Stock Market Counter-trend Rally

Stock-Markets / Stock Markets 2019 May 19, 2019 - 04:36 PM GMTBy: Andre_Gratian

Current Position of the Market

SPX: Long-term trend – Final long-term phase on the way? How much longer, is the question.

Intermediate trend – The anticipated intermediate-term correction has started. Can’t tell yet if it’s a C-wave or something less.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

Daily market analysis of the short-term trend is reserved for subscribers. If you would like to sign up for a FREE 4-week trial period of daily comments, please let me know at ajg@cybertrails.com

Counter-trend Rally

Market Overview

What is technically the first phase of an anticipated intermediate correction came to a stop at 2801 from a high of 2954, or a decline of 153 points. Structurally, this is either a wave-a, or a wave-1. Future action will determine which it is, but either one calls for a rally (wave-b or wave-2) followed by a resumption of the decline. The low was made on 5/13 and since then, SPX has retraced nearly .618 of the initial downtrend, which means that this may be all we get -- although there is enough ambiguity after Friday’s close to suggest that the retracement is not complete.

How far the correction will take us is unclear at this time, but it may be easier to gauge after we have started the second phase and made a new low. Some EWT analysts believe that 2346 was the low of wave-A of a larger correction, and 2955 the high of wave-B, with wave-C just starting, and possibly taking us to a new low before it’s all said and done. From a timing (cycles) standpoint, the correction could continue until August/September and this is enough time to fulfill all prophecies!

Chart Analysis (The charts that are shown below are courtesy of QCharts)

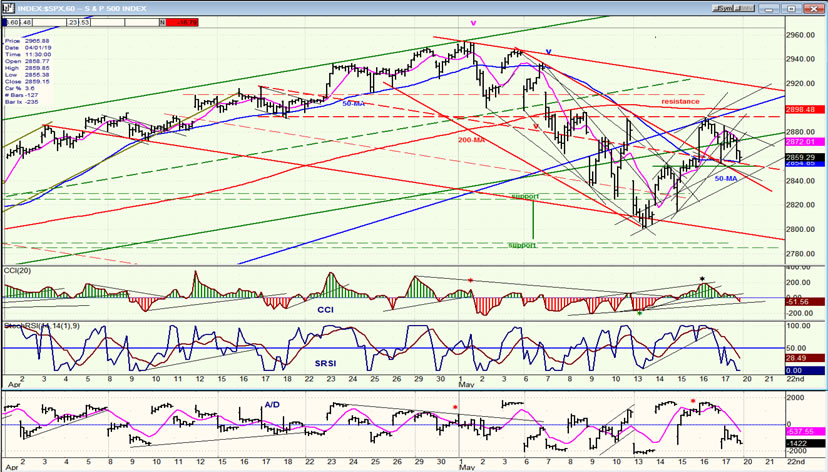

SPX daily chart

By declining to 2801, SPX has come out of both channels, the green one and the blue one. After an initial decline finds support, it is normal for a relief rally to take prices back to the bottom line of the channel which has just been broken (in what is called a “kiss-back”). The five-day rebound almost reached the blue channel line on Thursday before turning back down, but since there is no concrete sign that we are ready to resume the (presumed) primary trend right away, we could push a little higher before turning down again decisively. Of course, if we drive back inside the blue channel, we would have to allow for the possibility of continuing the uptrend instead of starting an important correction; but that is not on the radar, right now.

Proof that we are in an intermediate correction would require dropping back below the 200-dma and the 2722 former short-term low. This would also give us a congestion area above the lower red horizontal line which, on the Point & Figure chart, would give us an idea of how low the correction will eventually take us. It is possible that we extend the downtrend to the dashed green line and continue the primary trend in a broader, green channel. It’s early in the correction and there are many possible scenarios for what lies ahead. As we move forward, these will be eliminated one by one, until only a plausible one is left.

The green asterisk on the lower (A/D) oscillator stands for positive divergence, which suggests a little higher high before we roll over.

SPX hourly chart

I think that the 60m chart is clear enough for you to follow the various trend, channel, and parallel lines, all of which are valid and are serving to identify support, resistance, and various channels.

Several minor descending channels have been broken by the rally from 2801, but the primary one is still intact; and if prices turn down before it is touched, it will reinforce the view that we are in the process of forming a steeper descending channel which will extend below 2800. As for the near-term, the index has broken out of the secondary red channel and has already pulled back to the top channel line, and bounced. It may be in the process of forming a small c-wave prior to pushing a little higher before rolling over to continue the primary downtrend. There is an unfilled count to 2905+ which could turn out to be a good target if the index decides that it is not done.

QQQ, SPX, DJIA, IWM (weekly)

I want to stay with the weekly charts of our four indexes because these are the best time frames to determine if we have a confirmed intermediate sell signal. As we can see, the oscillators have only given a preliminary sell signal. The lower oscillator has dropped below the middle line, but the top indicator is still in the green. The RS ranking remains the same.

UUP (Dollar ETF) daily

UUP does not show any sign of weakening. It is trading inside various channels of different degrees and we’ll have to wait for the smallest one to be broken before there is any indication of a correction occurring; or, for price to move below the green 30-dma.

GDX (Gold miners ETF) weekly

The weekly chart of GDX gives us a good view of the longer-term trend. It has endured a long sideways consolidation and when it breaks out of it on the top side, it should have a good move. But for now, more patience is required. Persisting strength in UUP is not helping GDX to start an uptrend.

ACB (Aurora Cannabis) daily

ACB sold off to the bottom of a short-term channel and was bought on the red dashed support line as it reported good earnings. It may find it difficult to make more substantial headway when the market resumes its correction – unless there are positive developments in the company.

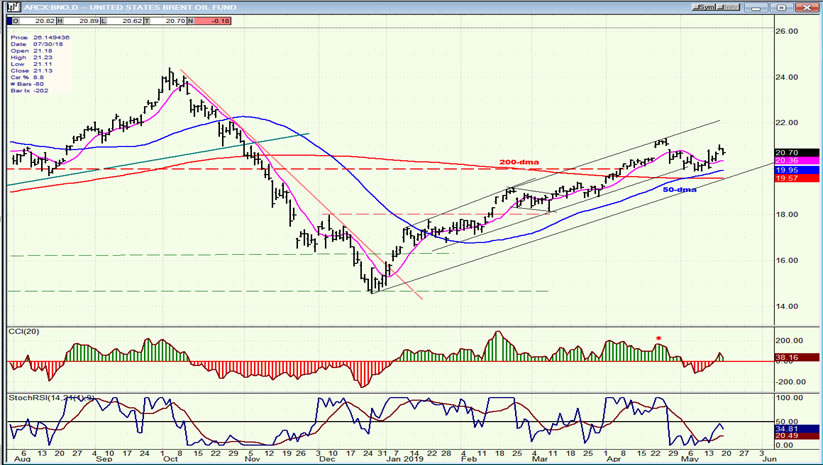

BNO (U.S. Brent oil fund) daily

BNO trades in tandem with the market. We can therefore expect more consolidation when the market resumes its correction.

Summary

After an initial down-phase, SPX is rallying in a countertrend move which could have a little higher to go before the primary downtrend resumes.

Andre

For a FREE 4-week trial, send an email to anvi1962@cableone.net, or go to www.marketurningpoints.com and click on "subscribe". There, you will also find subscription options, payment plans, weekly newsletters, and general information. By clicking on "Free Newsletter" you can get a preview of the latest newsletter which is normally posted on Sunday afternoon (unless it happens to be a 3-day weekend, in which case it could be posted on Monday).

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.