Sheffield City Council Deploys Private Security Against Street Tree Fellings Protestors

Local / Sheffield Nov 28, 2017 - 04:50 AM GMTBy: N_Walayat

Sheffield City Council's contractor Amey appears to have upped the anti in the council / Amey's long running dispute with thousands of residents opposed to the felling of thousands of 'healthy' street trees, as this week saw the deployment of private security patrols operating more aggressively than has been seen in the past in support of Amey's felling crews as they roam Sheffield's streets attempting to fell large trees before the end of this year.

Sheffield City Council's contractor Amey appears to have upped the anti in the council / Amey's long running dispute with thousands of residents opposed to the felling of thousands of 'healthy' street trees, as this week saw the deployment of private security patrols operating more aggressively than has been seen in the past in support of Amey's felling crews as they roam Sheffield's streets attempting to fell large trees before the end of this year.

The catalyst for which appears the looming deadline contained within the PFI contract signed with contractor AMEY to fell 6,000 of Sheffield's big street trees by the end of 2017 (out of an estimated total of 36,000). To date approximately 5,800 of Sheffield's big street trees have been felled leaving 200 remaining to fulfill contractual obligations and thus with the holidays approaching the Council and it's contractor have adopted a blitzkrieg approach by blanket coverage of whole areas with barriers surrounding dozens of trees as they play a cat and mouse game with tree campaigners.

For most of this year the campaign has proved largely peaceful on both sides of the barriers as protestors crossing barriers to prevent the felling of healthy trees at worst would tend to have their photos taken by Council information gatherers.

Where virtually every encounter has proven peaceful, with only a few rare reports of any physical contact between protestors and the council tree felling crews.

However, the start of this week has seen a Blitzkrieg approach, one of deploying private security personnel for the purpose of fulfilling the contracts quota of felling 6000 big street trees by the end of 2017, the first 5 year tranche of a 25 year contract.

As for the impact of the felling to date, apart from the impact on the health of Sheffielders by the removable of thousands of trees that had been soaking up vehicle pollution, one unintended consequence is being felt in Sheffield's housing market in the wake of leafy suburban streets being stripped of many of their street trees house prices have also been felled. Sheffield's tree lined leafy suburbs that the estate agents so welcoming advertise are increasingly becoming no more. Trees that have taken more than a 100 years to reach their adult splendour have been felled in there thousands leaving behind either voids or saplings that can fail to survive or are prone to vandalism, all in exchange for large trees with capital values of between £50k and £150k now permanently gone!

And as I a warned right at the start of 2017 (and for much of 2016 in many youtube videos) that such ongoing capital destruction would have consequences not just for the streets that were being stripped bare by a council that has OUTSOURCED DEMOCRACY TO A MULTINATIONAL but that the rampant out of control tree felling's were DEVALUING THE WHOLE CITY! Where Amey in effect was felling Sheffield house prices.

03 Jan 2017 - Sheffield Tree Felling's - Labour City Council Outsourcing Local Democracy to Amey

Which means that the Labour Sheffield city councilors have effectively out sourced themselves out of a job, betraying all those they purport to represent instead having handed power over to a foreign multinational to dictate what happens on Sheffield's streets. Whilst many of the tree campaigners remain unwilling to recognise the fact that it is a Labour council that is doing this to Sheffield, tending to respond that it has nothing to do with politics despite the fact that it is ALL ABOUT POLITICS!

I first became interested in what was happening to Sheffield's street trees some 2 years year ago, given that unlike most I recognised the impact that the loss of capital value of felling big mature trees would have on property prices that some web sites estimate have a value of £150k per tree. Of course this is a local issue, not a national issue yet! But given continuing austerity and brexit uncertainty than what is happening in Sheffield 'may' be replicated in cities across Britain as cash strapped councils outsource the running of their cities to PFI multinationals.

And where Sheffield's trees are concerned, then during 2017 my focus will be on documenting what it means for Sheffield Streets to be stripped bare of the capital value of trees estimated to be worth £150k per large mature tree, as undoubtedly it will have detrimental effects on the value of all properties on the streets and cumulatively amounts to a devaluation of the whole city.

And so as we approach the last month of 2017, my warnings of the capital destruction as a consequence of street tree felling's impacting house prices is coming to pass as on several measures such as Zoopla, Sheffield house prices momentum has now decidedly turned negative with rising prices of early 2017 now turning negative as annual house prices are now falling at the rate -0.25%, that masks a crash underway in Sheffield's house prices as illustrated by house prices falling by 2% during the past 3 months which annualises to -8%, which in real terms after inflation implies -11%, a trend which is more than likely to materialise by this time next year as house price falls in real terms enter double digits.

So that is no confusion of what is happening to Sheffield's property market as its streets are stripped of capital value estimated at over £200mln, the following video follows what happened to 1 street amongst hundreds to illustrate what it means for streets to be stripped of ALL of their trees, capital that has taken over a 100 years to grow destroyed in a matter of weeks, a loss of value of over £1/2 million for this street alone that instantly converts into a 10% loss in average house price values for the street that ripples out to the neighbouring streets, making the street and the area LESS appealing to prospective home buyers, no longer a leafy suburb!

