Stock Market Studies for July 27, 2018: Amazon, Financial Stocks, China, GE

Stock-Markets / Stock Markets 2018 Jun 27, 2018 - 03:58 PM GMTBy: Troy_Bombardia

Amazon will probably go up in July

Amazon will probably go up in July- The financial sector has fallen 12 days in a row. A short term bounce is nearby.

- The Chinese stock market is getting crushed. It will probably fall a little more in the short term.

- GE’s stock spiked yesterday. This is likely a dead cat bounce. GE will probably fall within the next month.

Amazon

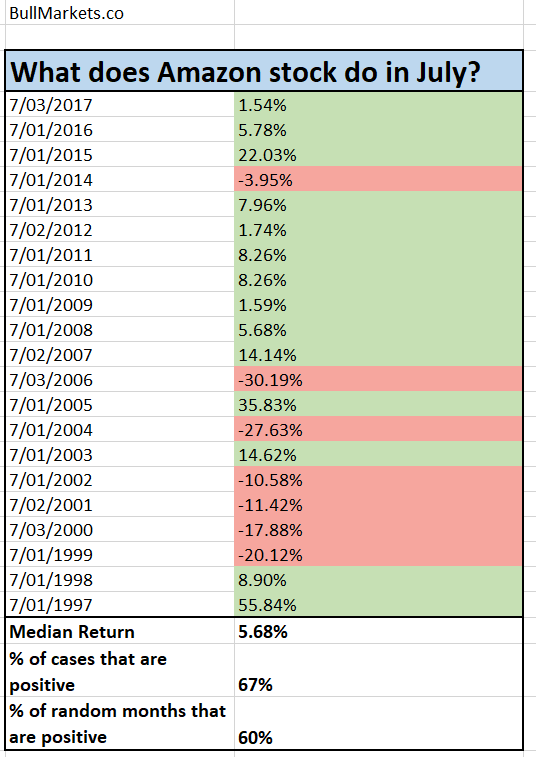

Amazon has had a very strong tendency to go up in July over the past 10 years. Here’s how Amazon stock performs in July (from the beginning to end of July).

Click here to download the data

Notice how Amazon’s tendency to go up in July has been especially prominent after the dot-com bust. Why?

Because July is earnings season, and Amazon tends to beat earnings expectation more often than not. When Amazon beats earnings expectations in July, its stock price is likely to pop.

Financial Sector

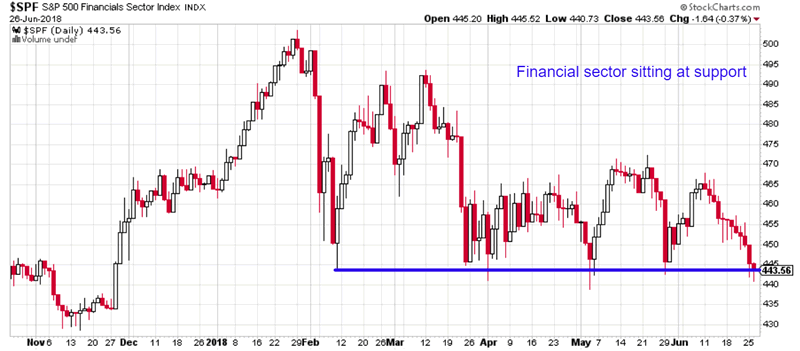

The S&P 500’s financial sector has fallen 12 days in a row ($XLF is the financial sector’s ETF).

This “12 days down” streak is unprecedented since 1997. With the financial sector sitting at support, we can expect a short term bounce right now or very soon.

*This tells you nothing about the financial sector’s medium term or long term. This is only applicable for the short term.

Chinese stock market

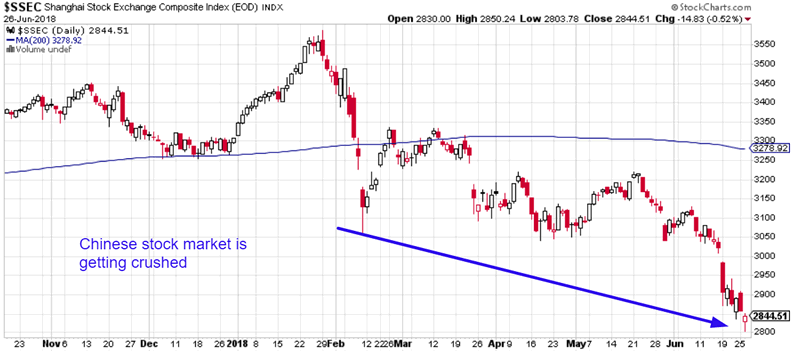

The Chinese stock market (Shanghai Index) is getting crushed thanks to Trump’s trade war threats. The Chinese stock market has fallen A LOT more than the U.S. stock market.

