The Federal Reserve And Long-Term Debt – Warning!

Interest-Rates / US Debt Jun 26, 2018 - 04:06 PM GMTBy: Kelsey_Williams

Won’t somebody please say something different about the Federal Reserve? Or nothing at all?

Won’t somebody please say something different about the Federal Reserve? Or nothing at all?

It seems amazing to me that we are so studiously focused on comments, statements, or actions emanating from the Fed. It is as if we expect to find a morsel of truth that will give us special insight or a clue as to their next move.

I suppose that is reasonable to a certain extent – especially today. We are social-app (il)literate and very impatient. Seems to be a sort of day-trader mentality. Problem is that every morning we see the same headlines. All week long we hear about the most recent Fed meeting, or the release of minutes from the last meeting, or what to expect at the next meeting, etc., etc. And the cycle repeats itself every month. (I’m not Bill Murray and this is not Ground Hog Day.)

We are addicted. We are all junkies.

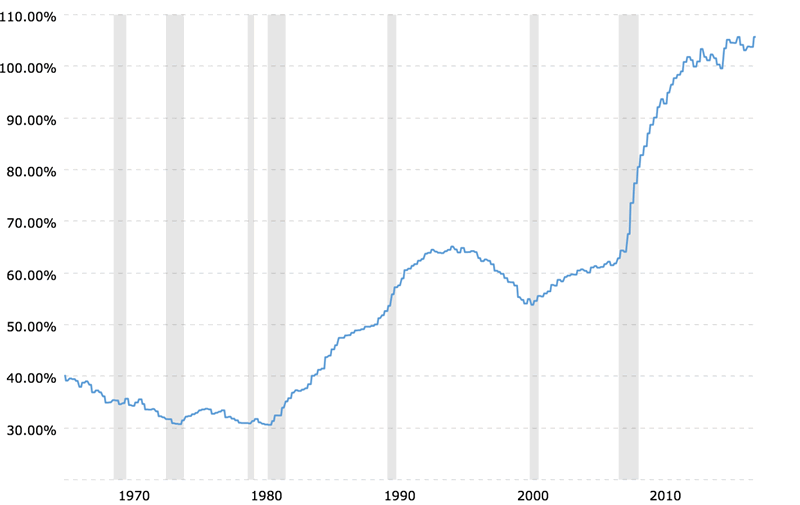

Case in point, see the chart below:

Debt to GDP Ratio Historical Chart

(Chart of historical data comparing the level of gross domestic product -GDP – with Federal Debt. The current level of the debt to GDP ratio as of March 2018 is 105.68.)

What this means is that it takes $105.00 of debt to generate $100.00 of goods and services.

A different way to think about this might be hiring someone at your company and paying them a salary of $100,000 per year. And then borrowing $105,000 to pay them.

Or maybe you are an investor in commercial real estate and your properties are worth one hundred million dollars. Which is fine, if you didn’t owe your bank one hundred five million dollars.

The current reserve ratio is set by the Federal Reserve at ten percent. This means that member banks can loan out nine dollars of every ten that they receive in deposits. The ten percent they are required to keep on hand is to satisfy your need to withdraw all of your cash reserves in order to pay for your daughter’s orthodontia. And, hopefully, everyone else won’t have similar needs at the same time.

But what if the reserve ratio was negative five percent? Suppose you deposit ten thousand dollars in your bank. The next day your bank loans out ten thousand five hundred dollars. Then what happens when you want to withdraw your money? It shouldn’t be a surprise when we hear talk about bank bail-ins and eliminating cash.

Federal debt as a percentage of GDP was declining in the sixties and seventies and reached a seemingly moderate level of about thirty percent in 1980. Since that time it has doubled and then doubled again.

How did all of this happen? Is it really this bad? It’s probably worse. The ratio uses the level of Federal debt. What about all of the other debt we have incurred in the form of student loans, auto loans, mortgages, CDOs, and derivatives?

