History Illustrates Stock Market Crashes Should be Embraced & Not Feared

Stock-Markets / Stock Market Crash Sep 28, 2017 - 05:10 PM GMTBy: Sol_Palha

If you're not just a little bit nervous before a match, you probably don't have the expectations of yourself that you should have. Hale Irwin

If you're not just a little bit nervous before a match, you probably don't have the expectations of yourself that you should have. Hale Irwin

This is a topic that financial writers should cover in more depth, but it also needs to be covered accurately. From the very beginning individuals have been trained to view crashes as disasters, and in doing so, they miss an opportunity of a lifetime. One has to wonder why so many experts almost purposely go out of their way to proclaim the next crash will mark the end of everything.

History is not on their side and the average person having failed to examine history is none the wiser. When experts start to make a lot of noise one has to understand that it is being done to redirect one’s attention; the masses always fall for this ploy. Stock market crashes are perfect examples of misdirection; the crowd is directed to fixate on the fear factor and not the opportunity factor. The dumb money always buys close to the top and sells close to the bottom, and the smart money always does the opposite.

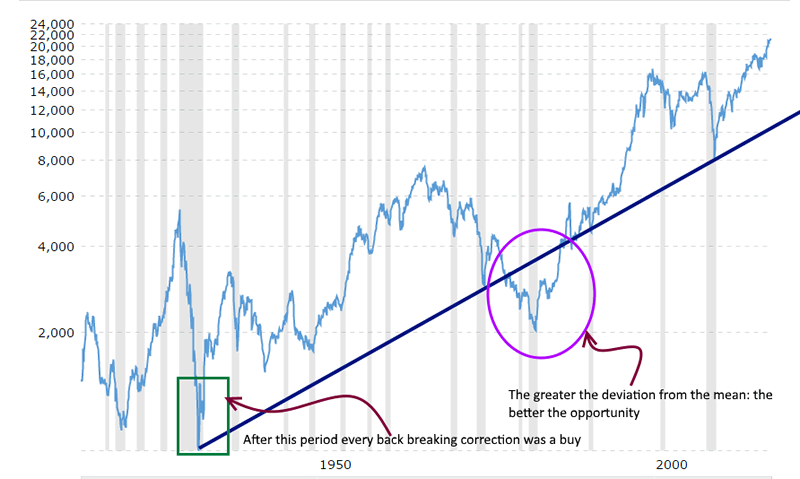

Chart provided courtesy of http://www.macrotrends.net

One of the best ways to determine optimal entry and exit points is to pay close attention to the mass sentiment. When the masses are joyous, then it is usually time to exit the markets and vice versa.

A very strong correction is going to hit this market sooner or later, and our goal is to use the trend indicator to get out close to the top. We are not going bother trying to get out at the exact top; the goal is to get out when the trend indicator starts to flash warning signals, and sentiment levels start to rise. The best lesson you could impart to your kids and grandkids is to teach them view stock market crashes through a bullish lens. This lesson is probably more valuable than anything they could ever hope to gain from the public education system.

Conclusion

Before we got off the Gold Standard, it would have been quite risky to view back breaking corrections as buying opportunities. If you look at the chart above and you take a long-term view, you can see that every back-breaking correction turned out to be a mouth-watering opportunity; this argument will hold true for the foreseeable future.

The crowd, however, will forget the opportunity factor the moment the markets start to crash They will utter these words “it’s different this time”. It is always different because fear has a way of making something look worse than it is.

In reality, nothing has changed; the crowd always reacts in the same manner. Instead of seeing opportunity, they will see disaster. Their response (as always) will be to throw the baby out with the bath water. The smart money waits for them to stampede, and when they have sold everything, they swoop in and purchase top companies for next to nothing. The masses, in turn, remain shell-shocked for years as the markets trend higher, then all of a sudden the memory of the last beating fades away and the process repeats itself again and again. This is what’s taking place now, and that is why this stock market Bull continues to trend higher than even the most ardent of bulls could have ever envisioned.

The masses have still not embraced it, but they are slowly warming up to it. Instead of a crash, the markets are more likely to experience a strong correction, as they are trading in the extremely overbought ranges. Until the crowd embraces this market with the same intensity that has gripped bitcoin, this market is unlikely to crash.

A long dispute means that both parties are wrong

Voltaire

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2017 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.