Fed Unwinds, Gold Market Yawns

Commodities / Gold and Silver 2017 Dec 22, 2017 - 04:46 PM GMTBy: Arkadiusz_Sieron

In October, the Federal Reserve started the unwinding of its massive balance sheet. According to the addendum to the Policy Normalization Principles and Plans revealed in June 2017, Fed officials wanted to reduce the size of its security portfolio by $10 billion in October ($6 billion in Treasuries and $4 billion in the mortgage-backed assets). Let’s analyze whether this is really what happened, how the so-called quantitative tightening has influenced the financial markets so far, and what the Fed’s normalization would mean for the gold market.

In October, the Federal Reserve started the unwinding of its massive balance sheet. According to the addendum to the Policy Normalization Principles and Plans revealed in June 2017, Fed officials wanted to reduce the size of its security portfolio by $10 billion in October ($6 billion in Treasuries and $4 billion in the mortgage-backed assets). Let’s analyze whether this is really what happened, how the so-called quantitative tightening has influenced the financial markets so far, and what the Fed’s normalization would mean for the gold market.

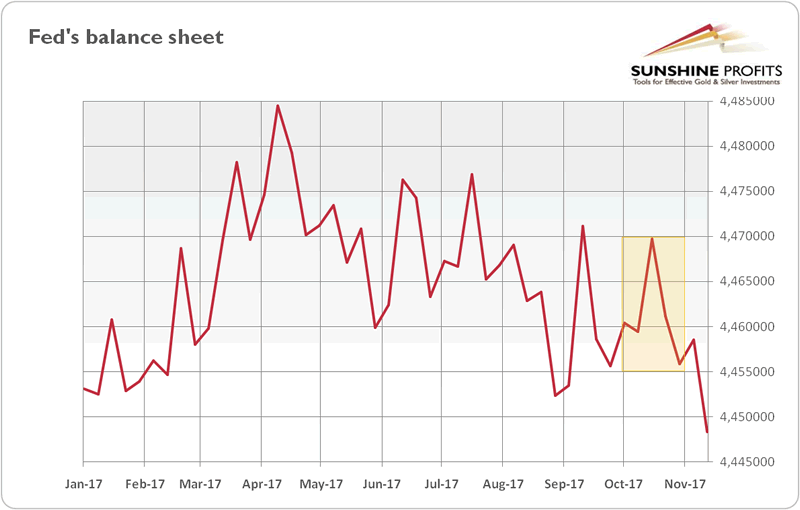

As for the first question, data shows that the U.S. central bank actually failed to reduce its balance sheet by $10 billion. Instead, the Fed’s balance sheet on September 27 amounted to $4,455,661 million, while on November 1 it was $4,455,887, as the chart below shows. So the U.S. central bank’s assets actually slightly increased on October!

Chart 1: Fed’s balance sheet from January to November 2017.

When it comes to the second question, the financial markets did not react significantly in response to the quantitative tightening, just as we predicted in the May edition of the Market Overview. Actually, the U.S. stock market calmly set more records in October, shrugging off the Fed’s historical move.

Why was that? As we have pointed out several times, there are a few important reasons. First, the unwinding of the Fed’s balance sheet was well telegraphed in advance and thus widely expected by the markets. Second, the pace of tightening will be gradual. Third, the U.S. central bank will not reduce its balance sheet to the pre-crisis level.

However, there is another thing we already mentioned at the beginning. The data shows that the Fed started to reduce the size of its securities portfolio, but simultaneously it also began to cut the size of its reverse repurchase agreements (the Fed’s sales of securities with an agreement to repurchase them later). The former reduces the liquidity in the banking system, while the latter increased it. Indeed, the so-called excess reserves in the U.S. banking system rose by almost $140 billion between September 27 and November 8. It implies that the Fed wants to unwind its balance sheet in such a manner that will not add pressure on bank reserves.

The implication is clear: the effects of the Fed’s balance sheet unwinding program will not be simply the reverse of the quantitative easing. Instead, the impact will be smaller.

What does it all mean for the gold market? Well, in May we wrote that gold investors should not count on the Fed’s tightening as the potential trigger of market turmoil which would send gold prices higher. The reason is that the Fed remembers the taper tantrum and is moving now with extreme caution. Actually, the caution is so extreme that the U.S. central bank’s balance sheet increased in October! Consequently, it is not surprising that the markets have not experienced any turbulence – there has not been any unwind so far.

Surely, one month may be not enough time to judge the unwinding program. And in November the Fed’s balance sheet indeed declined. But even when the unwinding really accelerates, the exit will be less dramatic than the entry. Investors should also remember that the macroeconomic picture is much different than when the Fed started its bond purchasing program. Then, the economy was doomed, but now it is in much better shape, so it is better prepared to cope without the Fed’s support.

Hence, the gold market should not be significantly affected by the Fed’s unwinding which is programmed to run quietly on autopilot in the background. Indeed, the September’s announcement of the start of the program had almost no effect on the bond yields.

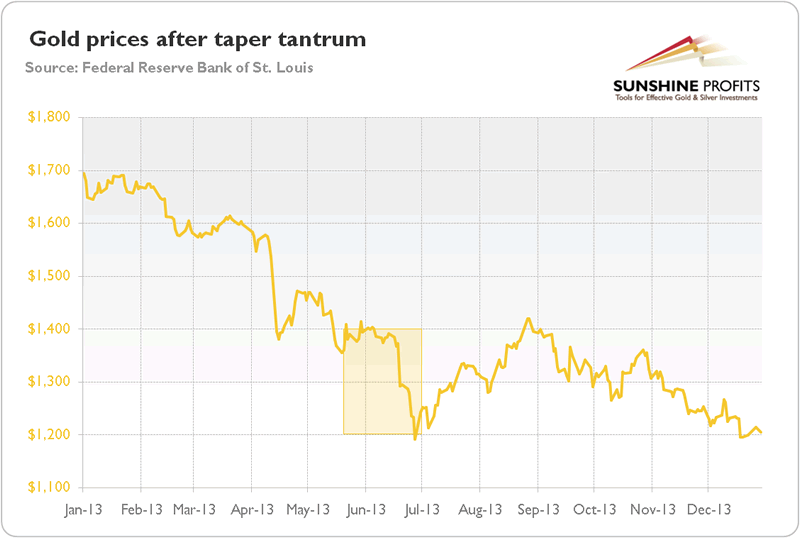

It is true that we cannot exclude the possibility of some market disruptions, but we do not see signs of it so far. We will keep you up to date, of course. But if there is any impact on the gold market, it should be rather negative. Let’s analyze the chart below, which shows the gold’s reaction to the taper tantrum.

Chart 2: Gold prices after taper tantrum in 2013.

As one can see, the price of gold declined after Bernanke’s suggestions of tapering in May and June. Why? The reason is simple: Bernanke’s comments triggered a rise in the interest rates. Hence, the price of gold – which is a non-bearing asset – declined. Therefore, investors should be aware that something similar could happen in the future. If the Fed’s unwinding has any impact on the financial market, it will be an increase in yields, which will be fundamentally bearish for the gold prices. The yellow metal shines during periods of low real interest rates, but struggles when yields are increasing. Stay tuned!

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.