Is Silver The Sleeper Rally Setup Of A Lifetime?

Commodities / Gold & Silver 2019 Jun 03, 2019 - 11:41 AM GMTBy: Chris_Vermeulen

Our research team believes Silver could be the Sleeper Rally setup of a lifetime for investors if the global economic cards continue to get scattered and crumpled over the next 10+ years. The recent rally in Gold got a lot of attention last Friday (the end of May 2019). We had been warning about this move for the past 8+ months and generated an incredible research post in early October 2018 that clearly highlighted our belief that Gold would peak above $1300 early in 2019, then stall and move toward $1270 near April/May 2019, then begin an incredible upside price rally in June/July/Aug 2019. We couldn’t have been more clear about this prediction and we posted it publically in October 2018. See This Previous Gold Forecast Snapshot

Now, our research team is going to share with you some incredible insights into what may become the most incredible trade setup we’ve seen in the past 12+ years – the Sleeper Silver Setup.

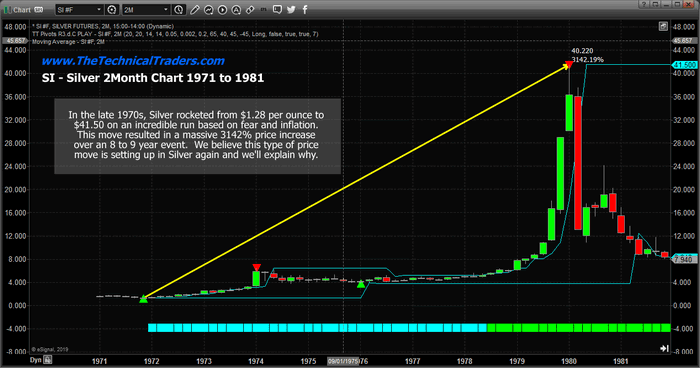

Going all the way back to the early 1970s, when the Hunt Brothers ran most of the metals markets, we can see the incredible price rally in Silver from $1.28 per ounce to nearly $41.50 in late 1979. This move setup with a very simple pattern – a high price breakout in 1973 that broke a sideways price channel and initiated a nearly 6+ year rally resulting in an incredible 3142% price increase from the lows.

Could it happen again?

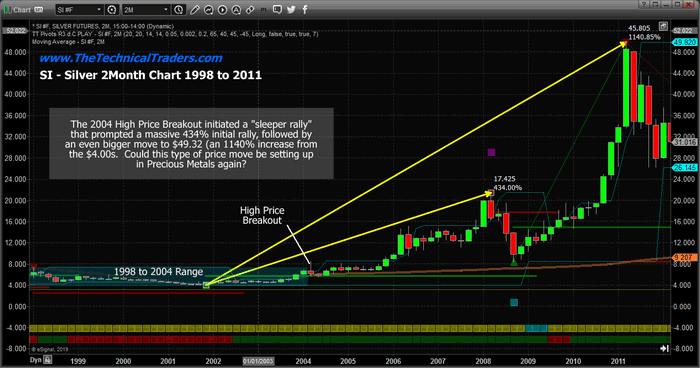

Well, after this incredible price peak, the price of Silver languished and moved lower, eventually bottoming in 1991 near $3.50. After that bottom setup, the price of Silver setup another sideways price channel and traded within this range until a 2004 High Price Breakout happened AGAIN. It seemed inconsequential at the time – a rogue high price near $8.50. Maybe that was it and maybe price would just rotate lower back to near the $4.00 range??

This High Price Breakout setup an incredible price rally that resulted in a continue price advance over the same 6+ year span of time. This rally was not as big as the 1974 to 1979 price rally in percentage terms, but it was much bigger in terms of price valuation. The 1979 price peak ended at $41.50 and resulted in a $40.25 price increase whereas the 2011 price peak resulted in a $46.32 price increase.

Will it happen again in our lifetime?

As incredible as it might seem, we believe Silver is setting up another High Price Breakout pattern that should conclude within the next 2 to 4 months with a price high near $22.50 to $24.00 (see our proprietary Fibonacci price modeling projections below). After this peak is reached, hold on to your hat because we believe the upside price rally could mimic past rallies and attempt to immediately move the price of Silver to well above $85 per ounce. Ultimately, we can only guess as to where the top of this move may end – but we can safely estimate it will likely top somewhere between $90 and $550. This, of course, will require some type of major bear market is other asset classes and possibly some global crisis but we believe it is very possible in due time. Our predictive modeling systems will help us determine where the actual price peak will be as this unfolds over time.

And there you have it – one of the most incredible trade setups you’ll ever see in your lifetime. Yes, it may happen twice in your life or more, but we believe this setup in Silver is just weeks or months from initiating the next upside price leg (the High Price Breakout) and we are alerting you now to be prepared.

UNIQUE PHYSICAL SILVER OPPORTUNITY:

We should start to see money flow into the safe-haven assets like the Utility sector, bonds, and most importantly precious metals. I anticipated this and our XLU utilities ETF taken with members was a quick 3.11% winner. Our VIX ETF trade also hit our 25% profit target within a few days of entry.

Now, I have a few silver rounds here at my desk I am going to give away and ship out to anyone who buys a 1-year, or 2-year subscription to my Wealth Trading Newsletter. You can upgrade to this longer-term subscription or if you are new, join one of these two plans listed below, and you will receive:

1-Year Subscription Gets One 1oz Silver Round FREE (Could be worth hundreds of dollars)

2-Year Subscription Gets TWO 1oz Silver Rounds FREE (Could be worth a lot in the future)

I only have few silver rounds I’m giving away so upgrade or join now before its too late!

SUBSCRIBE TO MY TRADE ALERTS AND GET YOUR FREE SILVER ROUNDS!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.