US Equities Destined For Negative Returns In The Next 7 Years - 3 Assets To Invest In Instead

Stock-Markets / Investing 2017 Sep 20, 2017 - 11:01 AM GMTBy: John_Mauldin

BY STEPHEN MCBRIDE : With the S&P 500 up 260% since March 2009, investors have been well rewarded for holding US stocks in the recent past.

BY STEPHEN MCBRIDE : With the S&P 500 up 260% since March 2009, investors have been well rewarded for holding US stocks in the recent past.

However, the prime time of US stocks has come to an end. Here’s why.

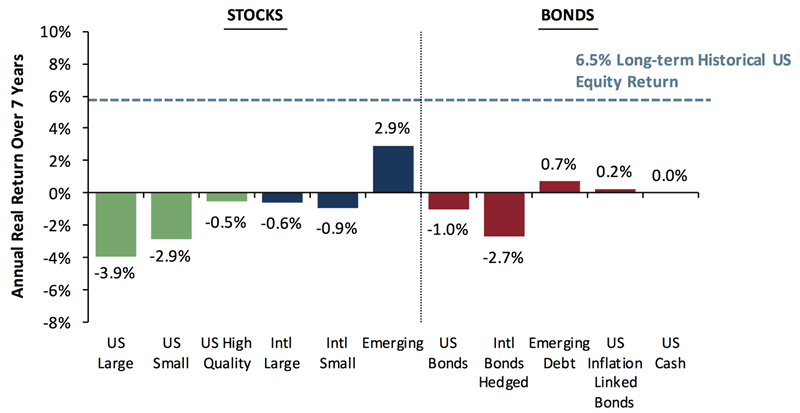

In a white paper titled The S&P 500: Just Say No, investment research firm GMO projected that returns on US equities would be -3.9% over the next seven years.

Source: GMO

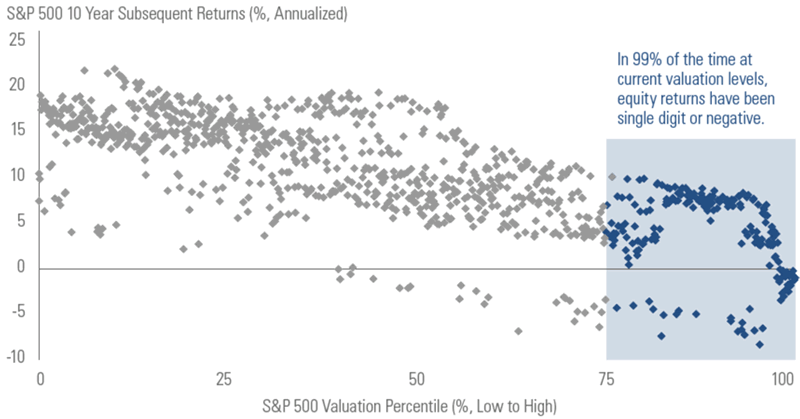

If you don’t trust forward projections as an indicator of future returns, look at history.

In their Q3 2017 outlook, Goldman Sachs found that valuations at current levels led to equity returns being single digits or negative over the following decade 99% of the time.

Source: Goldman Sachs Asset Management

Low return projections have led some of the world’s biggest money managers like PIMCO and T.Rowe Price to cut their allocations.

For those who want to follow their lead, here are three assets with positive outlooks.

#1 – Emerging Market Equities

In late 2016, billions flowed out of emerging market (EM) funds due to a rising US dollar and the promise of Trump’s pro-growth policies. As such, the outlook for EM coming into 2017 was uncertain.

However, EM stocks have been some of the best performing assets this year. The iShares MSCI Emerging Markets ETF, EEM is up 27% year to date. A far better return than the S&P 500, which is up 10.6%.

As such, almost $5 trillion has flowed into EM funds this year, with some of the world’s top money managers leading the way.

Bridgewater Associates, the world’s largest hedge fund recently increased its holdings of EEM, with the ETF now making up 21.4% of its overall portfolio.

