Stock Traders Must Stay Optimistic – Part 4

Stock-Markets / Stock Markets 2019 Feb 25, 2019 - 07:53 AM GMTBy: Chris_Vermeulen

Welcome to Part IV of our multi-part research post delving into the global markets, global opportunities and the current “revaluation” even that is taking place. We started this quest from a simple question, “are the Doomsayers correct in their analysis that the US and global markets would collapse in a spectacular form in the near future?”. We wanted to dig into this in more detail to prove they were right or to prove our analysis was correct and the markets are simply “re-balancing” in the process of developing greater opportunity.

Welcome to Part IV of our multi-part research post delving into the global markets, global opportunities and the current “revaluation” even that is taking place. We started this quest from a simple question, “are the Doomsayers correct in their analysis that the US and global markets would collapse in a spectacular form in the near future?”. We wanted to dig into this in more detail to prove they were right or to prove our analysis was correct and the markets are simply “re-balancing” in the process of developing greater opportunity.

So far, we’ve covered topics related to globalization, central banks, global GDP and capital asset deployment forms. We’ve highlighted how the transition from regional economies into global inter-connected economies is now nearly complete and we’ve highlighted how we believe a collapse event could only take place if the largest global economies were to experience some type of massive crisis event. Unless these types of massive crisis events unfold, the most likely outcome is what we have been proposing all along – a re-balancing/revaluation event cycle that is preparing current market valuations for a momentum breakout rally in the future.

Let’s continue our research.

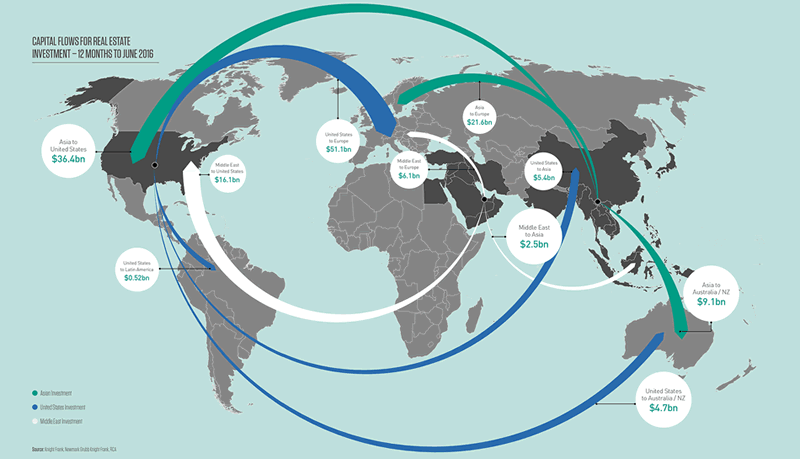

The chart, below, highlights just how critical global capital flow is in today’s world. Imagine, back in the 1950s and 1960s – the process of money flowing around the planet in an instant for investment purposes and global central bankers being able to capitalize on various global economies was very difficult to achieve. Now, with the speed of fiber-optics, these transactions can be completed in seconds and traders/investors can move capital across the planet multiple times throughout a single 24-hour span of time.

In our opinion, the reason the September 11, 2001 market crisis and the 2009~2014 market crisis events were so catastrophic and REAL was because they targeted the US economy (the biggest economy on the planet and the leader of growth throughout the planet) as well as the extended credit, debt and derivatives markets that were formed as the total globalization process expanded. When this “froth” began to implode, the underlying value of the assets supporting this “frothy fringe investment” imploded at dramatic rates.

(Source : http://ngkf.com/globalcities/2017/over-there.html)

The current issues that should concern investors are China and Europe. We believe a re-balancing of capital and expectations are currently taking place within these regions that could result in a “de-frothing” process in the near future. We would like it to be orderly and structured, but we don’t always get what we want – right? This process of revaluing the future expectations and opportunities within these global markets could create some issues for fringe elements as well (Russia, SE Asia, South America and Africa). Remember, many of these nations are operating on a “capital high” right now after seeing many decades of “easy money” and extreme growth. This is the reason for being cautiously optimistic. We have not completely transitioned into the “total global growth mode” yet.

The one thing that we believe is taking place at the moment is the positioning of capital in preparation for the final revaluation event. Capital is currently shifting towards safer and more secure global markets in preparation for this last revaluation event cycle. Our interpretation of this event is that a shakeup of banking/finance institutions as well as larger scale infrastructure projects (Belt Road) and economic coalitions (EU) will result in a more solid and rooted opportunity to build upon success for our future.

A “de-frothing” economic event will likely continue throughout the next 2~5+ years where localized markets will attempt to eliminate the “at risk” top and bottom end players. Think of this as a process of re-establishing core values and core opportunities. In an ecosystem, living organisms operate in two separate modes: survival and expansion. When the environment is hostile and difficult, the organism falls into “survival mode”. This is where froth and at-risk elements are terminated because the important aspect for the organism is “to survive the environment”. If the environment improves and becomes more “friendly and supportive”, then the organism will transition into “expansion mode” where it will try to grow, expand and “flower”. This is where the organism becomes very healthy and is able to begin taking on new risk/froth elements.

