Markets Big Macro Play Ahead

Interest-Rates / US Interest Rates Oct 28, 2017 - 05:39 PM GMTBy: Gary_Tanashian

At NFTRH, we are about major macro turning points above all else. Of course, it is often years between these turning points or points of significant change so we are also about the here and now, and managing the trends, Old Turkey style.*

At NFTRH, we are about major macro turning points above all else. Of course, it is often years between these turning points or points of significant change so we are also about the here and now, and managing the trends, Old Turkey style.*

Since we are all learning all the time, I have no problem admitting to you that while right and bullish on commodities and stocks in 2009, after becoming bullish on the precious metals in Q4 2008, I completely ignored Old Turkey due to my inner biases. The result has been that after taking excellent profits from the precious metals bull, personally, I have greatly under performed the stock market bull despite holding a bullish analytical view for the majority of the post-2012 period.

Undeterred and ever plucky, we move forward. Currently, I play the bullish stock market like millions of other casino patrons, but this is as a trader and portfolio balancer, with the goal always to be in line with the macro backdrop of currency moves (I’ve been very long the US dollar for a few months now) and Treasury/Government bond yields and yield relationships.

This week something happened that has gotten me geeked out like at no other time since Q4 2008, when it was time to put the real precious metals fundamental view (as opposed to commonly accepted gold bug versions) to the test and go all-in. This week, assuming it is confirmed by remaining active through the FOMC next week, we got a short-term signal in Treasury bond yields that starts the clock ticking on a big macro decision point, which may include an end to the stock mania and the beginning of a sustained bull phase in the gold sector, among other things.

But first, we need to understand that the macro moves at an incredibly slow pace and one challenge I have had is to manage what I see clearly out ahead with the extended periods of intact current trend that seem to take forever to change. We as humans (and quants, algos, black boxes, casino patrons and mom & pop) are increasingly encouraged to try to compute massive amounts of information in real time and distill a market view from that at any given time, all at the behest of an overly aggressive financial media that wants to harvest your over exposed, bloodshot eyeballs on a daily, no hourly basis.

I’d only argue that you try not to get swept up in the noise; that you try to consider the much slower big picture, especially when it is on the verge of indicating changes. So, long preamble behind us let me show you what is going on in bonds, which is where the markets have been routinely manipulated by the Federal Reserve (through QE 1-3, plus Operation Twist and 7 years of ZIRP) and thus, is ground zero for coming events.