JPMorgan and Credit Suisse are also bullish on EM equities, citing attractive valuations, rising earnings, and economic growth as the reasons.

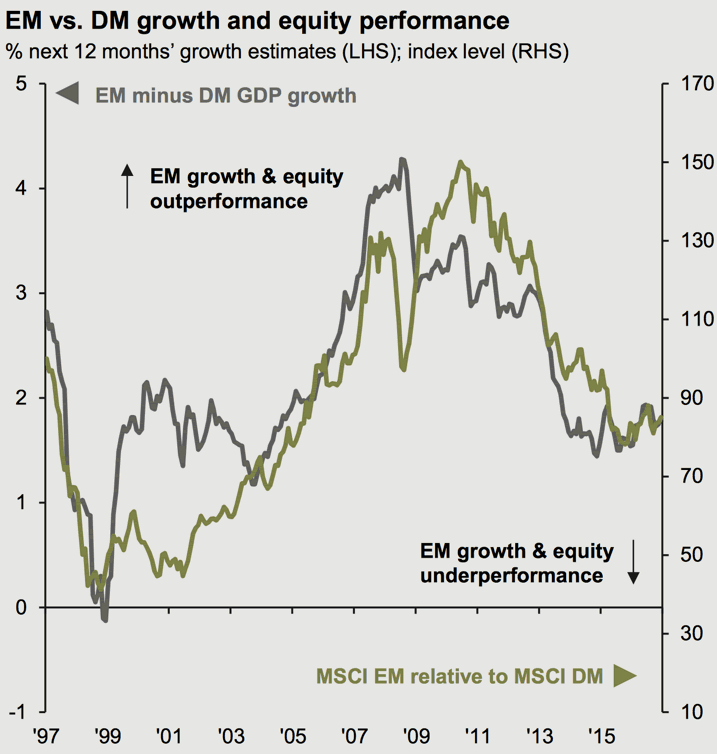

This chart from JPMorgan Asset Management shows EM stocks tend to outperform when domestic economic growth rises, which is now the case.

Source: JPMorgan Asset Management

#2 – Gold and Commodities

Many investors avoid gold because they consider it a low-return asset. While the yellow metal doesn’t yield anything, it’s the best performing asset since 2000, with an annualized return of over 9%.

And there are numerous reasons to be bullish on gold.

In a recent letter to clients, Ray Dalio, CEO of Bridgewater Associates recommended investors allocate 5–10% of their portfolios to gold, citing rising geopolitical tensions as the reason.

A falling US dollar, concern about the valuation levels of US stocks, and low prospective returns on US assets are three more bullish signals for gold.

And just like EM, some top money managers threw their names behind gold.

In a recent interview with the Hard Assets Alliance, Grant Williams, founder of RealVision TV said, ‘’gold offers incredible value now, not just through being undervalued, but because of the options and protection it gives you. If you don’t own some gold in your portfolio now, you don’t understand history.’’

Bank of America Merrill Lynch increased its target price for gold to $1,400 an ounce by early 2018, citing lower long-term interest rates and lack of progress by President Trump in delivering economic reforms as reasons.

