Rome vs Brussels. Will That Battle Benefit Gold?

Commodities / Gold and Silver 2018 Oct 25, 2018 - 04:29 PM GMTBy: Arkadiusz_Sieron

Only one digit has changed. But it may have profound consequences, sending the country closer to junk status. Meanwhile, Rome and Brussels clash over budget plan. Will that duel benefit or harm the yellow metal?

Only one digit has changed. But it may have profound consequences, sending the country closer to junk status. Meanwhile, Rome and Brussels clash over budget plan. Will that duel benefit or harm the yellow metal?

Only One Notch Above Being Junk

Italian drama continues. On Friday, Moody’s, one of the most significant rating agencies in the world, downgraded the Italian credit rating from Baa2 to Baa3. It means that Italy’s local and foreign-currency bonds are now only one notch above junk territory. The move was not surprising, as well as the reasons behind this decision:

• A material weakening in Italy's fiscal strength, with the government targeting higher budget deficits for the coming years than Moody's previously assumed.

• The negative implications for medium-term growth of the stalling of plans for structural economic and fiscal reforms.

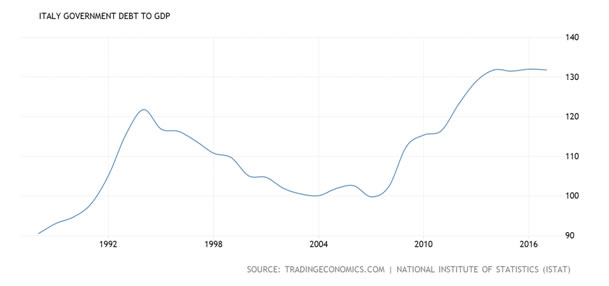

According to Moody’s, higher fiscal deficits in coming years imply that Italy’s public debt will not start trending down, but it will rather remain close to the current 130 percent of GDP – a very high level (see the chart below), which makes the country vulnerable to future negative shocks.

Chart 1: Italy’s public debt to GDP from 1988 to 2017.

On a more positive note, both sides struck more conciliatory tones. Although the Economy Minister Giovanni Tria defended Italy’s 2019 budget which hikes the deficit to 2.4 percent of GDP, he promised not to inflate its deficit any further in the years ahead. And Italy’s Prime Minister Giuseppe Conte dismissed any suggestion that Italy might have to abandon the euro or leave the European Union.

And Moody’s kept the outlook at stable, which calmed investors. As one can see on the chart below, the yield on 10-year Italian government bonds dropped yesterday.

Chart 2: Yields on Italy’s 10-year Government Bonds from January 2017 to October 2018.

However, Italian bond yields remain elevated, which feeds through to the nation’s banks. As they are the biggest holders of the government debt (owning about 28 percent of Italy’s public debt), the fall in bond prices (i.e. the rise in yields) undermines the value of their capital. Indeed, the UniCredit shares have lost more than around 30 per cent of their value in a year, whileItalian bank shares sank in general (tracked by the Boost FTSE MIB Banks ETP) to the lowest level since early 2017, as the next chart shows.

Chart 3: The Boost FTSE MIB Banks ETP since early 2017.

Implications for Gold

The current turmoil in Italy clearly shows that the global financial crisis and the resulting banking crisisin the Eurozone have not ended yet. European banks, and Italian in particular, are still fragile. Although the Italy’s government’s expansionary fiscal policymay support the GDP growth in the near-term, the downside risks for the Italian economy are mounting. It’s true that the banking sector has seen a visible improvement since the Great Recession. However, if the bond yields remain elevated, there might be a renewed banking crisis.

It could help gold, especially given the current positive sentiment. But the problems in the EU should drag the euro and support the greenback (both euro and gold rose before the EU decision on Italy’s budget), which would limit any potential rise in the safe-haven demand for gold.

One thing is certain. Although we hear more conciliatory tones from both sides, the Italy’s budget dispute is not over yet. So it will be a hot week, both for Italy and gold: today, Brussels will decide next steps on Italy’s budget, while the ECB will hold its monetary policy meeting on Thursday. Finally, Standard & Poor’s, another leading credit rating agency, will update its view on Italy this Friday. Stay tuned!

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.