Mortgage Providers Encourage First-time Buyers Cutting Margins on 95% loans

Housing-Market / Mortgages Mar 25, 2019 - 04:11 PM GMTBy: MoneyFacts

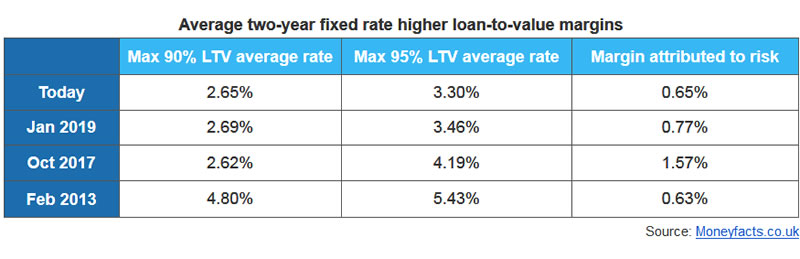

The latest research from Moneyfacts.co.uk shows that the margin between the average two-year fixed mortgage rate at maximum 95% and 90% loan-to-value (LTV) is at its narrowest since February 2013, with the difference between these two higher LTV rates currently standing at 0.65%, down from a high of 1.57% in October 2017. This has been driven by average rates at 95% LTV falling dramatically since then, offering hope for borrowers who can only amass a 5% deposit.

Darren Cook, Finance Expert at Moneyfacts.co.uk, said:

“It is evident that healthy competition among mortgage providers at the maximum 95% LTV tier has been the catalyst in causing the average two-year fixed mortgage rate at this level to fall by 0.72% in the last year, down from 4.02% in March 2018 to 3.30% today.

“A mortgage provider’s provision for costs, such as funding and administration expenses, are seemingly a constant addition to a mortgage rate, irrespective of different LTV tiers. Therefore, the biggest contributing factor to the difference between a 90% and 95% LTV mortgage rate can be attributed to a provider making provision for future ‘probability of default’ on the mortgage. In other words, providers need to factor in the greater potential of default on higher-LTV mortgages, which is why rates are typically higher at 95% LTV – but as we’ve seen, they’re increasingly willing to sacrifice these margins in order to compete.

“Indeed, the average two-year fixed rate at max 90% LTV has changed little since October 2017, increasing by only 0.03% to 2.65% today. However, the average at max 95% LTV has fallen by a significant 0.95% to 3.30% over the same period. It therefore seems that mortgage providers are forfeiting a portion of their provision for risk at this higher tier in their desire to secure the business of potential first-time buyers, who are the lifeblood of the mortgage market.

“This is fantastic news for potential first-time buyers who are looking to find their first step on the housing ladder. However, even though mortgage rates at the 95% LTV tier are falling, it may not be that simple; since the financial crisis, the Financial Conduct Authority has introduced clear affordability measures that mortgage providers must follow, so potential first-time buyers will still need to jump through several affordability hoops before they find themselves on the property ladder.”

moneyfacts.co.uk is a financial product price comparison site, launched in 2000, which helps consumers compare thousands of financial products, including credit cards, savings, mortgages and many more. Unlike other comparison sites, there is no commercial influence on the way moneyfacts.co.uk ranks products, showing consumers a true picture of the best products based on the criteria they select. The site also provides informative guides and covers the latest consumer finance news, as well as offering a weekly newsletter.

MoneyFacts Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.