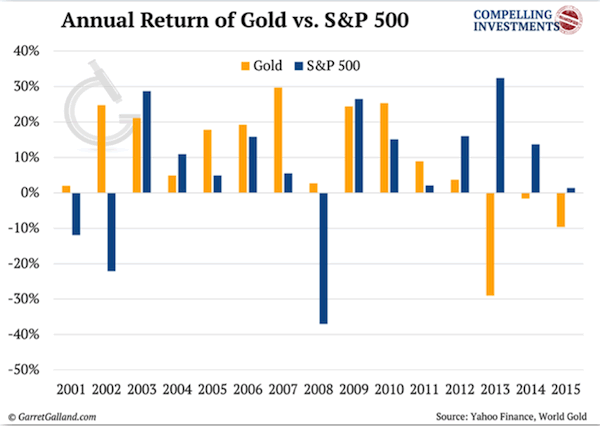

Gold was up 24.7% in 2002 and 2.7% in 2008.

But gold doesn’t just do well in bad times. Since 2001, gold has finished the year ahead of the S&P 500 eight times and been the best-performing asset.

For real returns, however, we should also consider equities. Besides, the long-term track record of equities makes them a mandatory holding.

So, what stock market sectors hold up best in a downturn?

Asset #2: Consumer Staples—The Best Performing Asset in Late Stages of Bull Markets

Even in the worst of times, consumers still buy the same amounts of staple goods like toothpaste and toilet paper.

In such times, the key is to have a system that can guide you through emotional markets. (Grab our free report 3 Proven Strategies for Investing in Uncertain Markets Like These to learn how to invest in times like these.)

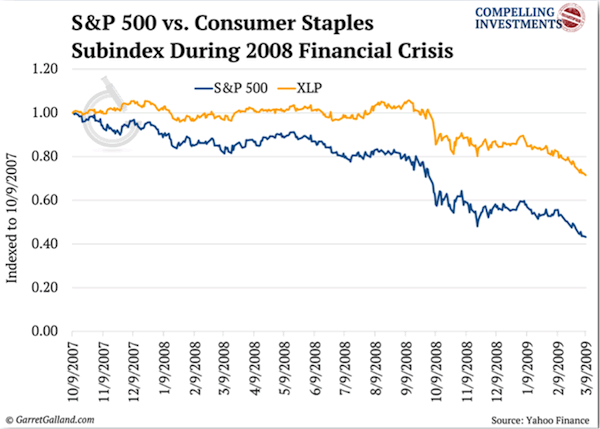

Historically, consumer staples have held up best out of any sector during hard times.

When the S&P 500 plummeted 49% during the dot-com crash, consumer staples as a group were up 1.2%. Although they fell 29% from peak to trough during the financial crisis, they performed the best of any sector.

Over the same period, the S&P 500 fell 57%.

Staples don’t just do well when the bad times hit either.

A 2015 report from Ned Davis Research found consumer staples were the best performing sector of the stock market in the late stages of every bull market since 1970.

Their ability to hold up during hard times is a major reason they are the best performing sector over past decade. Over the past 10 years, staples have generated annualized returns of 9.93%.

Another benefit staples provide is their low volatility. Companies in the sector rarely experience sharp price declines. Because of this, they have had the fewest bear markets of any S&P sector.

McKinsey found that earnings in this sector remained nearly steady in every recession dating back to 1980. Put simply, consumer staples are cycle-agnostic.

But there’s another reason behind the stability of this sector.

Consumer staples perform well in downturns also because of their reputation as high-quality dividend stocks. If a company can pay out even in the worst of times, investors will buy it.

The average staples company has increased their dividend by an annual rate of 8% since 1996. Over 25% of the S&P 500 Dividend Aristocrats Index, an index made up of firms that have increased dividends for the last 25 consecutive years, are staples companies.

Final Thoughts

This bull market could pop soon or go on for another year—nobody knows. Treasuries and gold offer the best protection in a recession. But you may be missing on decent gains in the meantime.

That’s why we also suggest considering consumer staples that are a relatively safe and lucrative place to put your capital while waiting for the storm to hit.

FREE PREMIUM REPORTS: 3 Stocks You Need (and 3 You Don’t) in 2017

Discover the best and worst stocks in 2017. This bundled series of exclusive reports reveals three companies set to soar and three you should steer clear of (one of them will surprise you). Download Three Deadly Dow Stocks and Three Top Picks for Income & Growth for free now.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.