The Story Behind Continuing Strong Gold Bullion Coin Demand

Commodities / Gold and Silver 2017 May 29, 2017 - 11:03 AM GMT I have always considered sales of modern gold and silver bullion coins a bellwether on the general health of the global precious metals market. In reality, though, bullion coin sales comprise only a very small portion of the physical gold and silver markets. According to the World Gold Council, modern gold coins make up only about 13% of investment demand and a little less than 5% of overall demand.* Yet, as is often the case in statistical inquiry, it is the small and often unobserved, sometimes even ignored, that can accurately tell the larger story – particularly when it reflects the net effect of human action within the greater economy and financial markets.

I have always considered sales of modern gold and silver bullion coins a bellwether on the general health of the global precious metals market. In reality, though, bullion coin sales comprise only a very small portion of the physical gold and silver markets. According to the World Gold Council, modern gold coins make up only about 13% of investment demand and a little less than 5% of overall demand.* Yet, as is often the case in statistical inquiry, it is the small and often unobserved, sometimes even ignored, that can accurately tell the larger story – particularly when it reflects the net effect of human action within the greater economy and financial markets.

So how is it that such a small aspect of the global gold market in terms of the overall volume can at the same time be so important?

In a nutshell, it is because the demand among ordinary private investors is telling us something very important: The level of confidence people have in the economy and the plan being carried out by the central planners in charge. Twentieth-century economist Joseph Schumpeter (1883-1950), most famous for his theory of creative destruction in capitalist economies, said it best: “The modern mind dislikes gold because it blurts out unpleasant truths.” I am quite certain that the “modern mind” to which Schumpeter referred was a collective term for the social and economic planners responsible to this day for the construction and maintenance of the fiat money economy.**

With that for initial spade work, let’s take a look at the demand for modern gold and silver bullion coins to see what they might be “blurting out” at this juncture in economic history. First and foremost, the numbers tell us that though Washington and the mainstream media may have recovered psychologically from the 2007-2008 crisis, the investing public has not. In fact, by implication the numbers tell us that concerns about a repeat, or better put, an extension, of that crisis still run high among investors.

