Harry Dent’s Fourth Cycle: More Evidence of Stock Market Downturn

Stock-Markets / Stock Market 2017 Nov 14, 2017 - 10:13 AM GMTBy: Harry_Dent

One of the hardest things I’ve had to stake my name to was the concept of how sunspot cycles ebb and flow about every 10 years and the effect they have on our economy and stock markets…

One of the hardest things I’ve had to stake my name to was the concept of how sunspot cycles ebb and flow about every 10 years and the effect they have on our economy and stock markets…

I’ve already got the label of “crackpot,” so giving skeptics more meat to chew on was tough. I did it anyway because I’d done my research (as I always do) and knew that we’ve had major or minor recessions about every 10 years!

They occurred in the early 1960s, early-to-mid 1970s, early 1980s, early 1990s, early 2000s, and between 2008/2009.

Another is due just ahead, between 2018 and 2020 by my forecasts.

This isn’t coincidence. There’s something behind this: sunspots.

Ned Davis, a great cycles guy, came up with the Decennial Cycle, which forecast that the first few years of every decade would see recessions and minor or major stock crashes.

I followed his cycle for decades, and it worked…

Until the early 2010s.

That’s when I expected we’d see a large crash, given the massive peak of the Baby Boom spending cycle in late 2007.

Yet we only got a minor crash into late 2011. There was a large crash from late 2007 into early 2009, but not on this cycle.

So, I went back to the drawing board.

What had gone wrong?

What had I missed?

While working on this problem, I came across an article in Barron’s, written by one of the largest fund managers at PIMCO. He was touting the sunspot cycle, saying how it had saved him from the 2000-2002 tech wreck.

I dug into this phenomenon, which scientists can track back to the 1600s accurately, and I found that 88% of the recessions back to the mid-1800s (where there is good data) occurred in the downside of these sunspot cycles!

Damn!

And better, 100%, 11 out of 11 major financial crises, occurred in the downside of this cycle – like the one I’m forecasting just ahead.

In short: Ignore this cycle at your peril.

Sunspot cycles are simple: sun and energy.

The more there is, the better people feel, just like sitting on the beach and soaking it in energizes us.

The less sun and energy there is, the more depressed people feel. Just hang out in Seattle during the long rainy season if you want a taste of this.

That’s why, despite other more fundamental cycles, people will be more bullish in a rising sunspot cycle than a declining one. There is literally, on average, 20% more radiation (and rainfall from evaporation) at the top of such cycles than at the bottom.

After many months of documenting past correlations, I finally presented this to our best audience at one of our annual Irrational Economic Summits.

The reception was skeptical, to say the least.

Then an emergency room nurse stood up. She and her policeman husband, she said, clearly observe the spike in erratic behavior, crimes, and accidents during the extra light reflected just during a full moon!

That’s when the audience started to take me seriously!

The sunspot cycle can oscillate between eight and 14 years. That makes this one of the more challenging cycles to implement into my hierarchy. It’s not as clock-work as most of the others. But that’s OK because scientists are very good at predicting this cycle!

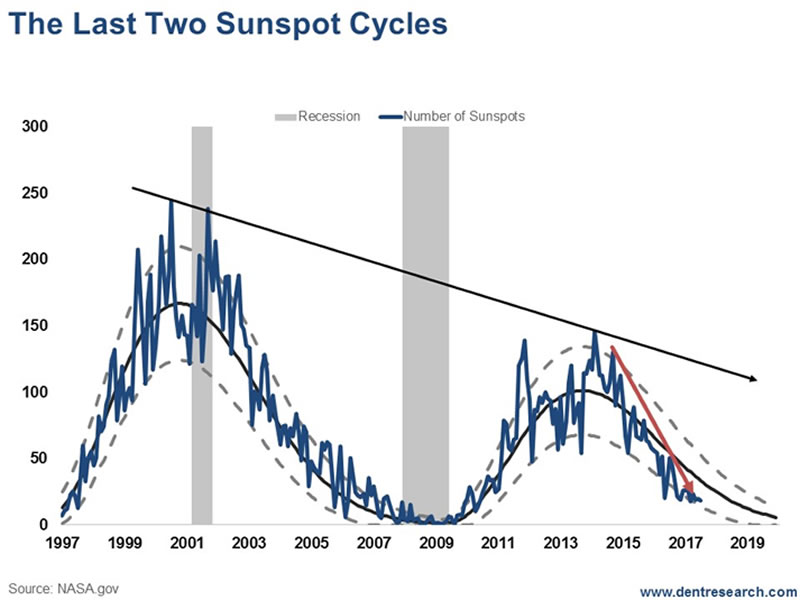

Here’s an update on the last two sunspot cycles…

The last one peaked in March of 2000, right at the top of the tech bubble! There was a first crash into late 2002 and then the Great Recession from 2008-2009 came at the very bottom of that cycle.

And it’s typical to see recessions and stock declines right after the peak, or near the bottom.

The sunspot cycle into the next top, in February 2014 was the most extreme I’ve measured, clocking in at nearly 14 years long.

That’s what threw off Ned Davis’s Decennial Cycle in the early 2010s.

The most recent sunspot cycle didn’t see the normal crash just after the peak thanks to unprecedented central bank QE and stimulus.

But you can see that we’re now quickly approaching the low end of this cycle starting in late 2017… the same place where the last Great Recession hit from early 2008 into mid-2009.

Now this cycle is projected, by the best scientists, to bottom around early 2020 or so.

That’s when my Geopolitical Cycle and the worst of the Baby Boomer’s Spending Wave bottoms!

My point here is this: If we’re going to see a major downturn and bubble burst, it will come between now and early 2020 or so.

That’s when you need to protect your assets.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2017 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.