My forthcoming in-depth housing market analysis will seek to update my Sheffield housing market analysis of 2013, given Sheffield's fast disappearing leafy suburbs, as the Council will have felled approx 20% of Sheffield's street trees by the end of this year :

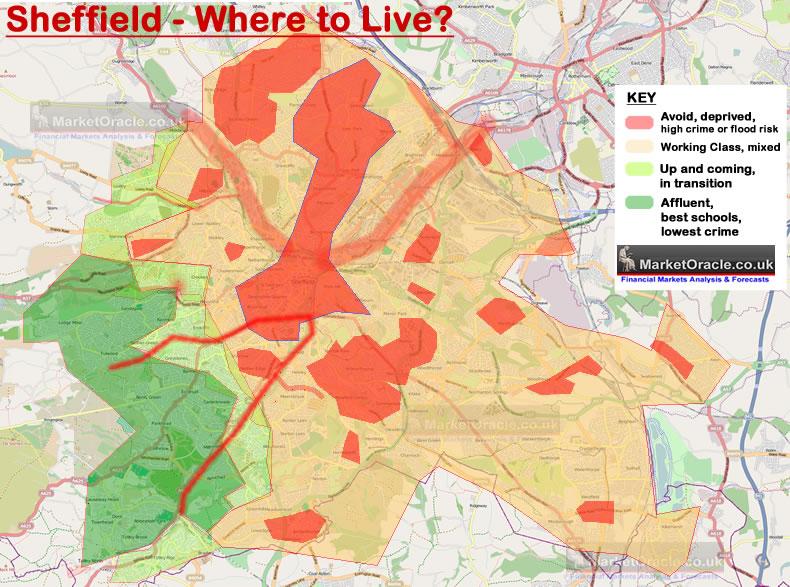

31 Oct 2013 - Sheffield Best and Worst Areas to Live, House Buying Analysis Map

Sheffield's Best Places to Live

The below map details which areas of Sheffield should be avoided and which areas should be favoured in terms of the best places to live. Obviously the amount of financing available will play an important factor in determining the choice of area's, but at a minimum the RED areas should be avoided as people moving to Sheffield, purchasing a property for their own residency in a Red area will soon come to regret their decision.

The large expanse of orange area's are as a consequence of the size of Sheffield's public sector and the private sector that directly relies on it, that continues to see deep cuts in local government spending, this also means that there is a continuing large supply of properties in these areas of Sheffield which acts to depress average house prices that masks booms taking places in pockets of the city and thus offers many opportunities towards the middle end of the property market.

Meanwhile prospective home buyers can expect a huge jump in financing requirements to purchase a property in the affluent areas of the city (Dark Green) which are situated in the the South West of the city as these areas will have experienced little in terms of the impact of the economic depression with the consequences and in terms of expected house prices is that just like many areas of London, these areas are already trading near their pre-crash levels as these are the areas that will be those that are in greatest NATIONAL demand, just as many parts of London are in great INTERNATIONAL demand (as high as 50% of properties in many areas of London are bought by foreign investors).

Click here for a Large version of the Where to Live Map

What is happening to Sheffield will form part of the drivers for national house prices as part of my comprehensive review and update of my forecast for UK house prices of December 2013, with key forthcoming areas being :

1. CITIES ECONOMIC AUSTERITY

Britains' largest cities such as Sheffield are feeling the real effects of crumbling infrastructure as a consequences of 9 years of economic austerity prompting house prices value destroying local council actions, such as high rise death traps and the felling of thousands of Sheffield's most valuable street trees.

2. THE LONDON BUBBLE - The centre of Britain's housing market, from which all UK property trends ripple out in waves of either euphoria or despair. A reminder that I have been bearish on the prospects for the London housing market for some time as my video analysis of December 2015 illustrates.

3. UK HOUSE PRICES TREND FORECAST - Aiming to conclude in a new multi-year trend forecast.

4. US HOUSE PRICES TREND FORECAST - And lastly my 3 year US house prices forecast successfully concluded early 2016. The forecast trend of which was in the face of overwhelming doom and gloom for the duration of the then unfolding US housing bull market that I will now attempt to map out a new forecast trend for another 3 years.

Therefore ensure you are subscribed to my always free newsletter and youtube channel for my forthcoming of 4 pieces of in-depth analysis that seek to conclude in a new multi-year trend forecast for the UK house prices:

UK House Prices Forecast

My 5 year UK house prices forecast has now passed its 3 1/2 year mark that originally forecast a 55% rise from November 2013 to the end of 2018.

30 Dec 2013 - UK House Prices Forecast 2014 to 2018, The Debt Fuelled Election Boom

UK House Prices Forecast 2014 to 2018 - Conclusion

This forecast is based on the non seasonally adjusted Halifax House prices index that I have been tracking for over 25 years. The current house prices index for November 2013 is 174,671, with the starting point for the house prices forecast being my interim forecast as of July 2013 and its existing trend forecast into Mid 2014 of 187,000. Therefore this house prices forecast seeks to extend the existing forecast from Mid 2014 into the end of 2018 i.e. for 5 full years forward.

My concluding UK house prices forecast is for the Halifax NSA house prices index to target a trend to an average price of £270,600 by the end of 2018 which represents a 55% price rise on the most recent Halifax house prices data £174,671, that will make the the great bear market of 2008-2009 appear as a mere blip on the charts as the following forecast trend trajectory chart illustrates:

Whilst my most recent look at average UK house prices data for June 2017 (£218,390) showed a 10% deviation against my 5 year forecast trend trajectory, which if it continues to persist then in terms of the long-term trend forecast for a +55% rise in average UK house prices by the end of 2018 would then translate into a 14% reduction in the forecast outcome to approx a +41% rise by the end of 2018.

So far my warnings from Mid 2017 for house prices momentum turning negative by the end of 2017 remain on target as UK house prices look set to end 2017 down on the year that could be a harbinger of far worse to come for 2018. So again do ensure you are subscribed to my always free newsletter and youtube channel for my forthcoming pieces of in-depth analysis and detailed trend forecasts.

By Nadeem Walayat

Copyright © 2005-2017 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.