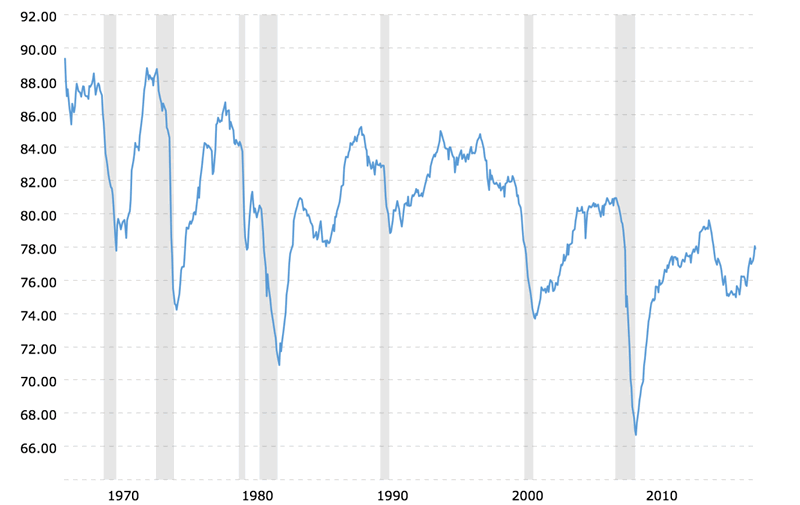

Let’s look at another chart…

Capacity Utilization Rate – 50 Year Historical Chart

(Chart shows Capacity Utilization back to 1967. Capacity Utilization is the percentage of resources used by corporations and factories to produce goods in manufacturing, mining, and electric and gas utilities for all facilities located in the United States (excluding those in U.S. territories). We can also think of capacity utilization as how much capacity is being used from the total available capacity to produce demanded finished products. The current capacity utilization rate as of May 2018 is 77.86.)

There is a clearly defined, long-term decline in the productive use of available resources by corporations and factories.

During the eighties and nineties, the cyclical rhythm of the Capacity Utilization Rate changed. And it appeared to start moving upwards on a long-term basis. I believe that is because there was some real economic growth during that period. That growth was triggered and enhanced by optimism about the future. Unfortunately, that changed radically in 1998 with the collapse and bailout of Long-Term Capital Management, followed by the Y2K scare.

The Federal Reserve ramped up their century-old expansion of the money supply considerably. It was the dawn of a new era of ‘super money’. Actually, the term is ‘super-cheap money’. And it only got worse with the collapse of tech stocks, 9/11, sub-par auto loans and mortgages.

Why should a corporation expand and produce more when it can borrow money so cheaply and buy back its own stock; and then increase dividends to shareholders? Because the focus is on generating a higher stock price – almost exclusively.

And that same price action is evident in bonds and real estate, too. Where is the value added for all of the price increases we are seeing?

If you wonder how we got to this point, look no further than – you guessed it – the Federal Reserve.

The Fed creates money out of nothing, which it gives to the U.S. Treasury in exchange for bonds (debt). Some of the bonds are kept by the Fed and the rest are placed with certain primary dealers/banks who offer them to investors; including other banks and foreign governments, and private investors.

When the bonds mature, the U.S. Treasury issues new bonds. The Federal Reserve ‘creates’ more money out of nothing which it gives to the government so that it can pay off the bonds which are maturing. Of course, it also issues additional bonds periodically to get more money from the Federal Reserve so that it can pay its expenses and continue to operate.

But that is just the beginning. The debt is perpetual and its effects are amplified by fractional-reserve banking.

(If you have played Monopoly, you know that all of the money comes from the bank. But where does the bank get its money?)

Cheap credit is a money drug which has, for the most part, had its intended effect – to goose economic activity. And, nobody wants to give back.

The Fed knows that keeping interest rates at artificially low levels for too long poses two huge risks: 1) it fosters suppression of fundamental economic activity and 2) it can lead to repudiation of the U.S. dollar.

Unfortunately, the Federal Reserve’s efforts have brought us to a point which is not very manageable. Their attempt to encourage a return to a more normal level of interest rates could trigger a deluge of worthless debt.

An implosion of the debt pyramid and a destruction of credit would cause a settling of prices for everything (stocks, bonds, real estate, commodities, etc.) worldwide at anywhere from 50-90 percent less than current levels. The depressed economic conditions could last far longer and be far more severe than anything we can currently imagine.

(Read more about the Federal Reserve here)

By Kelsey Williams

http://www.kelseywilliamsgold.com

Kelsey Williams is a retired financial professional living in Southern Utah. His website, Kelsey’s Gold Facts, contains self-authored articles written for the purpose of educating others about Gold within an historical context.

© 2018 Copyright Kelsey Williams - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.