2019 Starting to Shine But is it a Long Con for Stock Investors?

Stock-Markets / Stock Markets 2019 Feb 15, 2019 - 11:57 AM GMTBy: Chris_Vermeulen

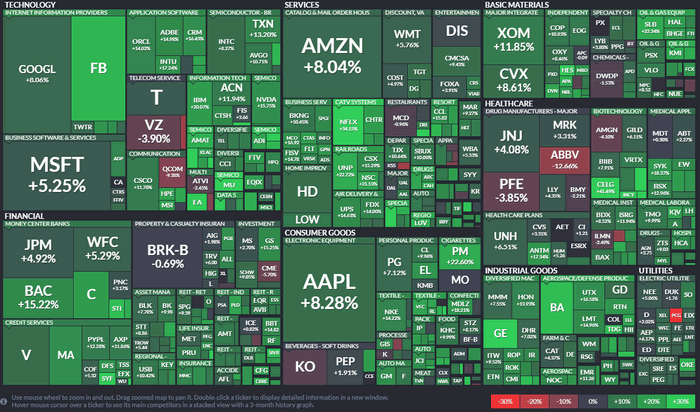

An odd thing happened at the beginning of 2019 for the markets – price levels across almost all sectors were deeply depressed as a result of the October through December 2018 price correction. We’re noticing that almost all sectors of the SP500 were relatively deeply depressed just before Christmas 2018 and the recent price rally has set up an interesting psychological phenomenon – a self-propelling bullish mantra for US Stocks.

An odd thing happened at the beginning of 2019 for the markets – price levels across almost all sectors were deeply depressed as a result of the October through December 2018 price correction. We’re noticing that almost all sectors of the SP500 were relatively deeply depressed just before Christmas 2018 and the recent price rally has set up an interesting psychological phenomenon – a self-propelling bullish mantra for US Stocks.

Yes, 2018 ended with a drop – almost a CRASH. Yet, 2019 is starting off on a terror rally that is beginning to lay the grounds for a very dramatic Q1 and possibly Q2 recovery for many in the managed and passive funds. Remember the news in early January 2019? Hedge funds losing 12~22% or more for the 2018 end of year returns? Remember the feeling that these firms just couldn’t find any means of success when almost the entire 2018 year was mired in deep price rotations and sideways trading?

So far, 2019 is starting out vastly different than 2018 but I have to wonder if the mega players/market movers of the world planned for a very week 2018. Maybe the big plan here is to make the first half of 2019 looks incredibly strong like the bull market is still in full force to convince new money to enter while they secretly unload shares before the bear market takes hold?

If you follow our research, you’ll recall our September 17, 2018 market prediction that an “Ultimate Low” would setup after the US November 2018 elections prompting an incredible upside price rally. You can read out exact wording here. We followed that article with an Elections Cycle research article showing how US election cycles tend to create FEAR in the markets, read it here.

Lastly, we followed up these research pieces with our Global Market research suggesting that perceptions are changing across the planet in terms of what is an acceptable risk and where capital will likely flow in the future. If you have not read this yet be sure to do so.

We believe the psychological results of the US markets pushing very strong Q1 and Q2 returns from a very deep price origination point could drive this global capital shift to target the US markets much more quickly than we expected. If the US markets continue to push higher with fairly narrow volatility going forward, we believe global capital will rush into the US market and undervalued technology, healthcare, basic materials and other sectors chasing the opportunity for the +5 to +8% returns on the back of a potentially strong US Dollar. It may seem odd that this type of capital shift could even take place right now, but we believe this renewed boost of foreign capital into the US stock markets has already started and will play a big roll in a final run higher in the overall US equities market for a few months.

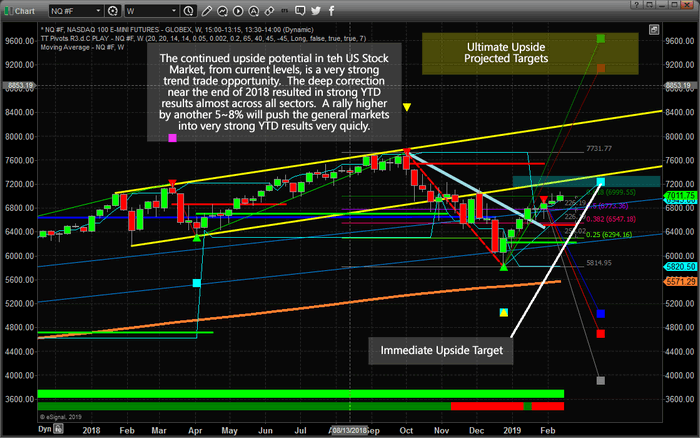

This Weekly NQ chart shows our Predictive Fibonacci price modeling system and suggests that volatility has already begun to narrow. You can see the CYAN “Immediate Upside Target” level that is our current price target and the first level where resistance may be found. Beyond that level, we enter the upward sloping YELLOW price channel from 2018 that suggests price may attempt a rally up towards the $8400 level. You can also see our Fibonacci Projected Targets labeled “Ultimate Upside Projected Targets”. These levels are created by an adaptive learning price modeling system where volatility, price range, price rotation, and an active learning Fibonacci modeling tool are suggesting “could be” the ultimate upside objectives. Imagine the NQ starting 2019 near $6400 and ending it near $9200 (+43%) or $9600 (+50%) for the year?? It would be incredible and it is a possibility.

The reality is, it does not matter what the markets do, go up or down from there. Technical analysis will keep the odds in our favor for us to follow the market closely and generate strong annual gains. No one truly knows which way the markets are headed next. Personally, I feel stocks will struggle to make new highs before rolling over to start a bear market, but our ADL adaptive statical system says we should be prepared of the possibility of a 50% rally.

So who/what is correct? It does not matter, either way, we will make money, but I a bear market does start then long-term investments will need to be moved to cash or inverse investments at that time.

Take a minute to consider how the global markets will react to uncertainty and rotation while remembering that the US stock market and economy are very unique from the rest of the world. The US economy seems to operate beyond the limitations of many other foreign markets and could turn into a safe-harbor for global capital throughout the next 2~5+ years. Time will tell.

Please take a minute to visit www.TheTechnicalTraders.com to learn how we can help you find and execute better trade in 2019 and stay ahead of these market moves.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.