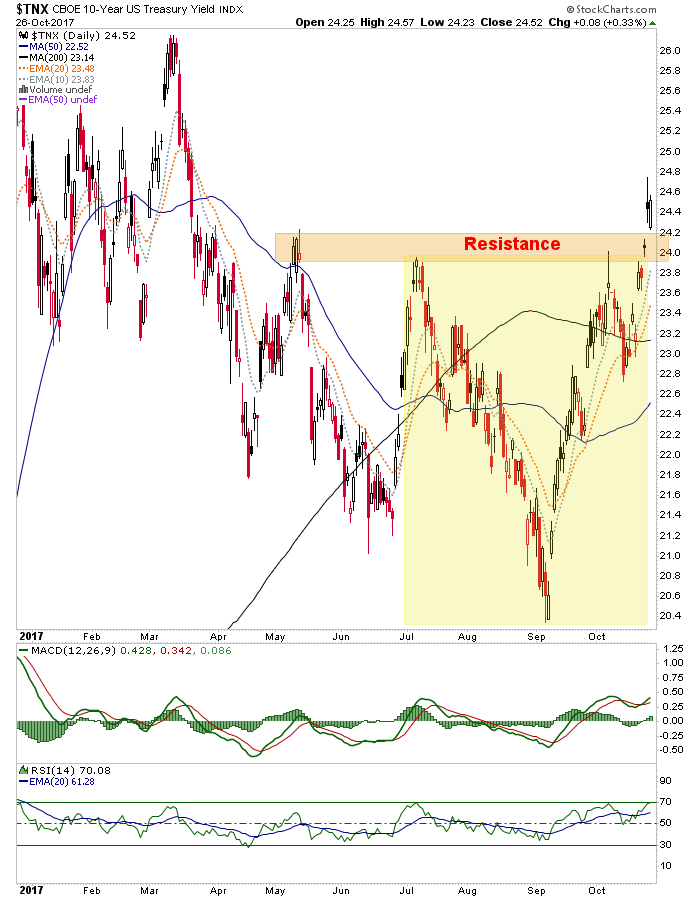

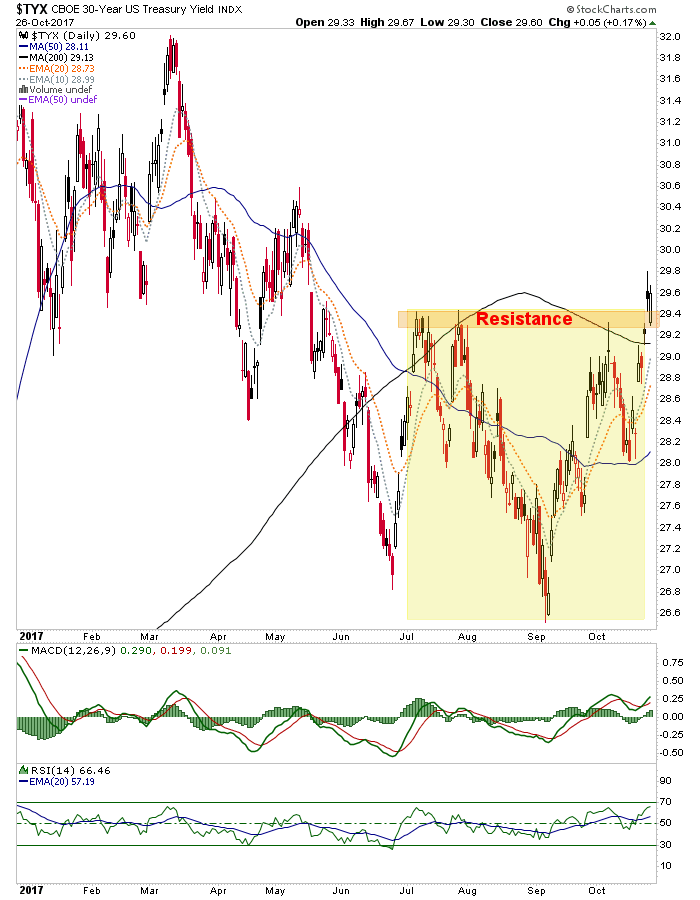

As noted earlier in the week, 10 and 30 year yields have made bullish breakouts on the daily charts. These patterns target 2.8% on the 10yr and 3.2% on the 30yr.

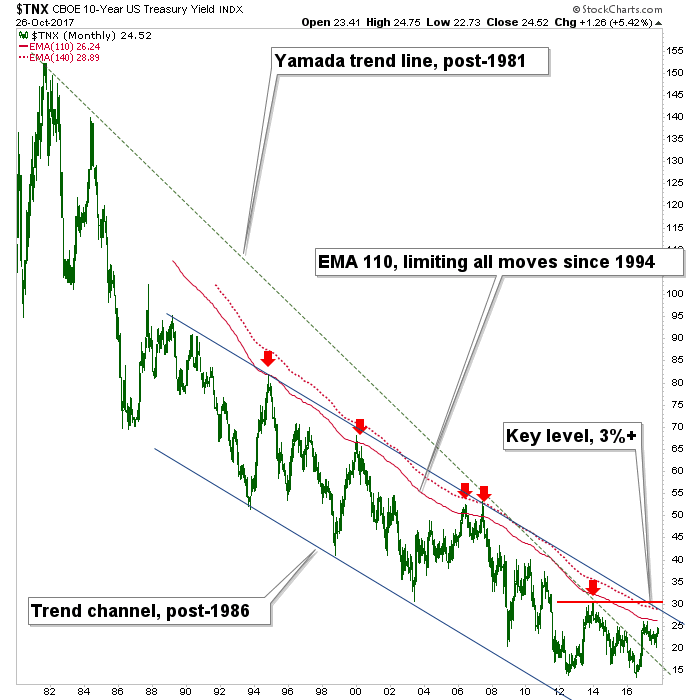

Now dialing out to the bigger picture, we have our limiters (to speculation) that have been in place for decades. To review, this chart noted the “Yamada trend line” back in December of 2016 in order to cast derision upon the Bloomberg headline R.I.P. Bond Bull Market as Charts Say Last Gasps Have Been Taken as a celebrity TA drew a single line on a long-term chart and Bloomy fell all over itself to turn it into a sensational headline. Bonds then went up for the better part of a year.

