Some Fascinating Stock Market Fibonacci Relationships...

Stock-Markets / Stock Markets 2018 Jan 15, 2018 - 10:17 AM GMT You may recall that I had mentioned in December that I was looking to see whether the INDU would make 27521.00 by year end. Since it took to January 12 to make that target may be telling us that Social Mood may be making a reversal. We may pin the reversal on an event, but the fact is, the fruit doesn’t fall from the tree until it is ripe. What I mean to say is that the conditions for a fall must be there. Hopefully I will be able to guide you through the process until the fruit actually falls. We know from the indicators on the SPX that the fruit is ripe. Here are some of the reasons why.

You may recall that I had mentioned in December that I was looking to see whether the INDU would make 27521.00 by year end. Since it took to January 12 to make that target may be telling us that Social Mood may be making a reversal. We may pin the reversal on an event, but the fact is, the fruit doesn’t fall from the tree until it is ripe. What I mean to say is that the conditions for a fall must be there. Hopefully I will be able to guide you through the process until the fruit actually falls. We know from the indicators on the SPX that the fruit is ripe. Here are some of the reasons why.

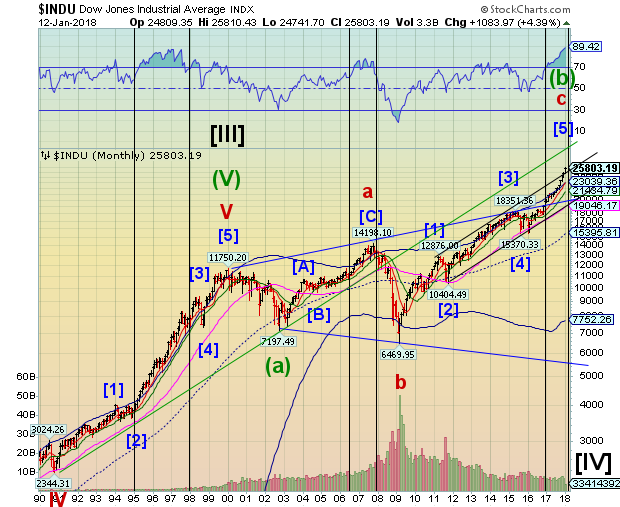

We’ve covered the Fibonacci relationships in the SPX. Let’s take a look at some other indices to see what has transpired. In the Dow Jones Industrials we find that Cycle Wave c is 2.75 times the length of Cycle Wave a at 25721.66. We hit that target on Friday. In addition, Primary Wave [5] is equal to 1.618 X Primary Wave [1] at 25735.32, also finally hit on Friday. What this is telling me is that the fruit is so ripe that the slightest breeze may cause its downfall…or maybe nothing at all. Just be ready for it.

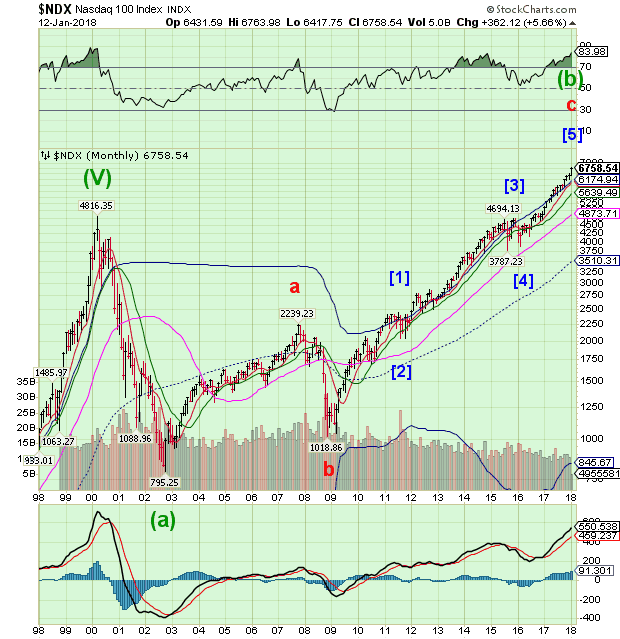

We also find similar relationships in the NDX. We find that Cycle Wave c is 4 X Cycle Wave a at 6794.78, only 36 points from Friday’s close. That is quite a relationship!

In addition, Primary Cycle Wave [5] is equal to 2X Primary Cycle Wave [1] at 6727.94, also made on Friday.

In the RUT we find that Primary Wave [5] is equal to 1.25X Primary Wave [1] at 1600.65. We also find that Cycle Wave c is equal to 4.382X Cycle Wave a at 1592.44.

Isn’t it fascinating that the indices have all made their multiple Fib relationships last Friday or have the opportunity to complete them on Monday. I have found more than these, but it would be rather exhausting to catalogue all of them. These are the most convincing, IMO.

I will be at a doctor’s appointment early tomorrow so I may not be available for commentary until the afternoon.

Best wishes to all,

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.