Car Sales About To Go Over The Cliff

Companies / Auto Sector Jun 22, 2017 - 02:49 PM GMTBy: Harry_Dent

The Retail Apocalypse.

The Retail Apocalypse.

Carmageddon.

Same story.

Different industry.

And we called both decades ago!

Autos are the last splurge for aging Baby Boomers. Their kids leave the nest and finally the parents can buy the car they wanted, not that damned minivan to taxi kids around.

But as we age, we don’t drive nearly as much and those luxury or mid-life-crisis sports cars last a long time.

So, even though Baby Boomers followed the pattern and bought better cars, they rebuy as often, which causes a decline in auto spending, especially after age 48.

At least, that’s what our research has shown us for years…

We just recently got updated data from the Consumer Expenditures Survey. This allows us to predict not only the broader economy in human life cycle spending, but every consumer sector as well.

Our previous data suggested that new car sales would peak around age 53 to 54.

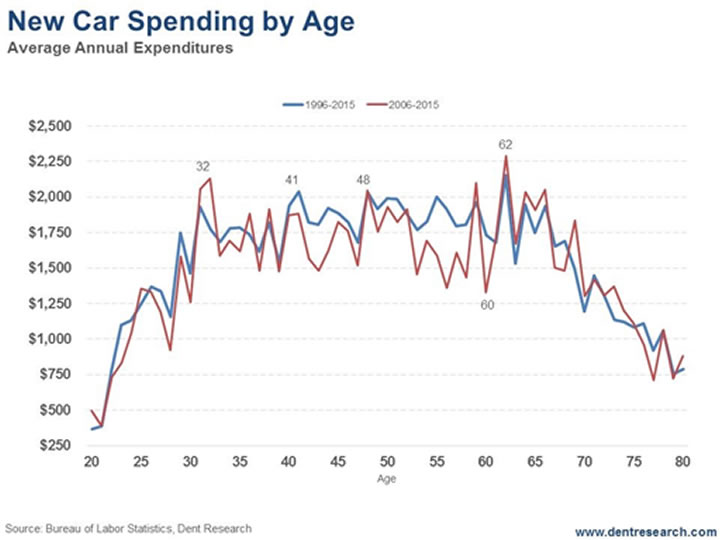

The new data, from 1996 – 2015 (blue line in the chart), and more recently from 2006 – 2015 (red line) says that auto sales peak closer to age 48 – earlier than we previously thought – and then continue sideways before surging one last time around age 62. Then it’s straight downhill from there.

Notably, car sales first collapse between age 51 and 60.

Guess where the bulk of the Baby Boomers are heading!

Let’s walk through the predictable car buying cycle…

Auto sales first surge into around age 32, along with first-home buying. They peak around age 41, again, along with trade-up home buying. Then they have another surge into around age 48, as their kids leave the nest and they buy the luxury Lexus or sports car that they really wanted (as I said earlier).

But then they don’t drive it nearly as much as they previously spent their time driving around their kids from school to soccer practice to “ecstasy” parties… or whatever.

So that “best car” lasts for 10 or more years instead of four years for the typical soccer mom.

Now the new data shows there’s a final surge into the early 60s, before people retire.

The truth is that car sales tend to plateau between 32 and 62 and lean towards the higher-end sectors, with the sharpest decline between age 51 and 56.

What has kept car sales going after they should have peaked around 2012?

The same thing keeping our economy going: QE or near-free money and lower interest rates.

But that seems to have run its course because the auto industry has only kept its growth going through more liberal lending policies based on lower interest rates and an accommodative Fed…

Did they learn nothing from the last subprime crisis?

Of course not!

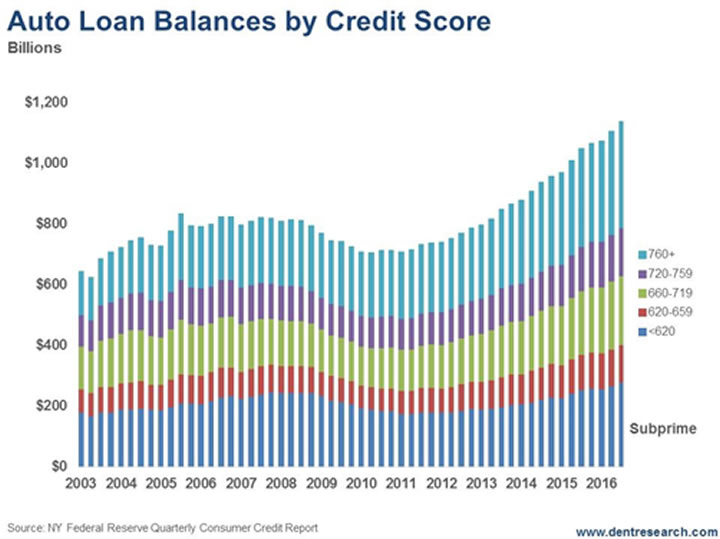

Look at this chart…

Total loans for autos are much higher than they were into 2007, and growing exponentially.

Subprime loans, at the lowest credit ratings, are now at $280 billion and rising. In 2007, they reached only $205 billion. When you add in the next red zone of near-subprime borrowers, it’s $405 billion!

Can anyone else smell that?

, it’s the stink of defaults and a worsening downturn in auto sales coming!

Car inventories are piling up on the borders of Mexico. Manufacturers are trying to hide their growing inventories.

GM plans to extend its typical summer shutdown at certain U.S. factories to deal with slumping sales and its bloated inventory.

In fact, car sales were down 0.5% in May, part of a five-month decline. The experts keep guessing things will improve and have been wrong.

They don’t understand that demographic trends are going against this last durable goods market to peak after housing and furniture. And they don’t understand how much this sector has been hyped up by liberal lending, like housing was into early 2006.

This is another sign of the beginning of the end, like plummeting retail sales and big brand failures in department stores and apparel…

Two very smart investors, Buffett and Soros, invested in major retail auto chains in the last few years… we could have told them not to bother.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2017 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.