Gold Hits All-Time Highs Priced In Emerging Market Currencies

Commodities / Gold and Silver 2018 Jan 10, 2018 - 12:42 PM GMTBy: GoldCore

– Gold at all time in eight major emerging market currencies

– Gold at all time in eight major emerging market currencies

– A stronger performance than seen when priced in USD, EUR or GBP

– As world steps away from US dollar hegemony expect new gold highs in $, € and £

– Gold is a hedge against currency debasement and depreciation of fiat currencies

Editor: Mark O’Byrne

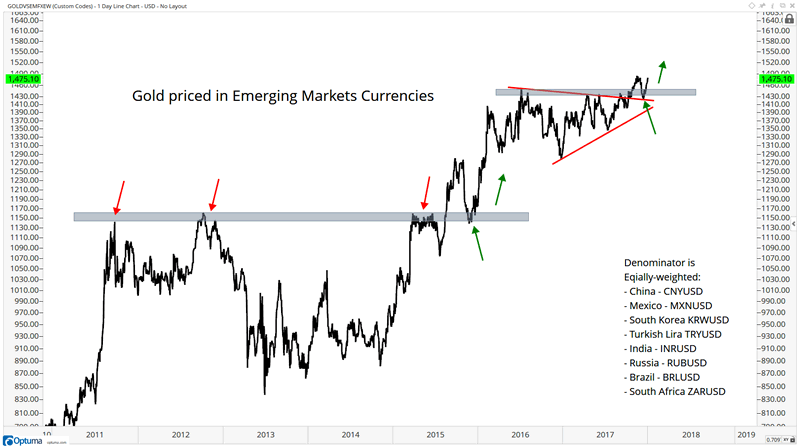

Source: allstarcharts.com h/t @DominicFrisby

When we talk about the gold price we all too often focus on it priced in US dollars, with some frequent glances to Sterling and Euro as well. This is understandable, after all these are the currencies the majority of readers buy and sell in. The US dollar price is also the one which is most universally quoted.

However this approach ends up giving us a very skewed perspective of the gold market and price behaviour.It is arguably an old fashioned approach in a very globalised world. The relationship between gold and the US dollar is one which is rooted in the Bretton Woods agreement, something which was scrapped in 1971.

Today the gold price and the gold market is international, with far more interest in physical gold being paid by the emerging markets. One just has to look at the gold buying policies of Russia and China to see this.

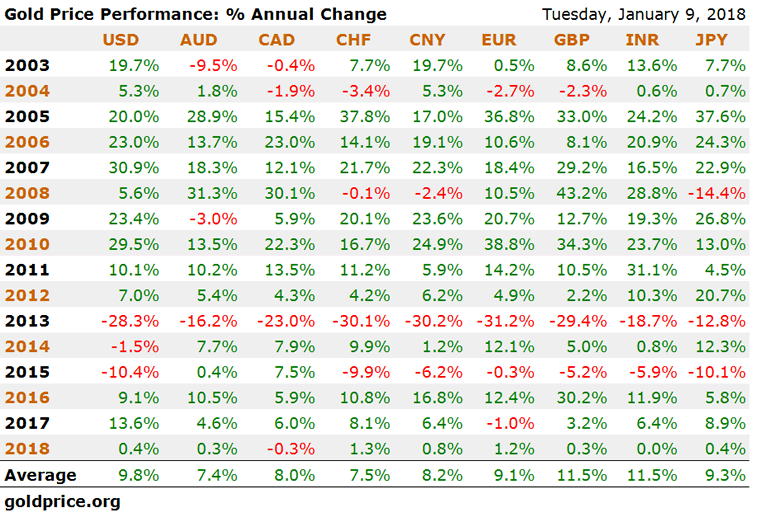

In the long term, gold has performed very well in dollar, sterling, euro and all fiat currencies with gains of between 7% and 12% per annum over a 15 year period. Gains in emerging market currencies have been even greater.