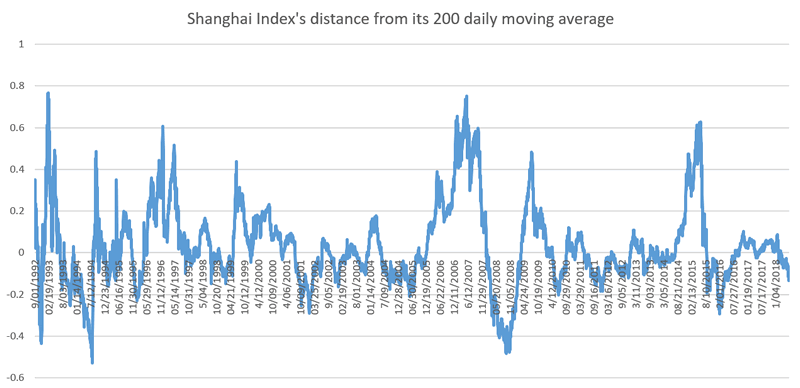

The following chart demonstrates the Shanghai Index’s distance from its 200 daily moving average (we use this as a mean reversion indicator). Readings above zero indicate that the index is above its 200 dma, readings below zero demonstrate that the index is below its 200 dma.

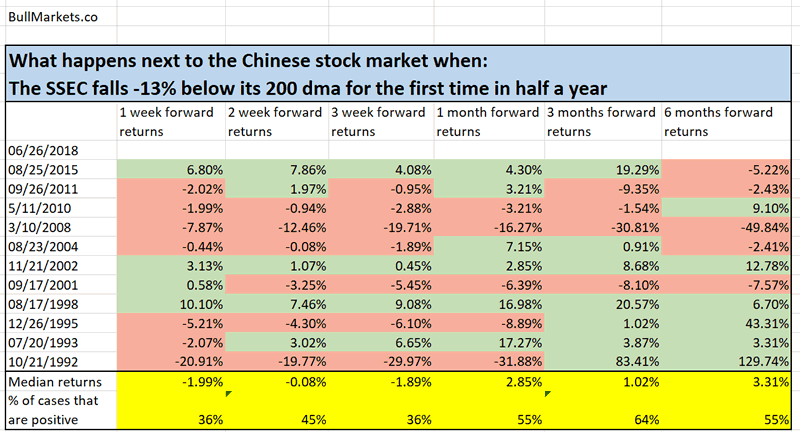

Here’s what happens next to the Shanghai Index when it falls -13% below its 200 daily moving average for the first time in half a year.

Click here to download the data in Excel.

As you can see, the Chinese stock market tends to fall a little more within the next month. 8 out of 11 historical cases saw the Chinese stock market fall more within the next month.

Hence, this is a short term bearish sign for the Chinese stock market.

GE

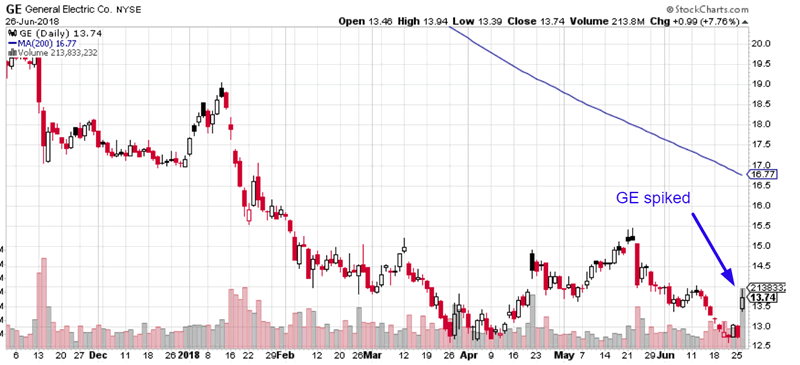

GE’s stock spiked yesterday (+7.7%). This is the largest 1 day spike in 3 years.

When these 7%+ spikes occur during a downtrend (i.e. GE is below its 200 daily moving average), GE usually continues to head lower over the next month.

Click here to download the data in Excel.

As you can see in the above table, 5 out of 6 historical cases saw GE move lower sometime within the next month.

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.