Bitcoin Hits New All Time High Near $3,000 As Cryptos Surpass $100 Billion Market Cap

Currencies / Bitcoin Jun 07, 2017 - 12:45 PM GMTBy: Jeff_Berwick

Are we witnessing the biggest wealth transfer in human history? A case can certainly be made for it.

Are we witnessing the biggest wealth transfer in human history? A case can certainly be made for it.

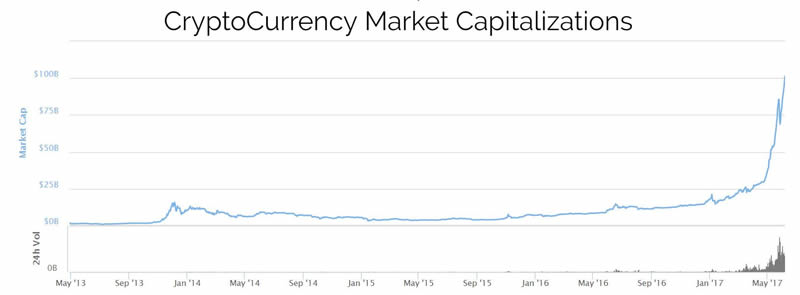

One year ago, cryptocurrencies as a sector had a market capitalization of only $11 billion. Looking back even further, four years ago, the entire sector including bitcoin had a market capitalization of less than $1 billion.

As of today, it has surpassed $100 billion.

But, note, that most of our data and charts on cryptocurrencies doesn’t come from Bloomberg or Reuters. The majority comes from places like Coindesk and CoinMarketCap.com - small organizations mostly operated by anarcho-capitalists who have been in these markets for years while Wall Street is just starting to wake up to the fact that they better get into this market now.

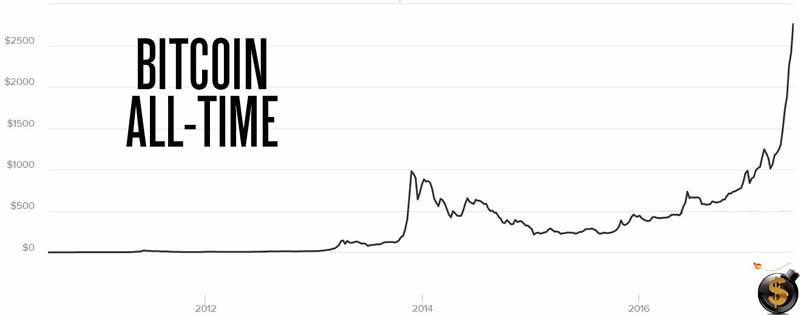

This is a big shift. The world of money and banking may just be beginning to fall out of the control of Central Banks and Wall Street and into what has been mostly anarcho-capitalists, like myself, who have been investing in bitcoin since it was $3 in 2011.

Now, with it at near $3,000, that is a nice 100,000% gain for those of us who want to end central banking, communism, fascism and big government.

With cryptocurrencies skyrocketing, the number of anarcho-capitalist millionaires in the world has likely risen from about 10 to around 10,000. This will have massive repercussions in the coming years.

Even The Guardian has taken notice, trying to write a hit piece about it.

As an aside, I interviewed masked Smuggler, back in 2012, when I did interviews while smoking and drinking a glass of wine while bitcoin was at $10.

If that were to happen, we’d have peace and prosperity on Earth like we’ve never known it.

Although, we still have a very long way to go before we get there. And they will do everything they can to stop it.

One of the most recent attempts being the Prime Murderer, Theresa May, calling for full government control of the internet after recently pulling off several more false flag attacks in the UK as a run-up to the (s)election.

Some people are still of the belief that bitcoin and cryptocurrencies are government controlled “psyops” - I can assure you that as a movement, they are not.

I’ve been involved since nearly day one and all any of us talk about is how we can take down the governments and the central banks. Cryptocurrencies are being created with 100% anonymity (Monero/Dash) and even alternative internets are being designed (Maidsafe) so that they can’t even take down the internet unless they manage to turn off the power for the entire world.

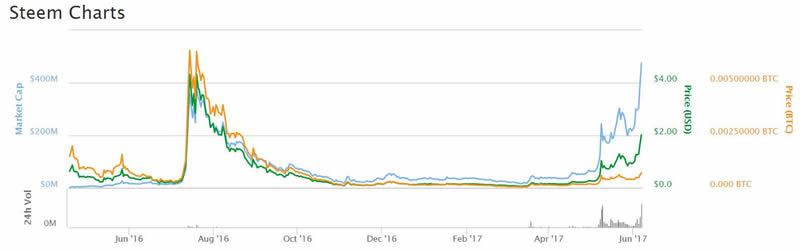

And alternative social media based off the blockchain is already flourishing, like Steem and Steemit.com where we have been posting our material first since its inception (and made $100,000+ doing so - (please follow us there) - you can actually make money just by upvoting and commenting on our content).

And that’s beside making a fortune on the rise of the currency itself! You may recall our article, “It's Time Everyone Looks at Steemit Again” just a few weeks ago when Steem was near $0.25.

It’s currently near $2.00.

But, is this an evolution in money and banking that could change the world forever? Yes.

If you still haven’t listened to my pounding the table on cryptocurrencies, which I have been doing since 2011 when bitcoin was $3, please check out this free 4-video tutorial here. In it, I even offer to send you your first $50 in bitcoin directly from myself.

The Guardian likes to act like we are a group of shadowy figures who wear masks and want to destroy the wonderful banking system of today. In fact, there are now millions of us in almost every walk of life. We look fairly normal, we act fairly normal, and yes, we do want to destroy this heinous central banking cartel that has funded all wars and impoverished billions - by making it obsolete.

And maybe, we just might succeed.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2017 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.