Very often a change in the price of gold is a reflection in the change of the value of the currency in which you are choosing the quote the price. This has certainly be the case in the last year or so when it comes to gold bullion priced in the US dollar.

In 2017, gold’s dollar price was far more reflective of the dominant world currency’s perceived value than it was of other global events such as inflation, the threat of nuclear war etc.

So when the price of gold changes it is how it is perceived in relation to that currency and (more importantly) how that currency is behaving against other currencies.

Gold is a currency and clearly one of the most important safe havens and alternatives to the greenback. We see this with other currencies such as the Yen and the euro. So whilst gold might be a bet against the value of the US dollar it is also a safe haven against global risks and a hedge against currency devaluation.

This is of particular interest when we consider the above chart. Eight emerging market currencies and currently experiencing all time high gold prices. This gives a perspective of the gold market through a lens that we don’t usually see from a Western perspective. This perspective shows a totally different gold market – one which is at all time highs.

Is this a gold market that is perhaps reflecting the true risk in the global system?

The above chart was created by allstarcharts.com and was accompanied by this analysis:

What I see is a massive base from the 2011 to late 2015. After breaking out, the retest of that former resistance sparked the early 2016 rally in all precious metals. Look how they all rallied into that summer of 2016. Since then we have gone sideways. The nasty mess that gold has been, as mentioned above, can be seen in this chart very clearly. Look at this 18 months of nothing, perfectly describing the price action in Gold investments in general.

So what now? Well we’re breaking out of an 18-month base to new all-time highs. And we have successfully retested that breakout level. So things become very simple here. We want to be long Precious metals if we’re above those 2016 highs in this ratio. It’s about 1400 by my work.

The above chart and table show us what the bigger picture is telling us. rather than the gold price in just one currency. Gold has had an excellent twelve months when priced in the dollar and it has protected those with dollar assets from the further depreciation of the dollar seen in 2017.

However, gold’s hedging benefits were more clearly seen in emerging market currencies which continued to lose value in 2017.

That picture is perhaps suggesting that emerging markets and those interested in their currencies do not see a world which is in an American led so called recovery.

The emerging market gold chart shows a picture of a world which is far more diverse and takes gold’s role as both a currency and safe haven more seriously and gold is acting as a hedge against currency devaluation again.

Western investors and savers would be prudent to follow the diversification lead of Indian housewives and the People’s Bank of China and own physical gold. The charade of US dollar hegemony is not going to continue for much longer and all currencies including the euro and the pound are vulnerable to further debasement and depreciation in the coming months and years.

Gold Prices (LBMA AM)

10 Jan: USD 1,321.65, GBP 976.96 & EUR 1,103.31 per ounce

08 Jan: USD 1,314.95, GBP 972.01 & EUR 1,102.19 per ounce

08 Jan: USD 1,318.80, GBP 974.33 & EUR 1,099.09 per ounce

05 Jan: USD 1,317.90, GBP 973.40 & EUR 1,094.25 per ounce

04 Jan: USD 1,313.70, GBP 969.77 & EUR 1,090.24 per ounce

03 Jan: USD 1,314.60, GBP 968.20 & EUR 1,092.96 per ounce

02 Jan: USD 1,312.80, GBP 968.85 & EUR 1,087.52 per ounce

Silver Prices (LBMA)

10 Jan: USD 17.13, GBP 12.64 & EUR 14.27 per ounce

09 Jan: USD 17.05, GBP 12.60 & EUR 14.30 per ounce

08 Jan: USD 17.17, GBP 12.68 & EUR 14.33 per ounce

05 Jan: USD 17.15, GBP 12.66 & EUR 14.24 per ounce

04 Jan: USD 17.13, GBP 12.64 & EUR 14.20 per ounce

03 Jan: USD 17.12, GBP 12.63 & EUR 14.25 per ounce

02 Jan: USD 17.06, GBP 12.59 & EUR 14.15 per ounce

Important Guides

For your perusal, below are our most popular guides in 2017:

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns (UK)

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.