Trump’s Quest to Undermine Multilateral Development Banks

Economics / Global Financial System Feb 12, 2019 - 02:14 PM GMTBy: Dan_Steinbock

In the postwar era, the multilateral development banks were created to facilitate global trade. Today, they are ‘America First’ targets.

In the postwar era, the multilateral development banks were created to facilitate global trade. Today, they are ‘America First’ targets.

Recently, the White House has been pushing its America First stance in the World Trade Organization (WTO) by controversial appeals to a “national security exception.” In response to the Trump tariffs, several WTO members have brought dispute settlement cases against the U.S.

World Bank is next in the firing line. Reportedly, the White House will announce David Malpass as the nominee for President of the World Bank, after Jim Yong Kim's resignation well before the end of his five-year term in 2022.

In the 2016 election, Malpass served as Trump’s economic advisor. A year later he was appointed Undersecretary for International Affairs in the U.S. Department of the Treasury. But he is an odd choice to head the World Bank - a bit like selecting a coal CEO to head the struggle against climate change.

An ‘America First’ World Bank

Like U.S. Representative of Trade Robert Lighthizer, Malpass began his political career in the 1980s Reagan administration seeking to contain the rise of Japan through the Section 301 of the 1974 Trade Act; the same unilateral legislation Trump is exploiting against China in the current trade dispute.

During his 15 years as chief economist at Bear Stearns, Malpass was not known for his economic foresight. A year before the global crisis, he wrote that "housing- and debt-market corrections will probably add to the length of the U.S. economic expansion." And amidst lingering crisis, he urged for higher interest rates.

During his tenure as Under Secretary of the Treasury for International Affairs, Malpass has taken an aggressive position against China. In early 2018, he slammed China’s “non-market behavior” advocating stronger responses. When Trump tariff wars began, some 20 career staff quit Malpass’s unit in less than a year opposing the administration’s unilateral trade policies and Malpass’s poor leadership style.

To Malpass, the World Bank is a “giant sprawl” of international organizations that create “mountains of debt without solving problems.” He promotes a new “debt-transparency initiative” that would shed more light on the international liabilities of the world’s governments. Such an initiative would not target America’s $22 trillion pile of sovereign debt, but China’s Belt and Road Initiative (BRI). Should he walk the talk, that could cause a fatal rift in World Bank.

As of November 2018, the largest recipients of World Bank loans were India ($859 million in 2018) and China ($370 million in 2018). Malpass could subject China and its loans into a politicized scrutiny, effectively extending U.S. investment reviews through the Bank. In that view, his nomination has done nothing to diminish China’s concerns that the existing international institutions will not accommodate it.

Toward ‘America First’ IMF

Since the Bretton Woods, the president of the World Bank has been an American, while the International Monetary Fund (IMF) has been led by a European. Both institutions are located in Washington, D.C. and work closely with each other, as international extensions of the U.S. Department of the Treasury - as critics contend.

Amid the 2008 crisis fall, IMF chief Dominique Strauss-Kahn managed to achieve G20 cooperation that contained the global free-fall. In exchange, advanced economies pledged commitment to global governance reforms in multilateral development banks. Yet, those reforms were ignored after Strauss-Kahn was replaced with French Finance Minister Christine Lagarde. As global managing partner of U.S.-headquartered Baker & McKenzie, Lagarde lived full-time in Chicago until 2005. Through the nomination process, she was subject of a legal investigation over alleged abuse of power in the “Tapie Affair.” In 2016, a French court found her guilty of negligence, but did not impose a penalty. That's how Lagarde was re-appointed for another five-year term at IMF.

IMF’s economic stance is shifting toward Washington as well. Recently, Lagarde appointed Gina Gopinath as the IMF Chief Economist to succeed Maurice Obstfeld. Gopinath is a veteran U.S. economistand co-director at National Bureau of Economic Research. In her most recent work, she has been an outspoken advocate of the U.S. dollar whose dominance she expects to continue largely undisturbed. She has cooperated with former IMF Economic Counselor Kenneth Rogoff, who has for years criticized China’s debt - as opposed to U.S. debt - as a global risk.

