Stock Market Due for 9-10% Pull Back?

Stock-Markets / Stock Markets 2019 Apr 25, 2019 - 06:44 PM GMTBy: Brad_Gudgeon

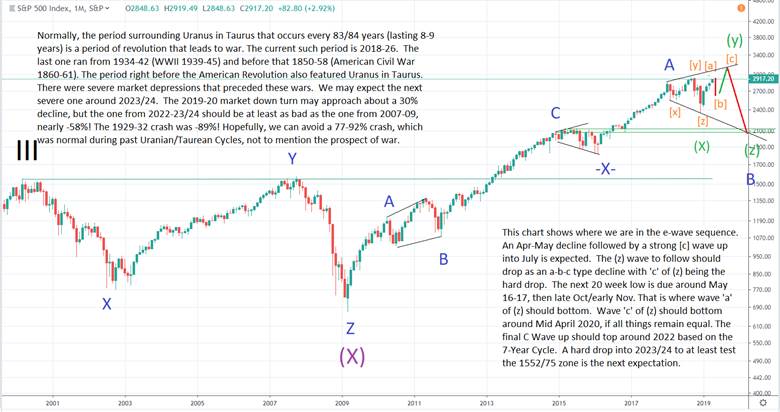

The December 24-26 low in the stock market finished an E-Wave xyz bullish flag, which itself was likely an X wave of larger degree. The move up to all time highs within only 4 months of a 20% pull back has been quite impressive. The xyz pattern is a very bullish e-wave pattern and the current Wave Y runs an abc type rally with “a” due in this general time frame.

The December 24-26 low in the stock market finished an E-Wave xyz bullish flag, which itself was likely an X wave of larger degree. The move up to all time highs within only 4 months of a 20% pull back has been quite impressive. The xyz pattern is a very bullish e-wave pattern and the current Wave Y runs an abc type rally with “a” due in this general time frame.

The 20-week low (“b”) is due around May 17-20 and it wouldn’t surprise me that an intermediate top forms shortly (within the next 1-4 trading sessions) and drops 9-10% into the mid May expected low. The 9 month top (“c” of Y) is due in early July and a move to above S&P 500 3100 would not surprise me at all, but like I said, a 9-10% pull back is likely first.

The mining shares and gold itself rallied out of a 31/32 month low back in August/Sept 2018. Gold is leading the rally. The current pattern is actually a must needed pause to refresh, a bull flag pattern that once finished should launch higher into the summer. The next cycle low is the 4-year due in Dec ‘19-Jan ’20.

Overall, I believe the trend is down from the 2011 30-31-year top and should bottom in late 2023 somewhere near the 2008 low of $667. This is not saying we won’t see some nice strong rallies in the months ahead.

2023/24 is also when we should see a hard low in the stock market based on the 7-Year cycle, which forecasts a top in 2021/22. We had a 20% bear in 2018 and the next one will likely be 30%+. Late 2019 into 2020 is the danger period for the next bear drop. After that, one more strong rally above 3500 on the S&P 500 looks likely to me.

For a long time, I had been looking for a major bear market in the category of the 1929-32 drop, which took the Dow 30 down 89% within less than 3 years. The current wave structure is giving me doubts that we will see anything harder than what we saw in 2007-2009 from 2022-24. It also bothers me that I have a lot of company out there calling for something apocalyptic in the next few years. When too many think the same way, we often times do not fulfill those exact expectations.

The cycle we are in is called the 4-generation cycle (80-88 years) as we tend to make the same mistakes that our great grandparents made. That cycle runs an average of 83-84 years and coincides with the Uranian/Taurean 8-9 period last seen 1934-42 and before that 1850-59.

It is a period of revolution and technological innovation. It is a period of banking/currency changes and changes in how we farm and our relationship to the earth. It leads into what is termed the “Crisis War”.

Crisis Wars were last seen in America in 1941-45 and 1860-65. Before that, it occurred right before the American Revolution. Hold on! If you ain’t got somethin’ to hold onto, grab anything, for as Dylan wrote in the 60’s “the times they are a-changin’”.

Brad Gudgeon

Editor of The BluStar Market Timer

The BluStar Market Timer was rated #1 in the world by Timer Trac in 2014, competing with over 1600 market timers. This occurred despite what the author considered a very difficult year for him. Brad Gudgeon, editor and author of the BluStar Market Timer, is a market veteran of over 30 years. The website is www.blustarmarkettimer.info To view the details more clearly, you may visit our free chart look atwww.blustarmarkettimer.com

Copyright 2019, BluStar Market Timer. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

Brad Gudgeon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.