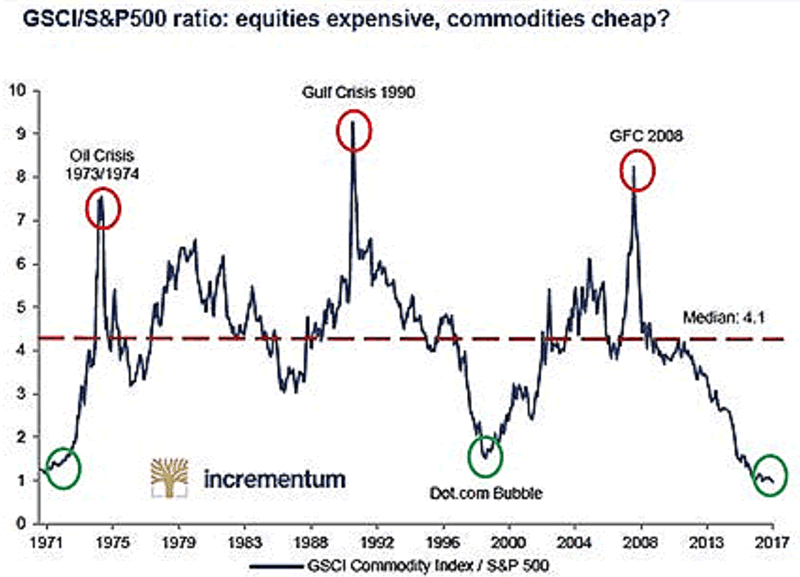

While gold is its own asset, the outlook for commodities in general is bullish. This chart from Incrementum shows that commodities, relative to the S&P 500, are at their most undervalued point since 1970.

Source: Incrementum

#3 – P2P Lending

Investors looking to further diversify their portfolios and earn outsized returns should also consider investing in Peer-to-Peer (P2P) lending. The P2P sector has grown rapidly in recent years and is an excellent new source of fixed income.

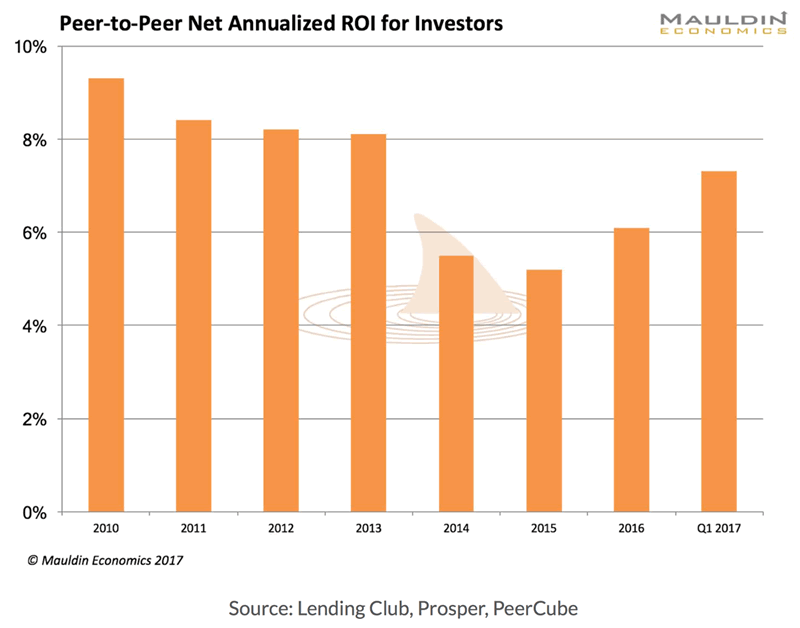

In 2016, P2P investors earned net annualized returns north of 7%. (Learn more in our free report on P2P lending)

Source: Mauldin Economics

Even those who took the most conservative approach saw returns of 5%. That’s more than double the average S&P 500 yield.

It’s worth noting that these returns are from 36-month loans. In terms of duration and return, that’s a much better deal than getting 2.2% on a 10-year Treasury.

In today’s low-return world, institutional investors are also getting onboard. Although the industry started out as peer-to-peer, the likes of Citibank and Goldman Sachs now fund around 70% of P2P loans.

Besides market-beating returns, one of the big advantages of P2P lending is that it has a very low correlation to traditional stock and bond markets: 0.18 to US stocks and 0.08 with US bonds.

This provides a healthy buffer against possible market volatility in the months and years ahead. Though broad markets may rise or fall, soar or crash, you still collect the interest on your highly diversified portfolio of small loans.

There’s a lot more to the topic of P2P lending. Various platforms have somewhat different approaches to screening borrowers, automating loan generation, collecting from late payers, and more.

Free Report: The New Asset Class Helping Investors Earn 7% Yields in a 2.5% World

While the Fed may be raising interest rates, the reality is we still live in a low-yield world. This report will show you how to start earning market-beating yields in as little as 30 days... and simultaneously reduce your portfolio’s risk exposure.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.