Palladium Hits Record High

Commodities / Palladium Mar 09, 2019 - 04:33 PM GMTBy: Arkadiusz_Sieron

Gold is no longer the most valuable precious metal! Palladium dethroned it! We invite you, thus, to read our today’s article about that metal and find out what is the fundamental outlook for the palladium market.

Gold is no longer the most valuable precious metal! Palladium dethroned it! We invite you, thus, to read our today’s article about that metal and find out what is the fundamental outlook for the palladium market.

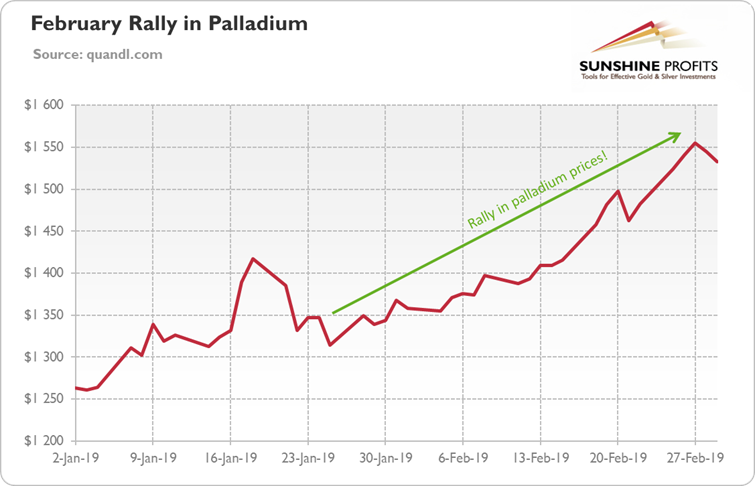

We have a new record! Please take a look at the chart below, which displays the palladium prices since the beginning of the year. As one can see, the price of palladium soared in the first two months more than 20 percent, jumping above $1,500!

Chart 1: Palladium prices from January 2 to March 1, 2019.

It means that palladium is at an all-time new record high, as the next chart clearly shows. Take a good look. If you do not believe, visit kitco.com. But the figure does not lie – the palladium is really more expensive than gold or platinum right now!

Chart 2: Palladium prices from April 1990 to March 1, 2019.

Who would have thought that palladium would shine so bright? Hm… in fact, we thought so! In July 2017 edition of the Market Overview, we wrote the following:

(…) the price of palladium should be supported in the near future. We know that the above-ground stocks of palladium are relatively plentiful (and may be greater than the market expects), but market deficits at such heights cannot last indefinitely – and when the market eventually tightens, prices will need to rise.

And this is precisely what happened. At the end of 2018, the period of extreme market tightness occurred, despite substantial liquidation of stocks. According to the latest Johnson Matthey’s Platinum Group Metals Market Report, the underlying structural deficit grew last year and, what is more important, is expected to widen in 2019, which will not be without significance for the price of palladium.

Why is that? The main reason is strong growth in autocatalyst demand due to the tighter emission legislation and stricter vehicle testing regimes. But if the autocatalyst demand is so strong, why platinum – which is also used mainly in the automotive industry – is so sluggish compared to palladium? This is because the latter is used in gasoline vehicles (and in hybrid electric vehicles, which tend to be partly gasoline-powered), while platinum is applied in diesel cars, which are out of favor after the Volskwagen scandal. We pointed out this key factor for the precious metals as early as in July 2017:

Given the retreat of diesel technology in the automotive sector, palladium should outperform platinum in the long-run. Surely diesel will not disappear, but its dusk is very likely after the Volkswagen scandal (…) Therefore, taking all this into consideration, the investment potential of palladium seems to be greater than in case of platinum.

However, one of our Readers turned our attention to another important factor which could significantly affect the precious metals market. Have you heard about Zimbabwe? In the 2000s, the government started to expropriate white farmers as an effort to more equitably distribute land between black and white people. The effects were disastrous, as the agricultural production declined sharply, and the hyperinflation set in. After farmland, the time has come for the mines – in 2008, Mugabe signed into law a bill giving local owners the right to take majority control of foreign mines.

OK, but what does Zimbabwe have to do with platinum and palladium? Well, nothing. But South Africa has, as the country mines about 70 percent of global platinum and about 38 percent of world palladium. And we see disturbing signals that the country is following the Zimbabwean route. In February 2018, Cyril Ramaphosa, who become the new president, has prioritized land redistribution. In December 2018, South Africa’s National Assembly established a committee to introduce a new bill on land reform, making way for land expropriation without compensation for the previous owners. The land seizures are to repair “the original sin committed against Black South Africans during colonization and apartheid”. Now, investors are afraid of the nationalization of the mines, as the Economic Freedom Fighters, a new left wing party, and even some members of the ruling African National Congress call not only for farmland but also for mines and banks to be state-owned.

Of course, South Africa is not Zimbabwe. But, Brexit or Trump as POTUS were once also considered unlikely. Hence, we should not exclude the scenario of expropriation of mines (or the scenario of disruptions in the production at least). If it materializes, platinum would benefit from it the most, as the country is the dominant producer of this metal. However, palladium will also benefit, as the production would probably drop (in the medium-term). And given that the latter metal has better fundamentals (platinum market is in structural surplus, while palladium market is in deficit), it still seems to be a better investment choice. Although it is true that the automotive demand for platinum should stabilize in the near future, and the rising price discrepancy should make platinum more attractive as catalyst, the autocatalyst producers say that they are not seeing broad-based substitution from palladium to platinum. Hence, the outlook for platinum improved, but the path for the palladium is still better.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.