What is actually important on this chart are the limiters at the red dotted monthly EMA 140, the channel top and lateral resistance from the late 2013 high when the media were busily honking the “Great Promotion Rotation”. The TNX limiter is at 2.9% (), which is in essence, the measured target of the daily chart pattern above! [I hardly ever use ‘!’ in my writing, but this warrants an exception].

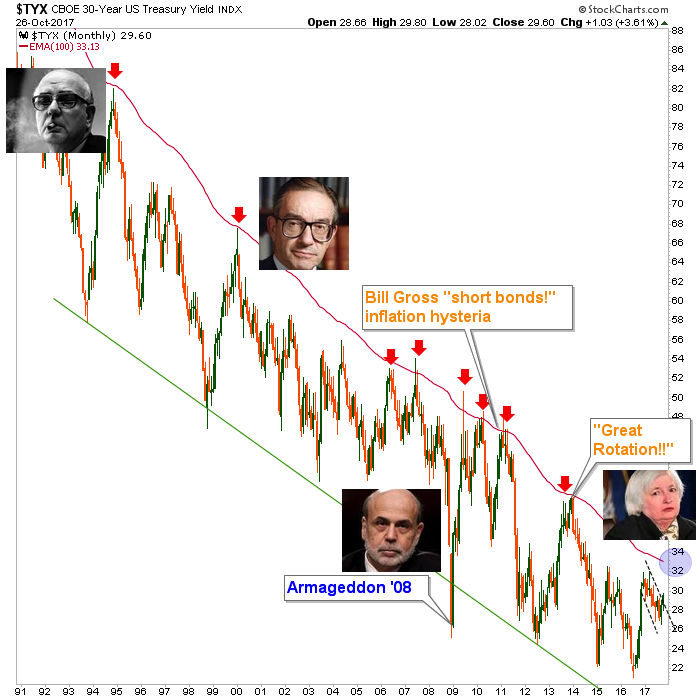

Similarly for the 30yr yield, AKA our “Continuum”, the limiter will decide whether or not the bond bull market is dead or not. It is currently at 3.3% and is in essence, at the daily pattern’s target!

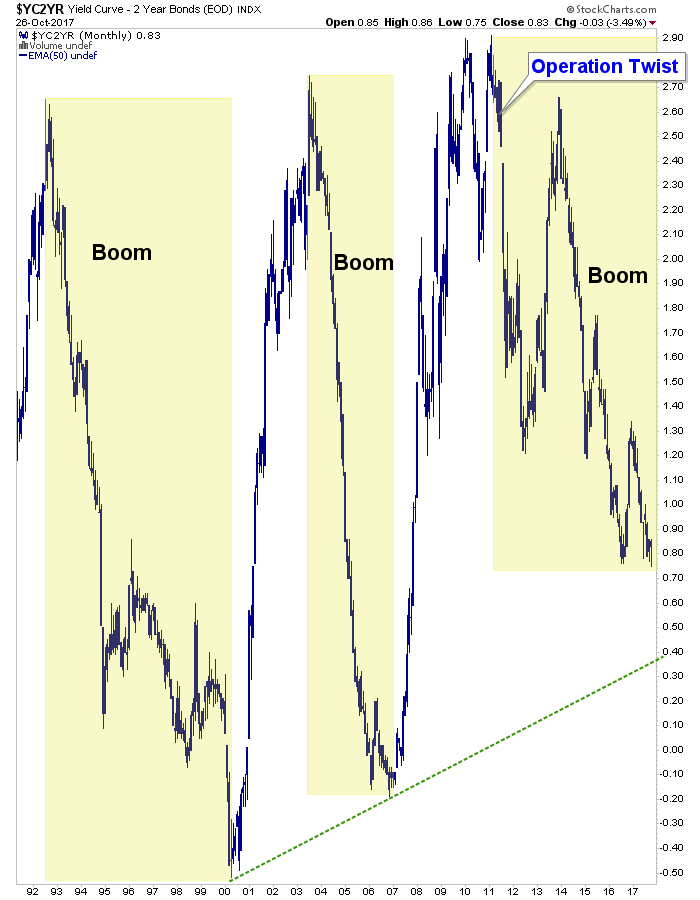

Now, to really change the macro we are going to have to add in yield dynamics to the view as well; and no yield dynamic is more important than the yield curve, which declines during a boom and rises during either a contraction or a major inflationary episode. At this time, like its fellow monthly charts above, it just lumbers along on trend; and that trend is bullish for stocks (and bearish for gold).