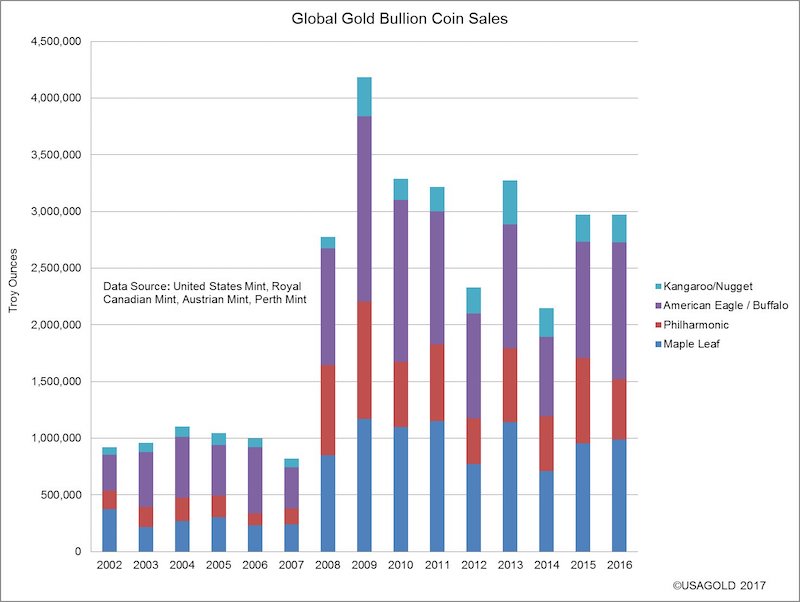

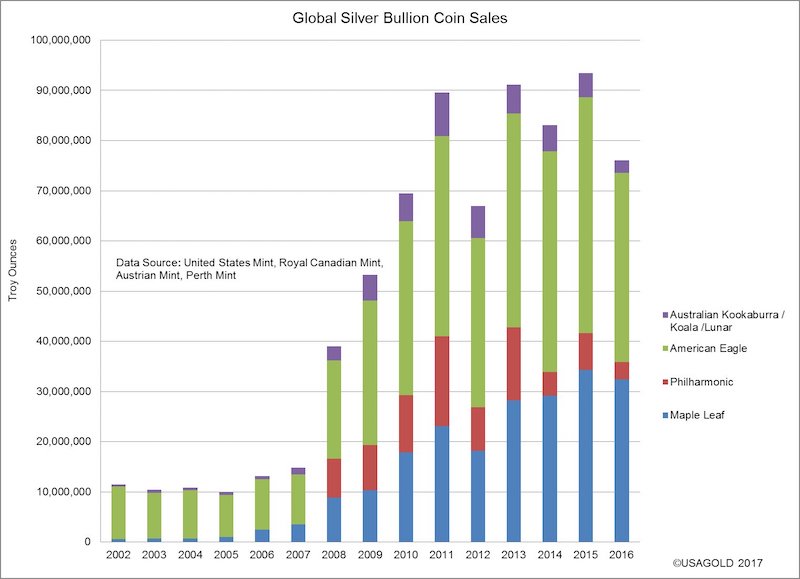

The charts depict two different eras for gold and silver bullion coins – the one before the crisis and the one after. The strong consumption in 2016, in that respect, is decidedly a continuation of a well-established trend that began in 2008. For gold, 2016 was the fifth best year on record in terms of sales and in a virtual dead heat with 2015. For silver, 2016 was the fifth best year on record coming after last year’s record sales. Since 2016 was a relatively calm year in financial markets, the question arises how high demand might go if another crisis were to suddenly ignite.

Another lesson in these charts, and one that should not be overlooked, is that the record performances in both precious metals since 2008 did not occur in an inflationary environment, but in a distinctly disinflationary one. The strong and continuing post-crisis demand, running consistently at five to nine times pre-2007 levels, belies the mainstream media’s unremitting mantra that the precious metals are an inflation hedge and inflation hedge only. In that regard, silver is the big surprise. Prior to the current period, silver was generally viewed as an industrial metal with some investment potential and rarely a safe-haven or crisis hedge. Now investors give silver nearly the same credence they do gold for asset preservation purposes.

FREE SUBSCRIPTION and access to this month’s edition of News & Views. This month we explore the big issues in Washington and how they are likely to affect gold in the months ahead; the mechanics of how algo-trading might create a stock market panic and much more. Several timely charts are included. We invite your free subscription at no obligation.

* These totals include only current year bullion coins and does not include the large volume in previous mintages traded in the secondary market globally. There is no accurate accounting available for the secondary market, but it would add significantly to the annual turnover demand if it were tracked.

** Complete quote: “In the first place, the ‘classic’ writers, without neglecting other cases, reasoned primarily in terms of an unfettered international gold standard. There were several reasons for this but one of them merits our attention in particular. An unfettered international gold standard will keep (normally) foreign-exchange rates within specie points and impose an ‘automatic’ link between national price levels and interest rates. The modern mind dislikes the this automatism, as much for political as for economic reasons: it dislikes the fetters this automatism clasps on government management of the economic process – dislikes gold, the naughty boy who blurts out unpleasant truths. But most of the economists of the period under survey liked it for precisely the same reasons. Though they compromised in practice as in theory and though they admitted central-bank management, the automatism – a phrase beloved by Lord Overstone [Samuel Jones Loyd, 1st Baron Overstone] – was for them, who are neither nationalists nor etatistes, a moral as well as an economic ideal.” –– Joseph Schumpeter, History of Economic Analysis (1954) Published posthumously

Charts compiled and designed by USAGOLD’s Jen Dentry with the assistance of the mints surveyed.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.