Currently, we believe the global economy is nearing the end of the de-frothing/revaluation phase and will begin to establish new growth footing over the next 2~5+ years. Our hypothesis is that the 2009~2014 Global Credit Market crisis started a massive global de-frothing process that is currently working through the global markets. Intentional or unintentional, we don’t know. But we do understand that the process of “survival or expansion” is key to the long term economic events that continue to work through the global markets. Let’s look over some charts.

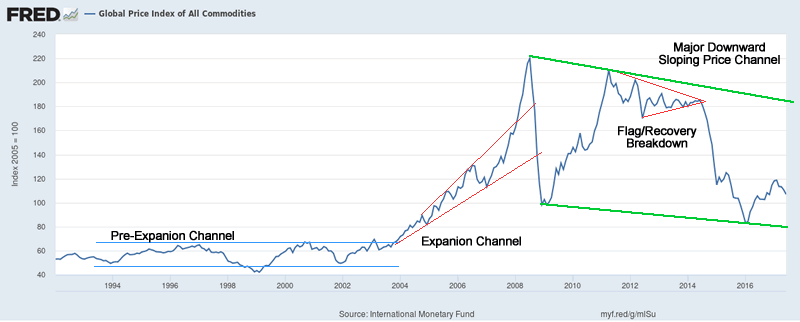

One element typically happens near the early/middle stage of economic expansion is a Commodities price increase. Looking at the larger picture of the global price of all commodities, we can see that an expansion channel existed between 2004 and the peak near 2008 and, since then, global commodities have been within a Major Downward sloping price channel. It is our opinion that global commodities will stay near the lower range of this price channel as the revaluation/re-balancing phase continues. Eventually, global commodities will likely attempt to setup a Flag/Pennant formation before attempting a true price advance after the froth/risk has been sufficiently eliminated from the global markets.

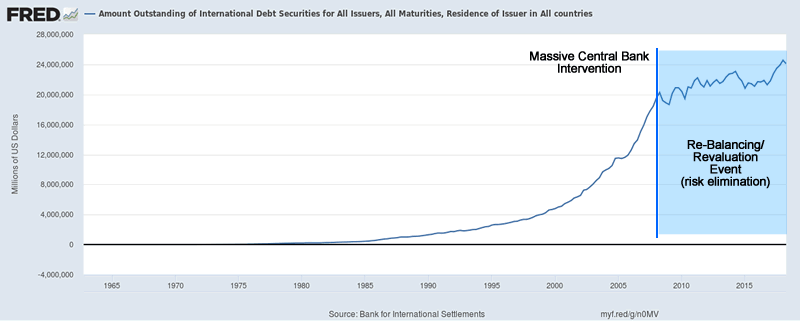

Additionally, this chart showing total international debt securities of all countries clearly shows WHEN the global markets entered the revaluation/re-balancing phase. It all started with the 2009~2014 global credit market crisis – not with the September 11, 2001, terrorist attacks. This information supports the process that the global economy was much healthier in 2001 as a result of the expanded opportunities supported by the new Internet/technology boom. The crisis event in 2001 was dangerous as it could have resulted in a global economic contraction, yet it appears the expansion in commodities prices and the continuous expansion of debt was unabated.

The 2009~2014 global credit crisis event was a completely different story for the markets. This event consisted of a core element implosion that touched nearly every corner of the planet and started a “de-risking” event that is still taking place. True economic expansion will not begin until this event is completed. The process of revaluing the markets is currently taking place and a true “capital shift” is still underway where capital is being deployed in the safest and most secure markets on the planet in order to secure proper ROI as well as seeking “speculative ROI” from undervalued international markets.

We continue to expect debt consolidation to continue throughout most of the established world. The single purpose of this Revaluation event is to find and secure proper valuation levels for the entire global market before true expansion can begin. We’ve already experienced a massive revaluation process across most of the planet and the only thing left to complete are the proper valuation levels of the most frothy and unhinged global markets on the planet.

This process may not be pretty at times, but it certainly will provide skilled traders and investors with incredible opportunities for profits. You won’t want to miss these moves over the next 3~5+ years.

Don’t miss Part V of this incredible research post as we’ll show you exactly what to expect over the next 24~30+ months in the US markets and who you why skilled and professional research, like this, is key to understanding where opportunity really exists in these markets.

If you want to learn how our proprietary price modeling systems, a dedicated research team, daily videos, and more resources will help you find and execute better trades, then please visit www.TheTechnicalTraders.com to learn how we can assist you. If you want to know how and when we are trading these markets to help our members, then consider becoming a member and enjoying all the benefits we offer our subscribers. This is going to be an incredible year for skilled traders. Isn’t it time you invested in something that can really help you develop greater success?

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.