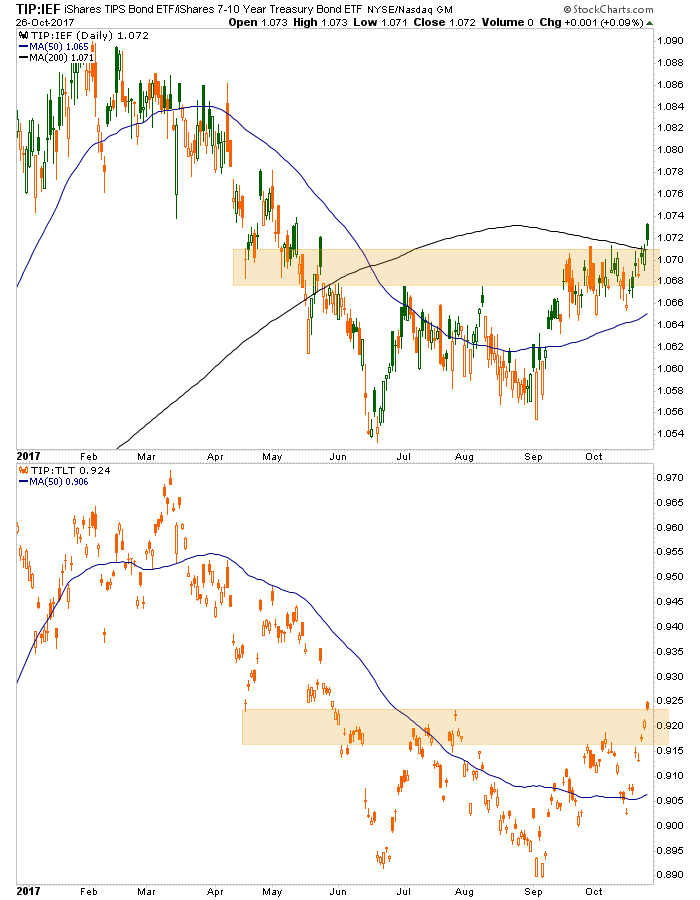

But again, the limiters on the monthly yield charts above have held for decades and if they hold again, the current speculative asset mania is going to find its end. In the meantime, it’s party on Garth, party on Wayne. Even the TIP/IEF ratio (an inflation expectations gauge) broke out yesterday as its bro, TIP/TLT sports a pattern not unlike the daily nominal yield charts above.

If the signals in nominal yields and the TIP ratios hold, and inflationary hysterics gain in the coming weeks/months, we will play the game (with tactical strategies refined all along the way in NFTRH) but realize that yet another inflationary asset mania (like silver and commodities in spring of 2011) is likely to blow out. A deflationary rise of the yield curve has now become the favored view. It’s either that or already brisk mania is going to intensify and a von Mises style Crack Up Boom is ahead. Either way the curve will rise and people had better prepare for big changes in their investment orientations.

Get it right and you’ll do okay as we finish up the current trend, but you may make a killing (or simply preserve your capital) in the years ahead. Get it wrong and you’re toast. So now let’s ramp down the urgency and realize that current trends are in play and resolution is still out on the horizon.

[edit] It’s worth noting that if the breakouts in yields and TIP/IEF should fail, the timing of a deflationary episode could be pulled in.

* From Reminiscences of a Stock Operator: Old Turkey would ***** his head to one side, contemplate his fellow customer with a fatherly smile, and finally he would say very impressively, “You know, it’s a bull market!”

Subscribe to NFTRH Premium for your 40-55 page weekly report, interim updates and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com. Also, you can follow via Twitter ;@BiiwiiNFTRH, StockTwits, RSS or sign up to receive posts directly by email (right sidebar).

By Gary Tanashian

© 2017 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.