Since 2011, BRICS economies (Brazil, Russia, India, China, and South Africa) have stressed that the selection of the IMF chief on the basis of nationality undermines its international legitimacy. In a 2015 interview, even Jim Yong Kim predicted that “you will never again see an IMF or a World Bank election without very strong contention, coming especially from the developing world.”

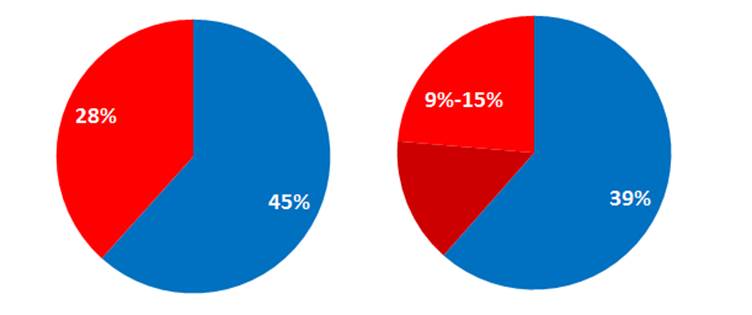

Despite the 2010 cosmetic reforms, advanced economies continue to dominate World Bank voting shares over emerging economies. Today, the seven major advanced economies account for 45% and the largest seven emerging economies almost 30% of the world economy. Nevertheless, advanced countries still control nearly 40% of World Bank voting shares, as opposed to only 9 to 15% by emerging economies (Figure).

Figure Advanced and Emerging Economies: Economic Versus Voting Power*

Nominal GDP, 2019 Voting Power, 2019 (IBRD, IDA, World Bank)*

*

Red: The share of seven largest emerging economies of total votes.

Blue: The share of seven largest advanced economies of total vote.

The World Bank comprises the International Bank for Reconstruction and Development (IBRD), which provides loans to middle-income economies, and the International Development Association (IDA), which targets low-income economies.

There is a gap between the economic share of emerging economies and their voice in the international community. And the gap is deepening. Since emerging economies are growing relatively faster, their economic share will exceed that of advanced economies within a decade or two.

From reforms to retrenchment

Since the early 2010s, China has been promoting the huge, multi-decade Belt and Road Initiative (BRI), which seeks to energize industrialization and modernization in many large emerging and developing economies. The Obama administration took a skeptical view of the initiative, which the Trump administration has branded as a “national security risk” to America.

In October 2013, China proposed creating a new multilateral development bank, the Asian Infrastructure Investment Bank (AIIB). In the Obama era, the White House stayed out of the AIIB and tried - but failed - to prevent its partners and allies from joining the Bank.

A year later, Brazil, Russia, India, China and South Africa launched the New Development Bank (NDB) to accelerate lending on infrastructure projects. The Obama White House sought to marginalize it, while the Trump administration sees cooperative activities with “potential Eurasian hegemons” as a national security risk.

As the World Bank may face a divisive political struggle, U.S. interests are growing more prominent at the IMF, while the WTO has been targeted by trade hawks. Attempts by emerging and developing economies to help themselves are shunned as security threats to American interests. Meanwhile, the West’s multilateral development banks are bailing out rich European economies, targeting poorer ones and sanctioning those that oppose Washington's unilateralism.

The gap between the multipolar 21st century world economy and aging West, which created its prosperity through colonial plunder in the 19th century, is progressively deepening. That serves neither America’s nor emerging powers' long-term interests.

Dr Steinbock is the founder of the Difference Group and has served as the research director at the India, China, and America Institute (USA) and a visiting fellow at the Shanghai Institutes for International Studies (China) and the EU Center (Singapore). For more information, see http://www.differencegroup.net/

© 2019 Copyright Dan Steinbock - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Dan Steinbock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.