Monetary Metals on Keynes, Inflation and Evil Itself

Economics / Inflation Mar 20, 2019 - 04:55 AM GMTBy: Gary_Tanashian

Since NFTRH 543 was also known as the ‘What if… Inflation?’ report, I was attuned to the subject; and on cue here comes Keith Weiner with a knockout punch.

Since NFTRH 543 was also known as the ‘What if… Inflation?’ report, I was attuned to the subject; and on cue here comes Keith Weiner with a knockout punch.

Keynes Was a Vicious Bastard, Report

He goes off on the evil (and I do mean evil) genius, John Maynard Keynes before moving on to his usual gold and silver supply/demand fundamental report.

He gave us the recipe for “overturning the existing basis of society.” All you have to do is “a continuing process of inflation,” which will “confiscate, secretly and unobserved, an important part of the wealth of their citizens.” This “brings windfalls, beyond their deserts and even beyond their expectations or desires” to the “profiteers, who are the object of the hatred of the bourgeoisie, whom the inflationism has impoverished, not less than of the proletariat.” Finally, this process “engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”

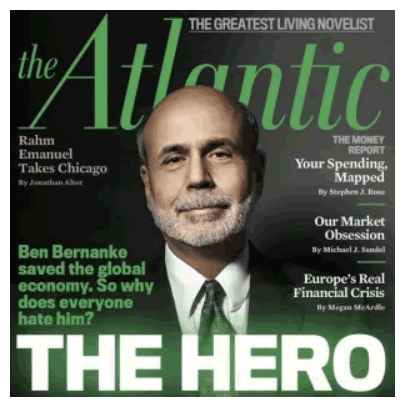

Though I am much less studied on monetary history than Keith I have bitched and moaned in real time about the “evil genius” known as Ben Bernanke, who was the bringer of the most recent phase of inflation that has relatively impoverished the lower classes in favor of the asset owner class (under the guise of saving the economy).*

Why do we have a belligerent, unqualified TeeVee star in the White House? Because the middle class could not take it anymore, that’s why. While the public focuses on the two headed (and IMO evil itself) political system, the public is relatively ignorant of the Fed and its evil policy, applied at various times and to varying degree over the decades. Its policy is inflation, sometimes disguised, but always in effect.

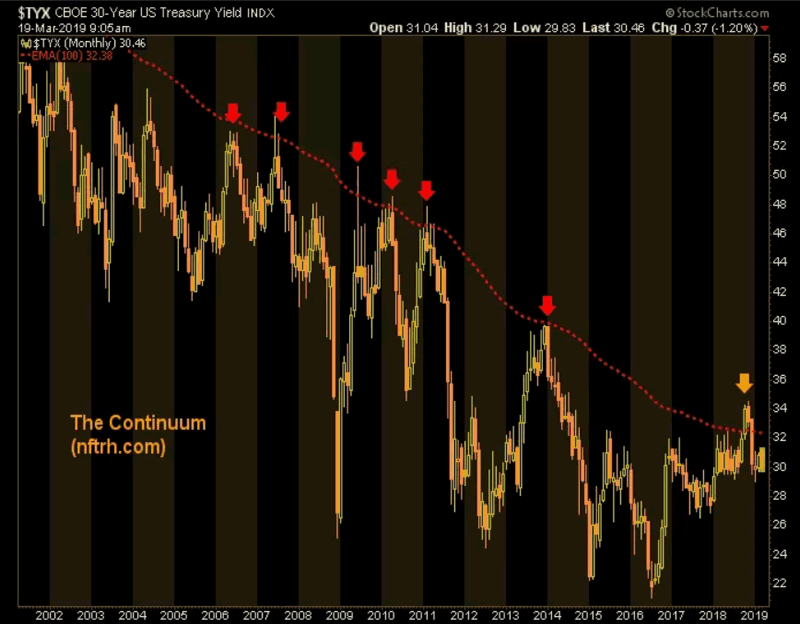

As I have noted often, without the ongoing inflationary regime there is no Fed (which is why I made such a big deal about why Powell had to be stern in the face of rising interest rates and the breakout in the Continuum last year. See Jerome ‘Dead Eye’ Powell and a bunch of posts that came before it.

Today yields again sit comfortably below the Continuum’s limiter and so the macro is at peace and for now the inflation can be promoted once again.

But let’s let Keith have the last word, because it needs to be said and he says it so well.

Keynes sees the connections between: (1) confiscating the wealth of the people, (2) generally impoverishing the people, (3) but arbitrarily enriching a few, (4) which means some prices rise and those who bought those things profit, (5) and the process of wealth-getting degenerates into a gamble and a lottery, (6) pushing interest down to zero, (7) which means pushing asset prices to infinity, (8) leading to resentment against the enriched even by members of their own bourgeois class, (9) which causes the breakdown of relations between debtors and creditors, and finally (10) the best way to destroy the Capitalist System, (11) in a manner which not one man in a million is able to diagnose.

That *****. I’m sorry, but the normal words of the English language do not give me a way to describe how I feel about someone this vicious, and not only malevolent but smart enough to devise such an evil scheme, and lucky enough or persuasive enough to set the entire world on the path to destruction.

Let me be 100% clear: this is the path to the destruction of civilization itself.

* Had the 2008 liquidation been allowed to complete, it would have actually freed the people, eventually, and destroyed those entities that suck the economy’s blood to this day (this goldbug moment brought to you by your friends at nftrh.com).

Subscribe to NFTRH Premium (monthly at USD $33.50 or a 14% discounted yearly at USD $345.00) for an in-depth weekly market report, interim market updates and NFTRH+ chart and trade setup ideas, all archived/posted at the site and delivered to your inbox.

You can also keep up to date with plenty of actionable public content at NFTRH.com by using the email form on the right sidebar and get even more by joining our free eLetter. Or follow via Twitter ;@BiiwiiNFTRH, StockTwits or RSS. Also check out the quality market writers at Biiwii.com.

By Gary Tanashian

© 2019 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.