The Dangers of Investing Based on Phony Government Statistics

Economics / Economic Statistics Jun 12, 2018 - 06:32 PM GMTBy: MoneyMetals

President Donald Trump recently took to Twitter to boast, “The U.S. has an increased economic value of more than 7 Trillion Dollars since the Election. May be the best economy in the history of our country. Record Jobs numbers. Nice!”

President Donald Trump recently took to Twitter to boast, “The U.S. has an increased economic value of more than 7 Trillion Dollars since the Election. May be the best economy in the history of our country. Record Jobs numbers. Nice!”

“We ran out of words to describe how good the jobs numbers are,” reported Neil Irwin of the New York Times, amplified in a Trump retweet.

If you believe the headline numbers, joblessness is at a generational low with the economy booming.

Trillions in nominal value added to the stock market since Trump’s election. GDP up over 3% in the second quarter. 223,000 jobs added in May. Unemployment at an 18-year low of 3.8%.

On the surface, this all paints a beautiful picture for the economy and stock market. But dig a little deeper, and the numbers aren’t quite as bright they appear. All that glitters is not gold.

Headline Unemployment Number Is Fake News

Donald Trump himself put his finger on one of the main flaws with the unemployment number back when he was a private citizen.

“Unemployment rate only dropped because more people are out of labor force & have stopped looking for work. Not a real recovery, phony numbers,” he posted on September 7th, 2012.

The headline unemployment number isn’t any less phony in 2018. Though it has improved under Trump’s presidency – in large part because of his pro-growth tax cuts and deregulation – the statistic is still derived from a dubious formula.

Back in 2012, Trump rightly pointed to the large numbers of workers who had dropped out of the labor force but weren’t counted among the ranks of the unemployed.

The labor force participation rate currently comes in at just 62.7%. That means 33.7% of the population is currently not employed in the labor force. The vast majority of these jobless Americans aren’t among the 3.8% officially “unemployed.”

A healthier labor force participation rate of more than 66% prevailed before the Great Recession. It’s lower today not just because more people are retired. It’s also lower because the share of Americans aged 25 to 54 who are working still hasn’t risen back up to pre-2008 levels.

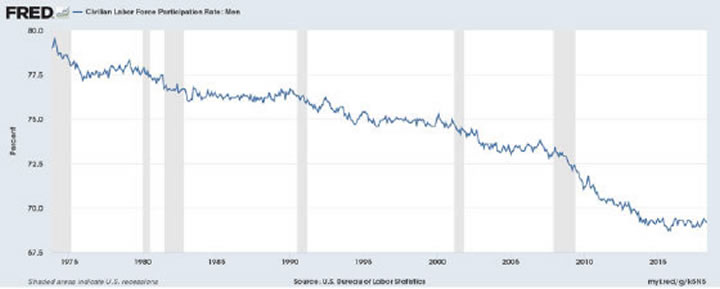

Among working-age males, only about 69% are currently working – closer to a record low than a record high for this cohort.

Civilian Labor Force Participation Rate among Men

The most cited unemployment measure (U3) doesn’t include people who have been unemployed for so long they have fallen off the unemployment insurance rolls.

“Discouraged workers” who are no longer looking for employment because they believe no jobs are available aren’t counted as unemployed by the Bureau of Labor Statistics; nor are partially-employed or under-employed workers.

They aren’t employed, but they aren’t officially “unemployed,” either. They are statistically invisible.

Phony government statistics on employment, inflation, GDP, national debt, and other key measures of the economy can cause investors to pursue the wrong strategy at the wrong time. Politically skewed data can cause investors to overestimate their expected returns from conventional financial assets and underestimate downside risk.

Inflation Manipulation

Any investor who buys a stock, bond, or other financial asset has a set of expectations about the future. Whether implicitly or explicitly, an investor who accepts a 3% bond yield or a 3% earnings yield, for example, is making a bet that the economy will remain stable and inflation relatively low.

The problem is, the real-world inflation rate isn’t fully accounted for by the headline Consumer Price Index (CPI) figure.

Over the years, the government has changed the way the CPI gets calculated. In the late 1990s, the Congressional Budget Office announced the CPI would now include “geometric weighting” which has the effect of giving more weight to things that are going down in price and less weight to the things that are going up.

The government also introduced “hedonic” adjustments to the inflation statistics, supposedly to account for improvements in the quality of goods.

If a brand-new car has more technology features than a similar one built 20 years ago, then government statisticians use the improvements to offset the cost inflation of the car.

Of course, the extent to which cars are better today is debatable, especially since many of the “improvements” have been mandated by government.

The government manipulates inflation data in order to buttress GDP reports, suppress Social Security cost of living adjustments, make its bonds look more attractive, and raise more revenues.

A provision buried in last year’s GOP tax bill changes the inflation gauge used to adjust tax brackets to the “chained CPI.” The difference between chained and unchained CPI is small in any given year. But according to the Joint Committee on Taxation, this arcane provision will cost taxpayers over $30 billion through 2026. That’s because chained CPI usually comes in lower than regular CPI.

Government manipulation of the CPI results in a hidden tax that probably not one voter in 100 even knows exists. Sadly, a similarly small paucity of investors understands how phony statistics can distort market valuations.

The upshot is that when inflationary assets such as precious metals are systemically underpriced due to false economic perceptions, contrarians can pounce on the value opportunity.

Stefan Gleason is President of Money Metals Exchange, the national precious metals company named 2015 "Dealer of the Year" in the United States by an independent global ratings group. A graduate of the University of Florida, Gleason is a seasoned business leader, investor, political strategist, and grassroots activist. Gleason has frequently appeared on national television networks such as CNN, FoxNews, and CNBC, and his writings have appeared in hundreds of publications such as the Wall Street Journal, Detroit News, Washington Times, and National Review.

© 2018 Stefan Gleason - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.